Mortgage servicing is the process of collecting monthly loan payments and managing the borrower’s annual taxes and insurance premiums using their escrow accounts. This process begins after the mortgage loan closes and funding is completed.

MSP® Mortgage Servicing System

An end-to-end software system that handles every servicing need

MSP®, ICE’s best-in-class loan servicing software, has set the industry standard and is unmatched, due to a strong focus on regulatory compliance and risk, protection of borrower-owned data, decades of proven performance and a commitment to continuous innovation. MSP offers servicers of all sizes the ability to tackle today’s most pressing business challenges.

More servicers choose MSP than any other loan servicing software

Our mortgage servicing platform is used by financial institutions that service first mortgages, along with home equity loans and lines of credit. These include banks, mortgage companies, credit unions, housing agencies and more.

Single, comprehensive system

Service and support

Address regulatory requirements

Customer retention

Lower cost

Scalability

Customer experience

Advanced capabilities for an unparalleled customer experience

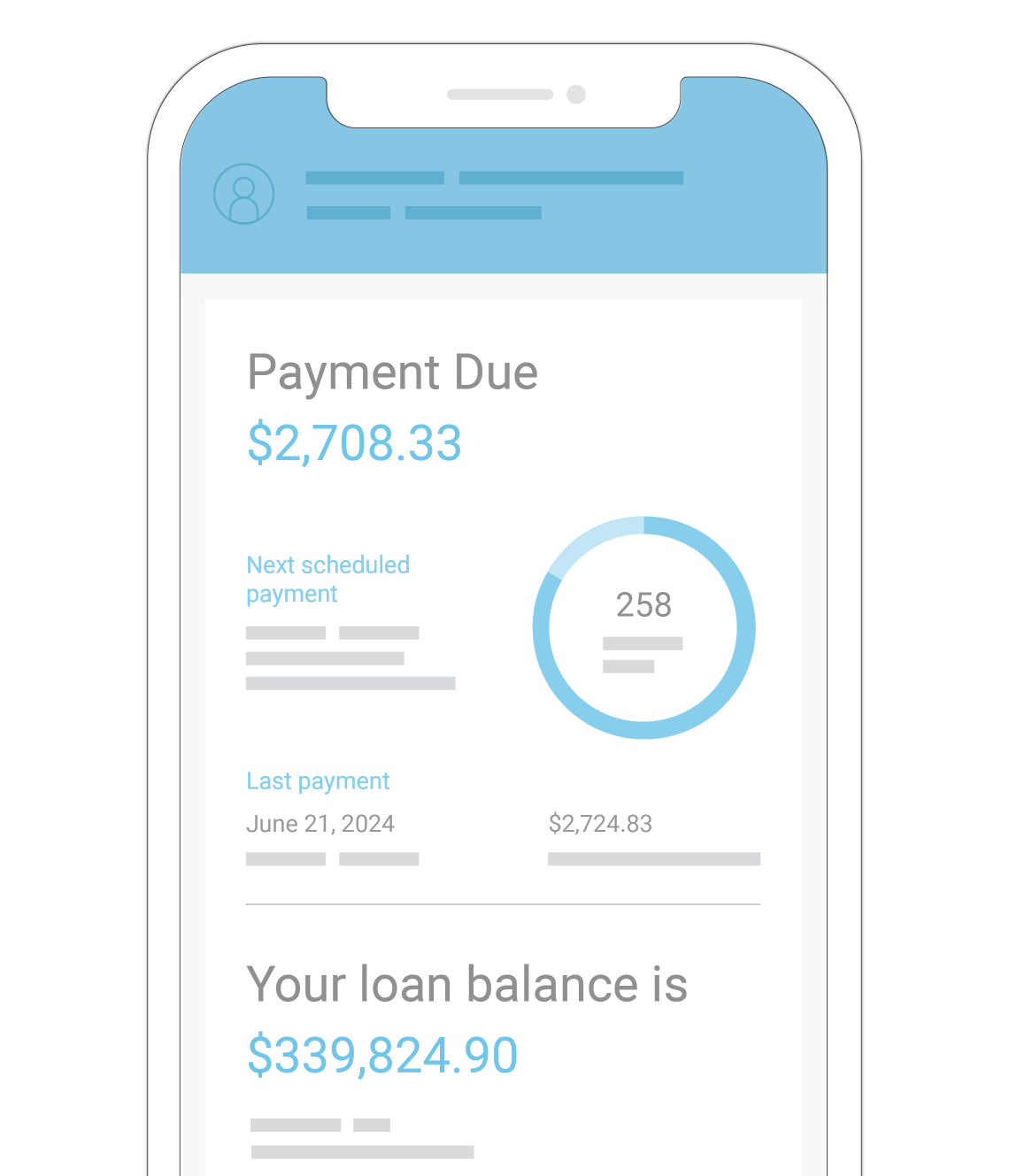

Customers want quick and simple access to their loan and property-related information – anytime, anywhere. MSP integrates with Servicing Digital, ICE’s consumer-facing native app and responsive web solution, to give borrowers 24/7 access to highly personalized home, loan and neighborhood information. And when borrowers call for support, Customer Service quickly provides your agents with relevant information about the customer’s loan, helping them quickly and efficiently resolve many issues in just one call.

Operational efficiency

Do more with the team you have

MSP is continually enhanced to deliver the latest advancements in digital technology, workflow automation and decisioning capabilities. Supporting efficient processing from loan boarding to disposition, MSP helps your back-office teams work seamlessly across functional areas to drive performance, reduce costs, and improve communication and collaboration.

System integrations

The right technology, right when you need it

MSP supports several types of integrations, including digital application programming interface (API) integrations, so users can rapidly access data and services. Servicers can also leverage the ICE InterChange Services electronic data interchange (EDI) network, with more than 400 providers already integrated to ICE's servicing technologies.

Home equity

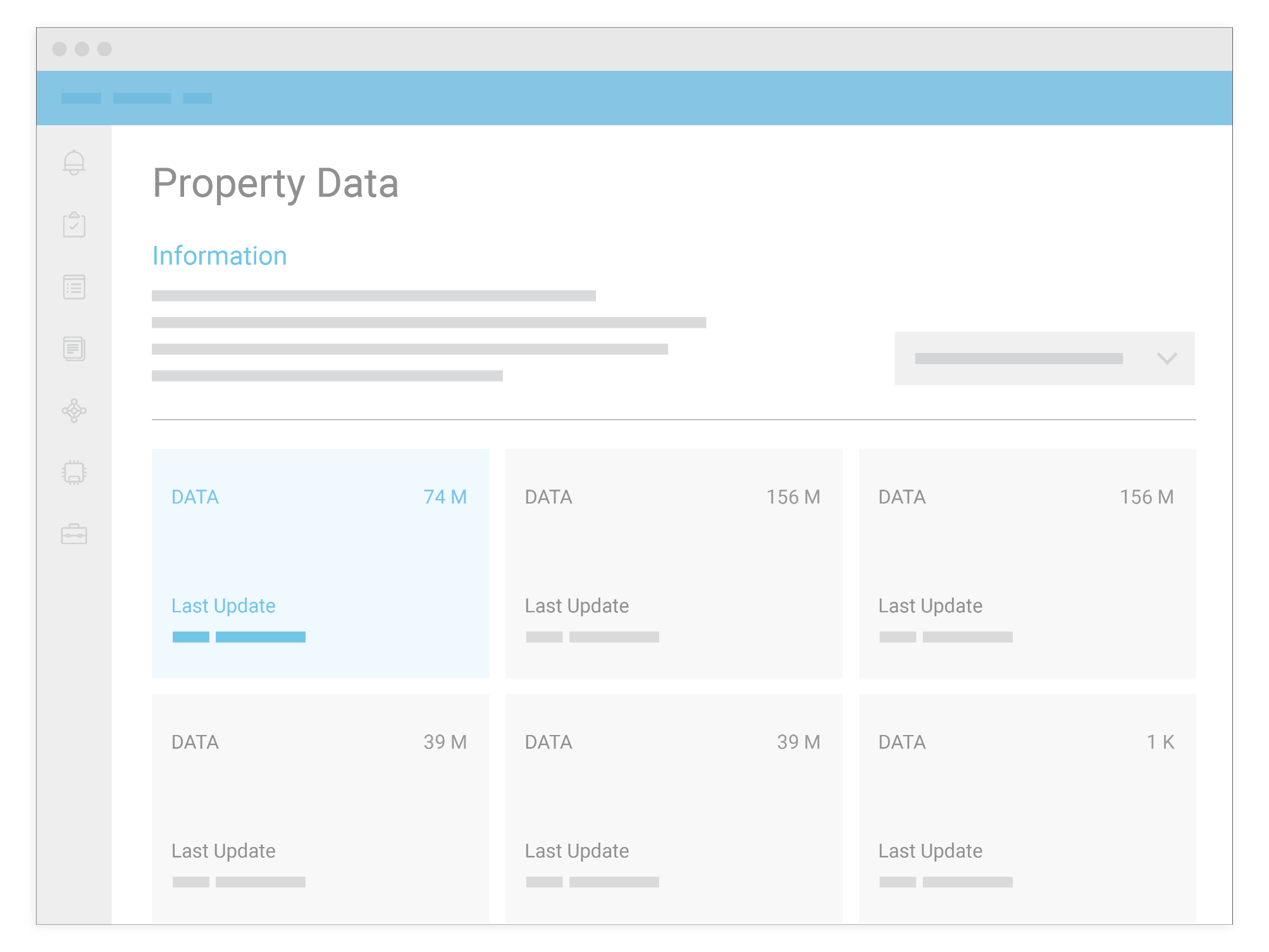

Help homeowners realize their potential in an equity-laden market

With MSP, servicers can handle home equity loans and first liens on a single platform. Plus, the integration of ICE's robust dataset with MSP helps servicers identify customers in their portfolio who are most likely to take advantage of home equity loans and lines of credit. This data can also help during loss mitigation, as strong home equity cushions provide borrowers incentive to work with their servicers to return to making mortgage payments.

eBook

The strategic servicer’s playbook: Four ways to fortify your servicing operations to adapt to any market

Read our complimentary eBook to explore four ways servicers can strategically uncover opportunities to adapt to the market’s ebbs and flows – and delight customers while driving repeat business with modernized servicing technology.

Explore more resources

MSP in the news

Longtime servicing client PNC expands use of ICE data and analytics to further benefit from end-to-end, integrated technology ecosystem

MSP® Mortgage Servicing System

Take your MSP experience to the next level

Leverage integrated servicing solutions to make smarter business decisions, lower costs and drive innovation across all your channels.

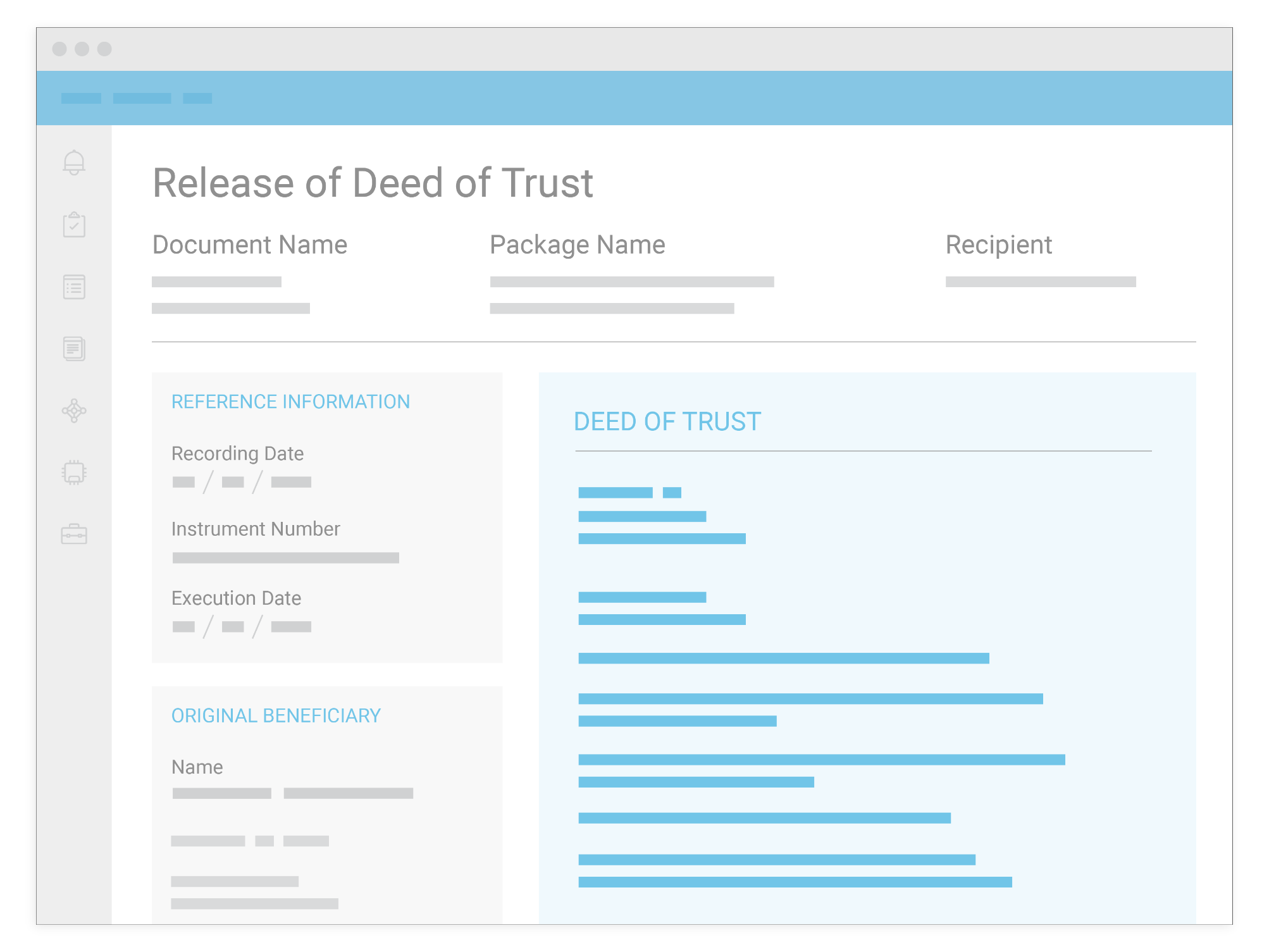

Automated Lien Release

Bankruptcy

Claims

Credit Bureau Management

Foreclosure

Invoicing

Lien Alert

Servicing Events

Servicing Orders

Servicing Partner Success Program

Frequently asked questions

What is mortgage servicing?

What is the difference between loan origination and loan servicing?

Loan origination is the process of obtaining a mortgage to finance a home. Mortgage servicing is the process of keeping borrowers in their homes after they close by managing monthly payments and escrow accounts for taxes and insurance.

What is a mortgage servicing system?

A mortgage servicing system is a software platform used by loan servicing companies to help them manage a borrower’s monthly mortgage payments. It also helps servicers pay the borrower’s annual taxes and insurance premiums on time by giving servicers tools they can use to track due dates, automate processes and manage escrow accounts. Read more to see what other tasks a mortgage servicing system can help servicers perform.

What is the difference between servicing a loan in-house and subservicing?

Loan servicing is the process of collecting monthly loan payments and managing the borrower’s annual taxes and insurance premiums using their escrow accounts. Subservicing is when a financial institution outsources some or all of the administrative loan servicing functions to another entity. Read more about subservicing and how it compares to servicing a loan in-house.

What are the benefits of servicing a loan in-house?

While contracting with a subservicer can be an effective business model, there are several advantages to servicing the mortgages you originate in-house. When servicing a loan for the extent of its life cycle, servicers can:

- Reduce risk

- Improve the customer experience

- Increase the potential for repeat business

- Maintain a competitive advantage

Read more about the benefits of servicing a loan in-house, as well as why subservicing might be the right choice for some organizations.

What is the process for evaluating a new mortgage servicing system?

When evaluating a new mortgage system, servicers will need to first consider the business objectives they want the system to help them achieve and whether that technology fits their budget. Second, they will want to go through process consultation with their technology provider. You can read more about both those processes here.

How much does a mortgage servicing system cost?

There are several factors that affect the pricing of a mortgage servicing system, including portfolio size, the solutions the servicer needs and more. Read some frequently asked questions that will help you understand how pricing works for mortgage servicing systems and how you can get the most from your investment.

What is included in the pricing of a mortgage servicing system?

Depending on the mortgage servicing technology provider, pricing approaches vary. Pricing typically includes:

- Loan servicing management functionality

- Third party integration

- Borrower self-service capabilities

- Customized system implementation

- Staff training

Options can go beyond this list. Read more about the configurations offered within advanced mortgage servicing systems.

What is the implementation process for a mortgage servicing system?

A mortgage servicing system implementation includes installing software and configuring that software with the mortgage servicer’s specific business rules and processes. The mortgage servicing system can be integrated with third-party software from other participants. Read more about the types of providers servicers can integrate their technology with.

What technology is available to help manage home equity loans and HELOCS?

With the ICE Encompass® loan origination system (LOS), lenders can originate home equity loans on the same platform as first lien mortgages, and then service both those loan types on a powerful servicing platform like MSP. Read more to see how ICE’s digital mortgage ecosystem can help lenders and servicers support HELOCs and first mortgages on a single platform.

Can home equity loans/HELOCs and mortgages be serviced on the same system?

Yes. Advanced mortgage servicing solutions, such as MSP, allow first lien mortgages and home equity products to be processed on a single, integrated platform. This helps mitigate risk and reduce duplicative systems and processes. Read more about the benefits of choosing a single technology provider that helps lenders and servicers support both home equity and first liens.