Portfolio Management

Maintain enhanced oversight and management of the loans in your portfolio with robust technology and data solutions to help maximize profitability, mitigate risk, identify opportunities and improve decision-making.

Stay informed. Support compliance. Be proactive.

Discover the right solutions to seamlessly and effectively manage loan portfolios, driving servicing and investor success.

Monitor

Stay informed on timely property, loan and regulatory changes that could impact performance

Analyze

Use actionable analytics to help make more informed business decisions

Evolve

Forecast market and borrower trends to help uncover new growth opportunities

Solve

Proactively address potential loan issues and streamline the servicing process

Optimize portfolio performance

See how ICE’s mortgage portfolio management solutions can help deliver deeper property insights, forecast mortgage and housing trends, improve margins, identify and mitigate risk, optimize processes, benchmark performance and improve customer satisfaction.

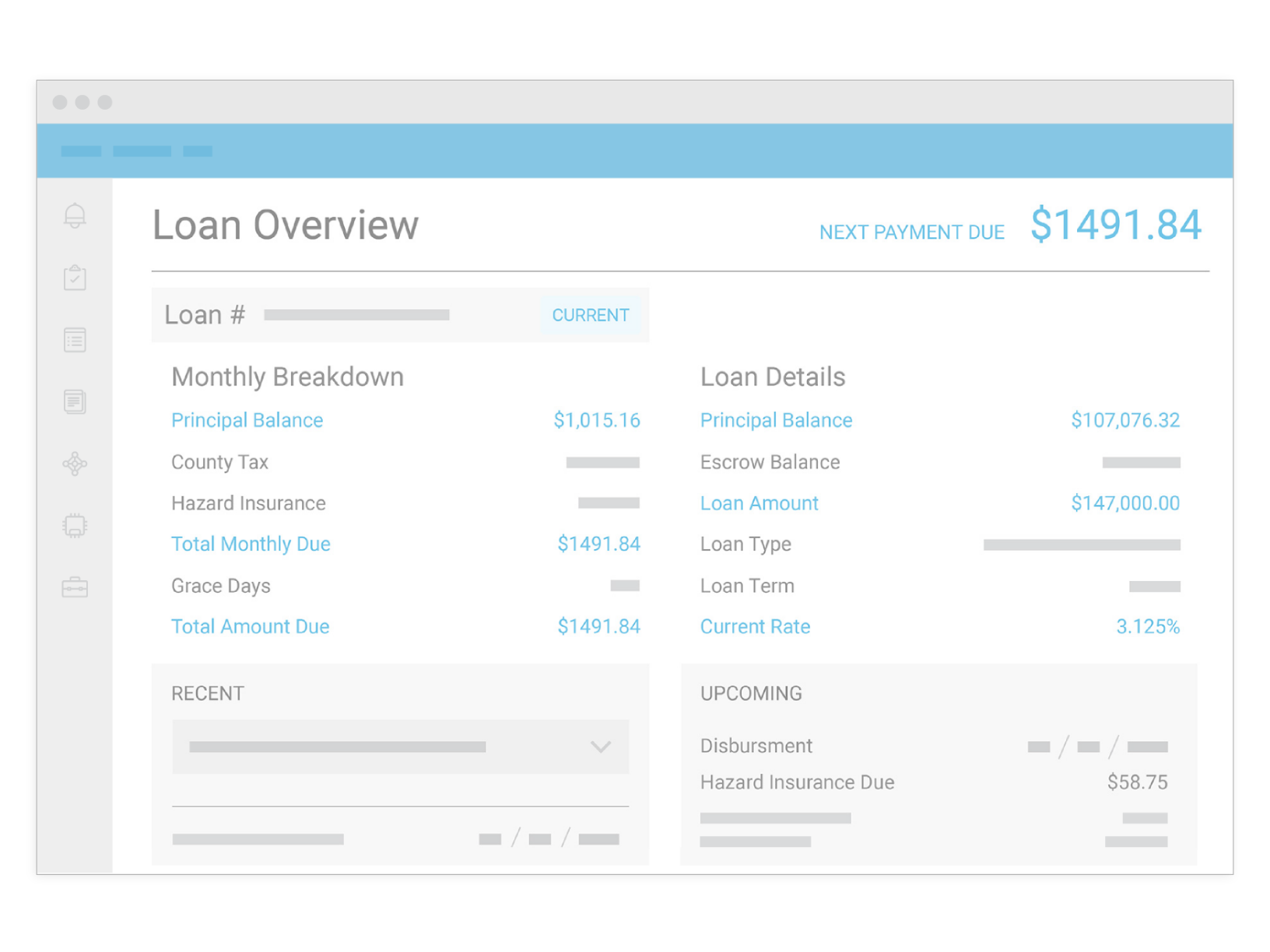

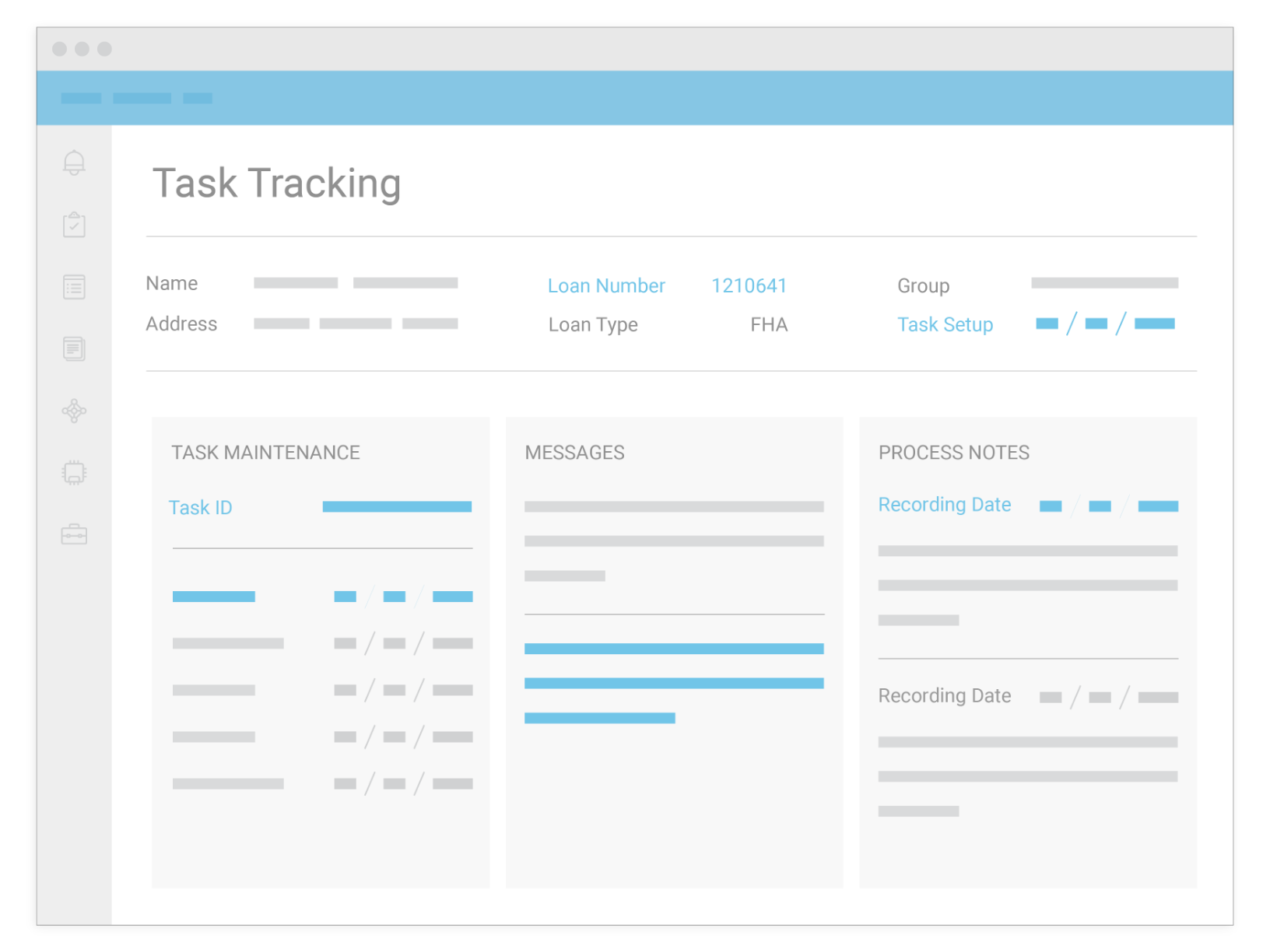

Automate your servicing workflow and document management

MSP®, ICE’s best-in-class mortgage servicing system, can drive your end-to-end loan processes and scale your business. Using one platform, MSP can help servicers manage their portfolio through integrated task tracking, exception-based processing, workflow automation and business intelligence capabilities to support all functional areas of servicing.

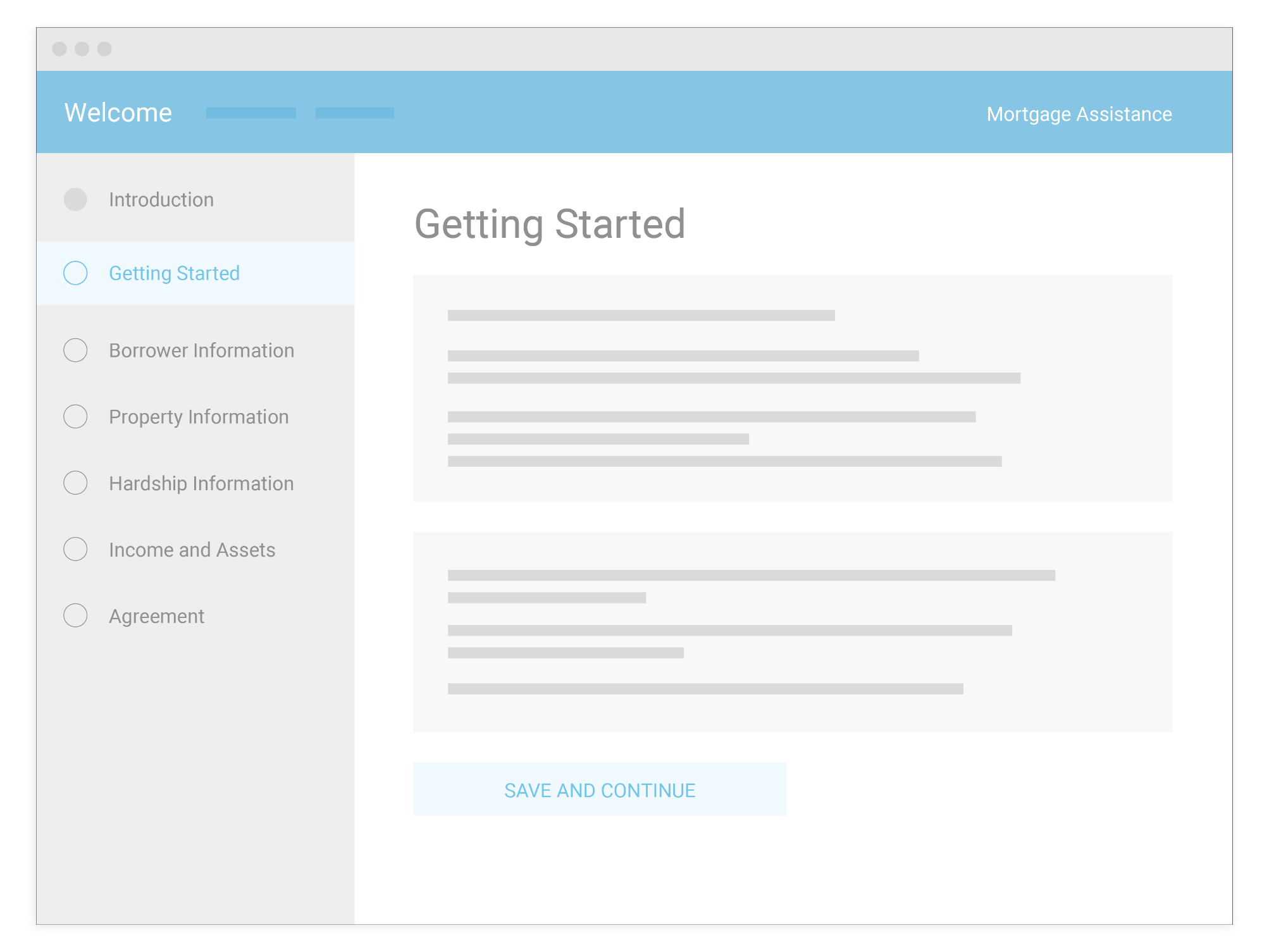

Provide enhanced support for customers in times of hardship

ICE’s default solutions can assist servicers in their efforts to support those struggling to make mortgage payments. With loss mitigation, bankruptcy, foreclosure, claims capabilities and more, ICE delivers a full set of solutions to help borrowers who fall behind.

Stay on top of critical loan changes

ICE’s Monitoring and Alerts deliver crucial updates on loans, properties, ownership and liens to help servicers stay informed, mitigate risk and drive efficiency.

Gain deeper insights into your portfolio

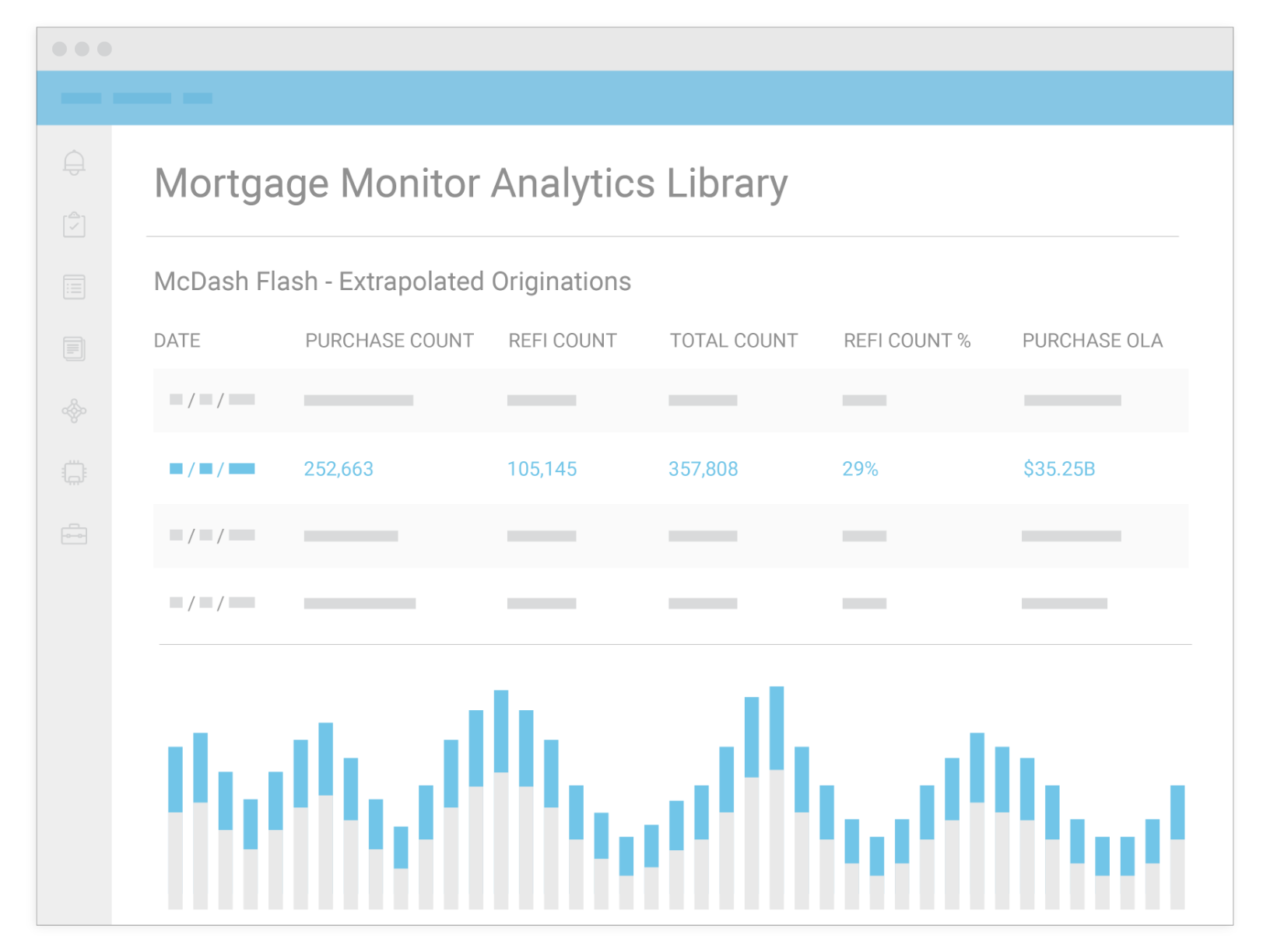

Develop a deep understanding of mortgage performance across the U.S. with McDash®’s loan-level data and information covering the entire credit spectrum of agency, non-agency and portfolio products on the majority of the mortgage market.

Access predictive analytics and gain reliable insights into voluntary and involuntary risk with our AFT Prepayment and Credit Model.

See more ICE Portfolio Management solutions

Take your business to the next level with our suite of real estate solutions that can help you increase productivity, strengthen customer relationships, increase opportunities and more.

Business Intelligence

Easy-to-use, next generation solutions that help real estate professionals, MLSs and title companies generate more business, increase productivity, strengthen relationships and deliver a competitive edge in today’s market.

Disaster, Hazard and Risk Data

Robust data solutions that include EPA category information on contaminated sites, hazardous waste and solid waste facilities, reports that indicate flood hazard areas, near-real-time disaster alerts and climate risk scores.

Flood

Automated, nationwide flood zone determinations leveraging FEMA information, high-resolution images and public records data for greater accuracy and a better understanding of risk.

HOA Indicator

A fast, easy and affordable solution that identifies if a property is in a homeowners or condo association.

Lien Alert

Efficient, cost-effective portfolio-monitoring solution delivering early notifications of critical property-, borrower- or mortgage-related events that could impact the collateral supporting your loans.

Rapid Analytics Platform®

Cloud-based software solution for users to access diverse data assets and run advanced analytics on a single, turnkey platform.