Encompass TPO Connect®

Optimize how you receive and manage loans from your Third-Party Originators (TPOs)

Maximize volume and profitability using Encompass TPO Connect® in your wholesale and correspondent channels

Featured customers

TPO Connect enables fast, complete and compliant loan acquisition, and collaboration

TPO Connect is a web-based portal featuring your company branding and content, enabling you to easily create your own TPO acquisition portal.

Easy to onboard and deploy

Easy set-up and a selection of templates make customization simple and maintenance minimal.

Customizable

Use your choice of images, assets, content, and color to make the portal your own, without building it from scratch.

Flexible and configurable

Create a custom workflow, including pipeline views, configurable pages and navigation, and other features, without writing a single line of code.

Compliant

Let us manage compliance. TPO Connect includes automatic compliance and technical updates to keep everything up-to-date.

Enable correspondent lenders to achieve better ROI and loan savings

Correspondent solutions, Encompass and Encompass TPO Connect allow for maximum efficiency, scalability and profitability

Delivers 10.8x annual ROI

- Scale operations and improve capacity by 28%

- Process 1,414 more loans per year without additional resources

Save $654 per loan

- Save an average of 498 minutes per loan

- Speed funding by a full day

Win more business

“Having a system like Encompass TPO Connect that links you with your TPO partners and lets them know that they’re valued as customers is critical to winning more business.”

Lorenzo Adams

Vice President of Operations

First Community Mortgage

Deliver a first class experience for your TPOs

TPO Connect enables you to give your lenders and sellers an optimal way to collaborate.

Higher quality loans

Maximize profitability and collaboration with your TPO channels

- Increase your pipeline and attract customers with an easy to use branded portal

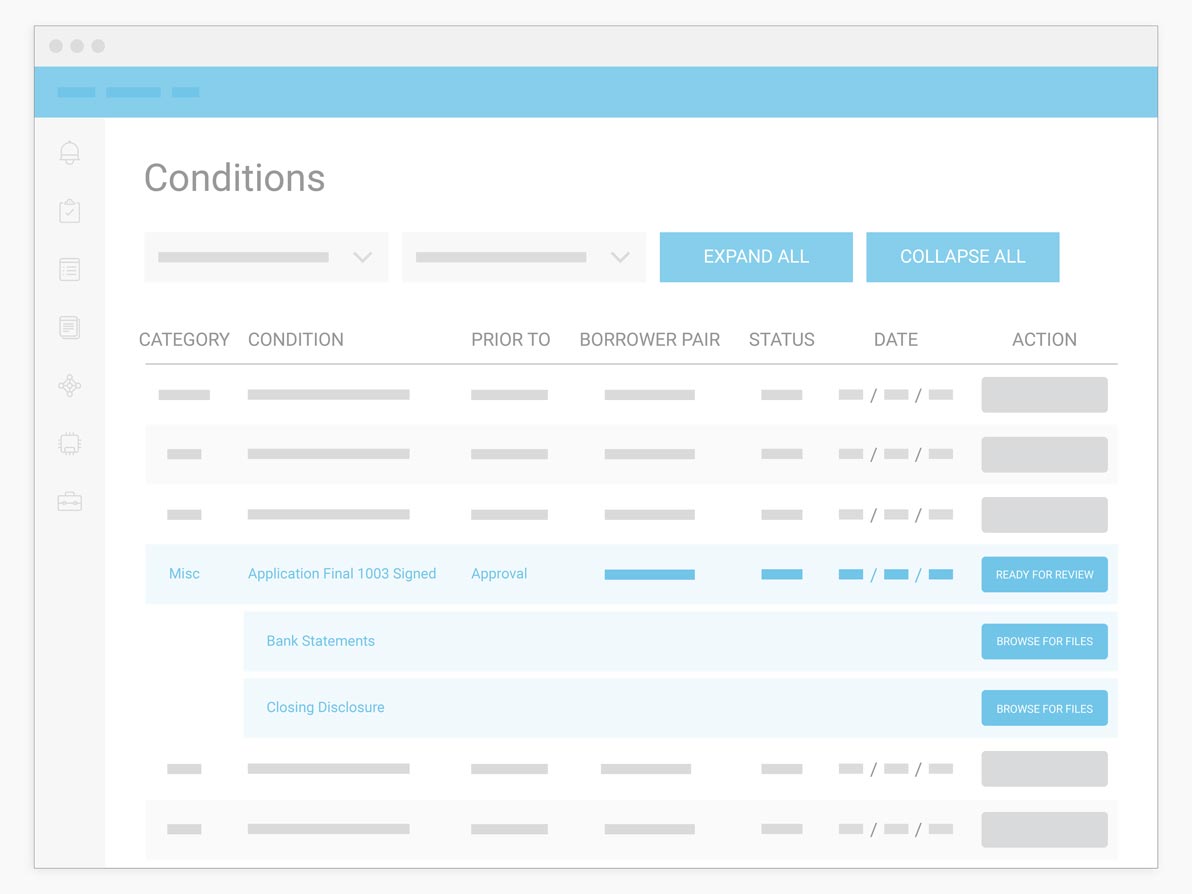

- Receive loans faster and improve collaboration by giving your TPOs an easy way to manage and deliver loans

- Close and purchase higher quality loans faster by bringing your TPO channel into Encompass

ACCESS DATA

Improve TPO collaboration, and give them the ability to:

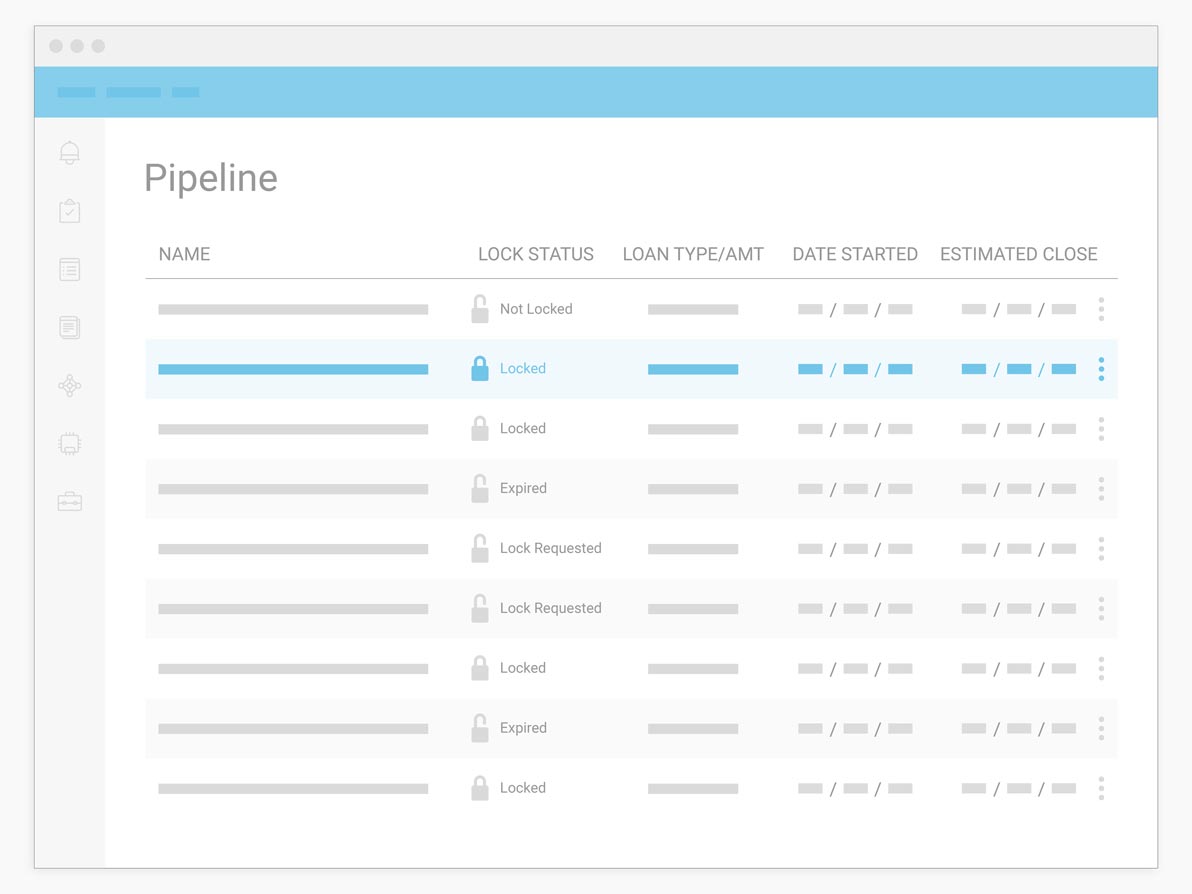

- View pipeline reports and monitor status

- Order credit, AUS, submit lock requests

- Deliver and eSign loan packages

- View and manage correspondent trades

Your end-to-end workflow

Streamline every step of the mortgage process

ICE Mortgage Technology delivers a true digital mortgage experience across your entire workflow. Our technology enables mortgage professionals across the industry to focus on personal connections where they need them most.

Benchmarking

Capital Markets & Secondary Marketing

Customer Acquisition

Default

Home Equity

Loan Manufacturing

Market Analytics

Partner Network/Integrations

Portfolio Management

Real Estate

Retention

Risk Management

Servicing

Settlement and Closing

Title

Valuations

Professional Services

Take your business to the next level with ICE Mortgage Technology® Professional Services

We offer customizable implementation packages, advisory consulting, custom solutions development, and project management. Our Professional Services representatives are ready to help you optimize your system and improve operational efficiencies so you can get the most out of your investment.

What customers are saying

“The flexibility of TPO Connect gives us what we need to provide a better customer experience; from making it easier to onboard loans to providing timely information to our TPOs and giving them the tools they need to manage their pipeline.”

Rick Q. Chin,

Vice President of Lending Solutions, PHH Mortgage

Encompass®

Take your Encompass experience to the next level

Leverage solutions across the Encompass platform to make smarter business decisions, lower costs, and drive innovation across all your channels.

Encompass Consumer Connect®

Borrowers expect an engaging online experience. Are you delivering?

Encompass for Loan Officers

Empower your loan officers to drive more business and deliver better borrower experiences.

Encompass CRM™

Loan delivery, funding, and purchases- fast.

Encompass eClose

One source. One workflow: The future of closings is here.

ICE PPE (Product and Pricing Engine)

Loan pricing in an instant, with total confidence.

Encompass Investor Connect™

Loan delivery, funding, and purchases- fast.

Encompass Data Connect

Do more with your data, anytime and anywhere.

Encompass Connector® for Salesforce®

Connect Encompass and Salesforce to create a true digital mortgage platform.

Home Equity

Connect Encompass and Salesforce to create a true digital mortgage platform.

Resources

Learn more about how ICE Mortgage Technology® is changing the industry and stay up-to-date with the latest tools and information.

Amerihome Mortgage Case Study. Increase loan productivity by 25%

First Community Mortgage Case Study. Reduce cycle time and improve the user experience

Receive and Manage Loans from TPOs