Encompass Consumer Connect®

Borrowers expect an engaging online experience. Are you delivering?

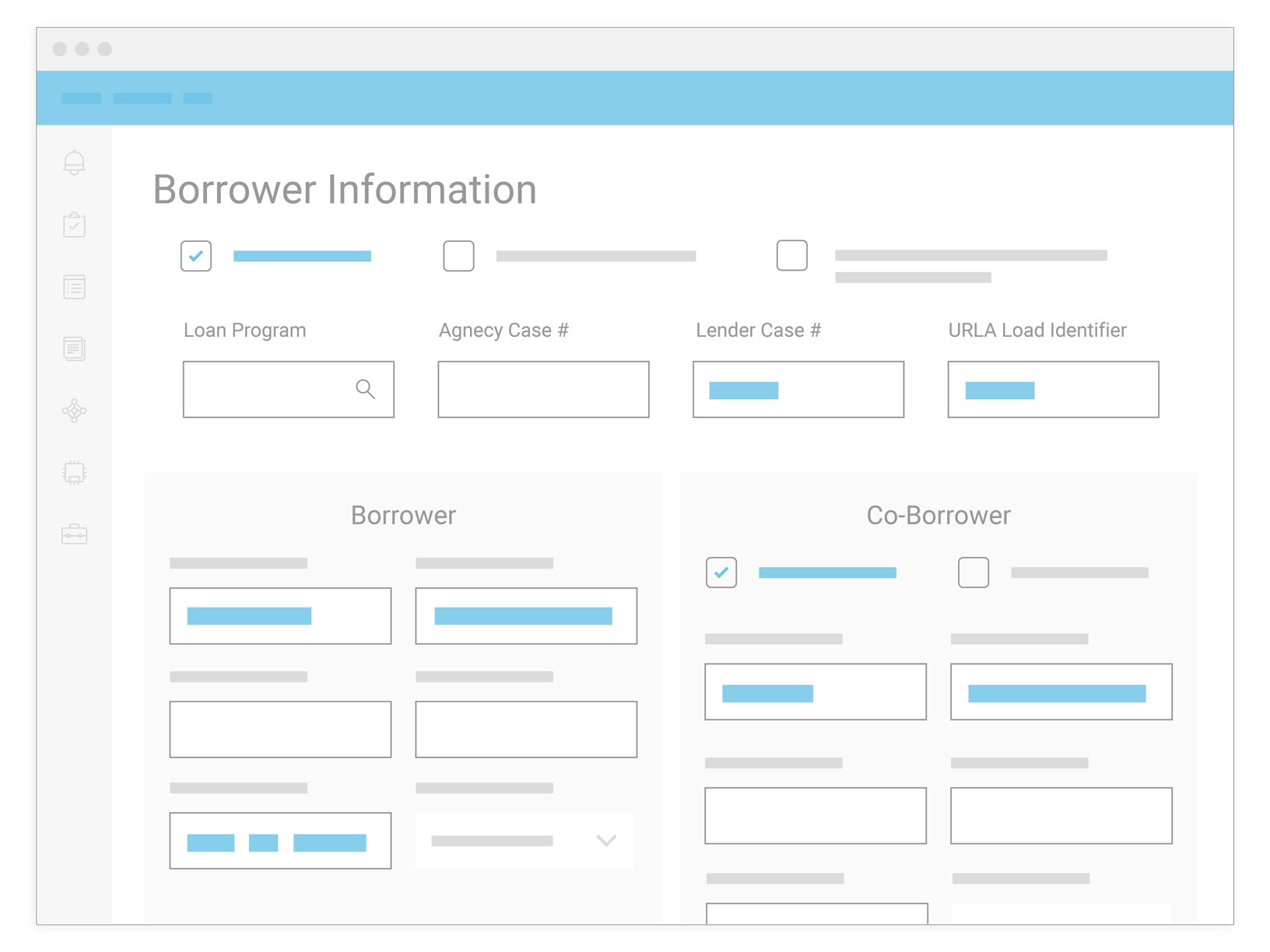

With Encompass Consumer Connect® borrowers can easily complete an online mortgage application, instantly engage with their loan officer, and securely upload and eSign documents, making it faster and less expensive for a lender to process a loan.

Featured customers

A digital-first solution for modern borrowers

Enhance borrower engagement, optimize the loan process and deliver exceptional value.

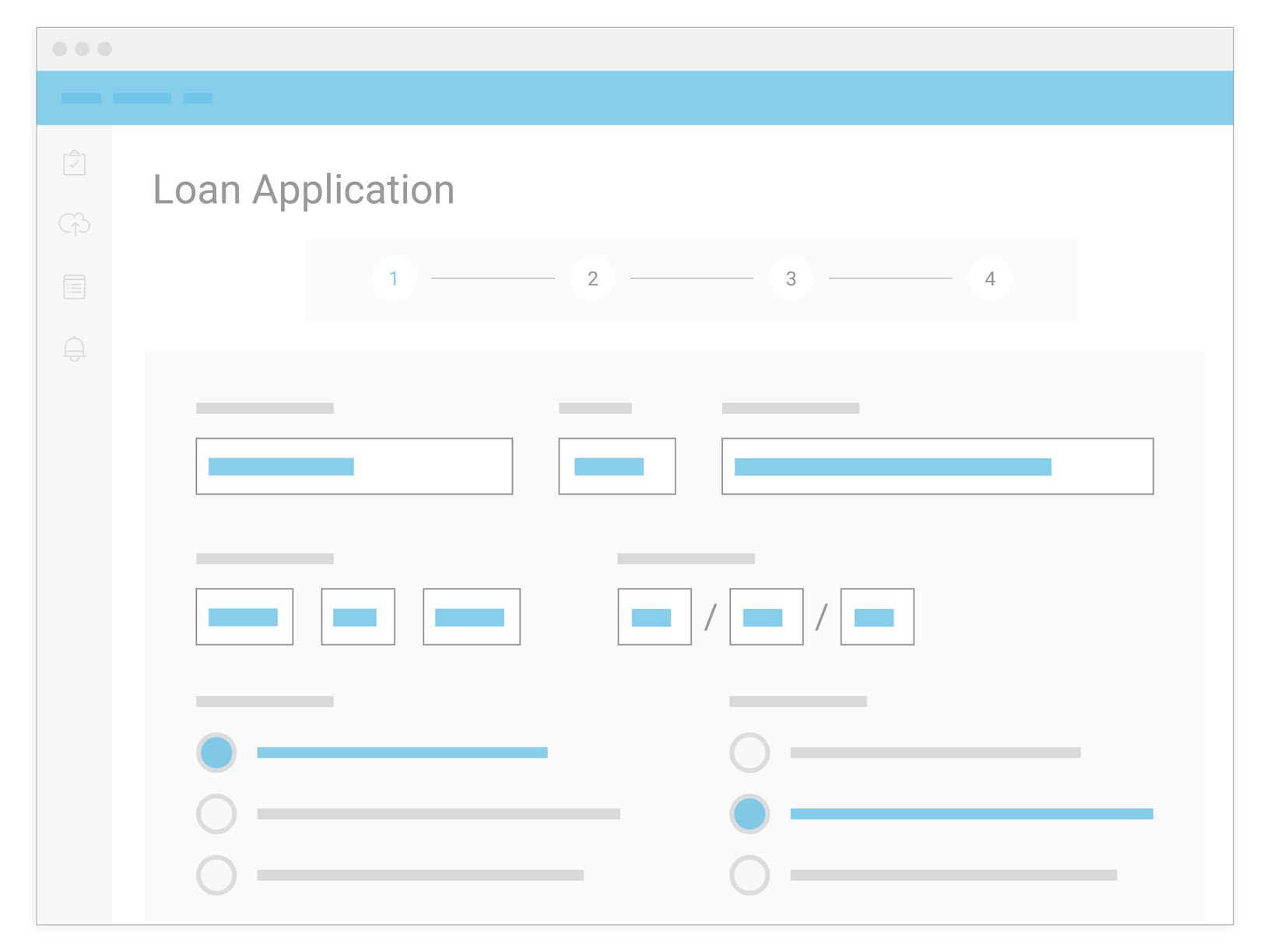

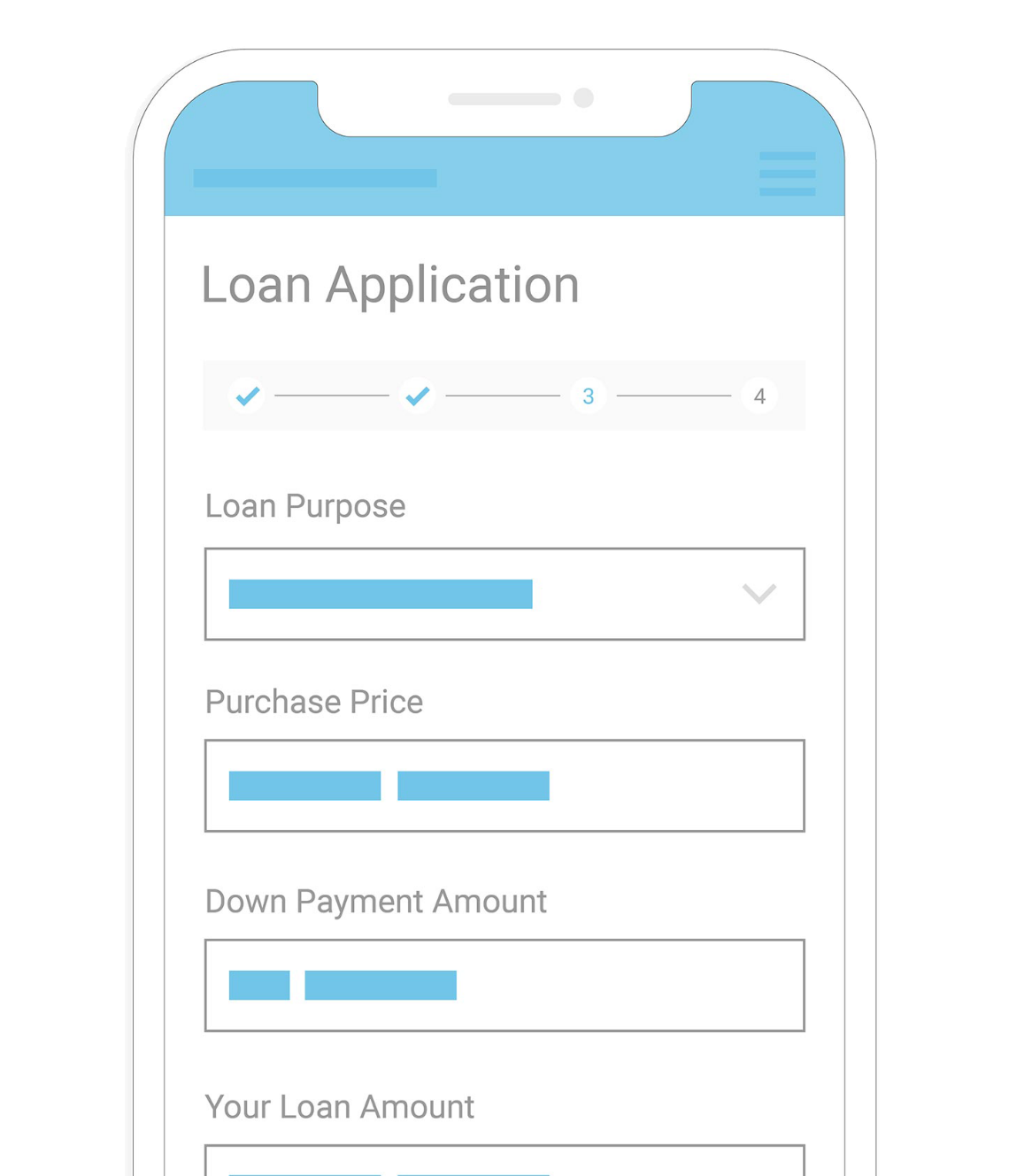

Transparent progress tracking

Provide real-time updates at each stage of the loan process, fostering trust through transparency.

Faster document submission

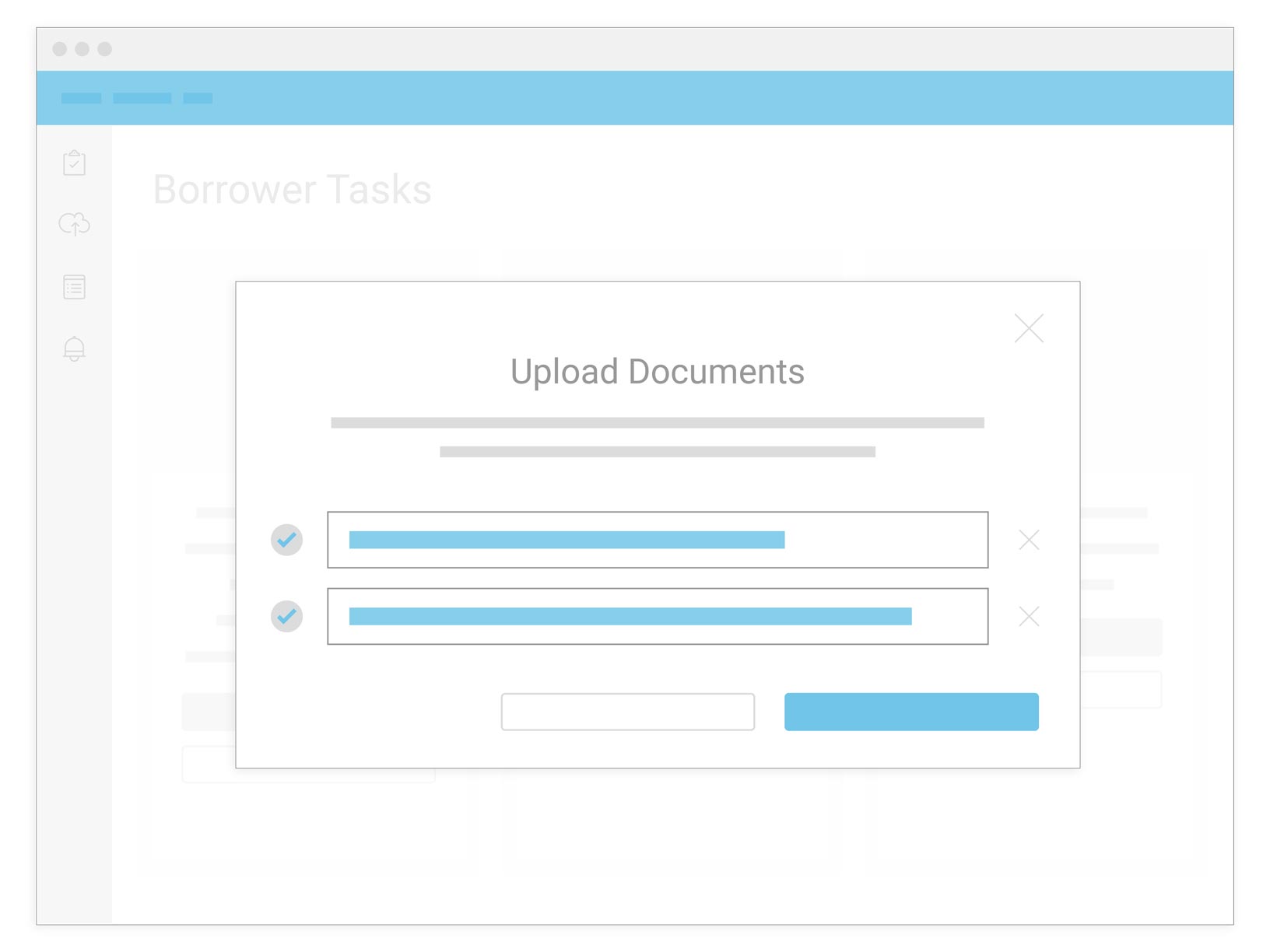

Securely submit documents and eSign forms , saving time and eliminating paperwork.

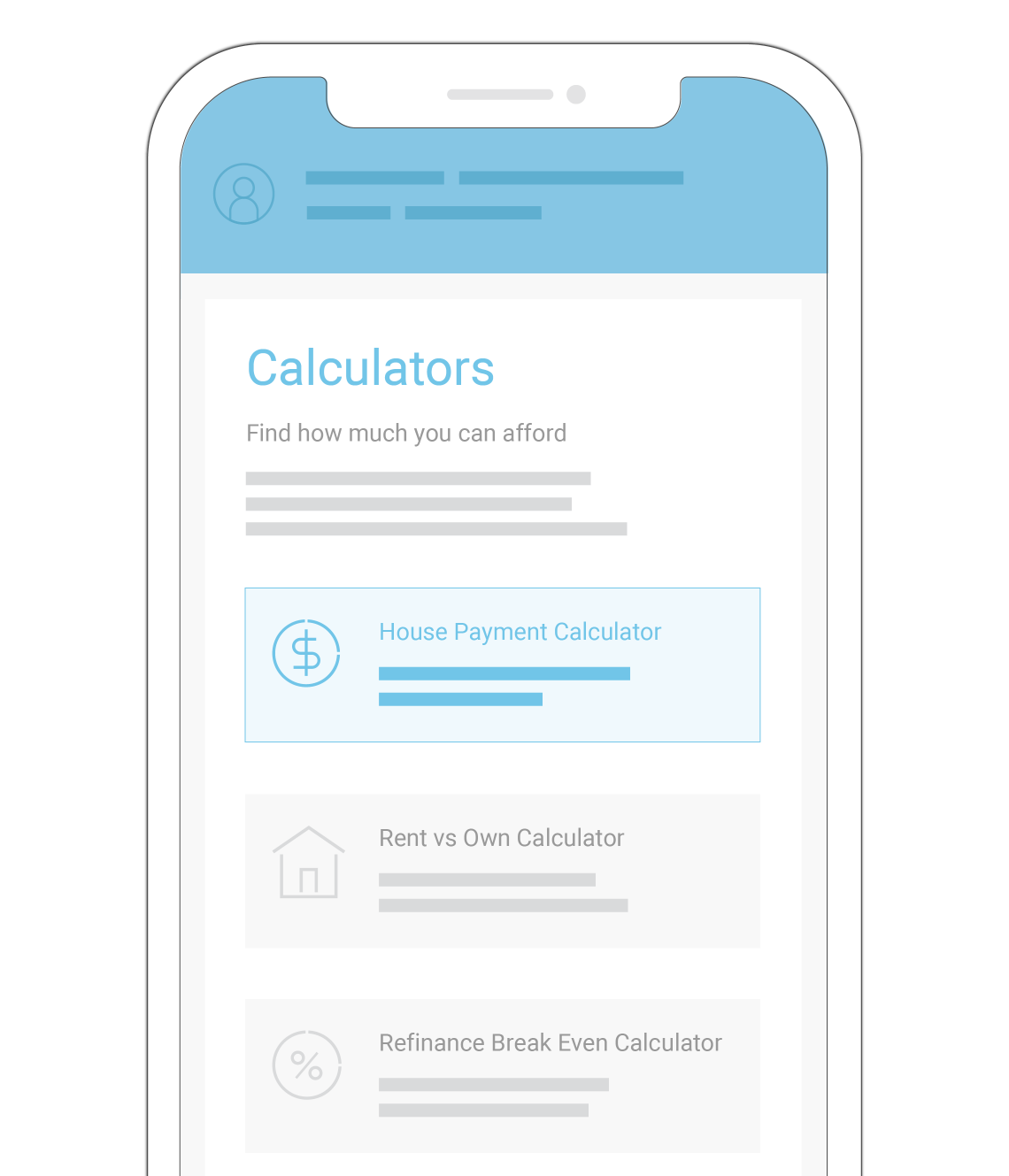

Smarter financial choices

Estimate payments, compare options and make informed decisions with built-in mortgage calculators and real-time pricing.

A customized experience

Deliver a branded, ready-to-go experience tailored to meet your borrowers’ needs on any device.

Encompass Consumer Connect features

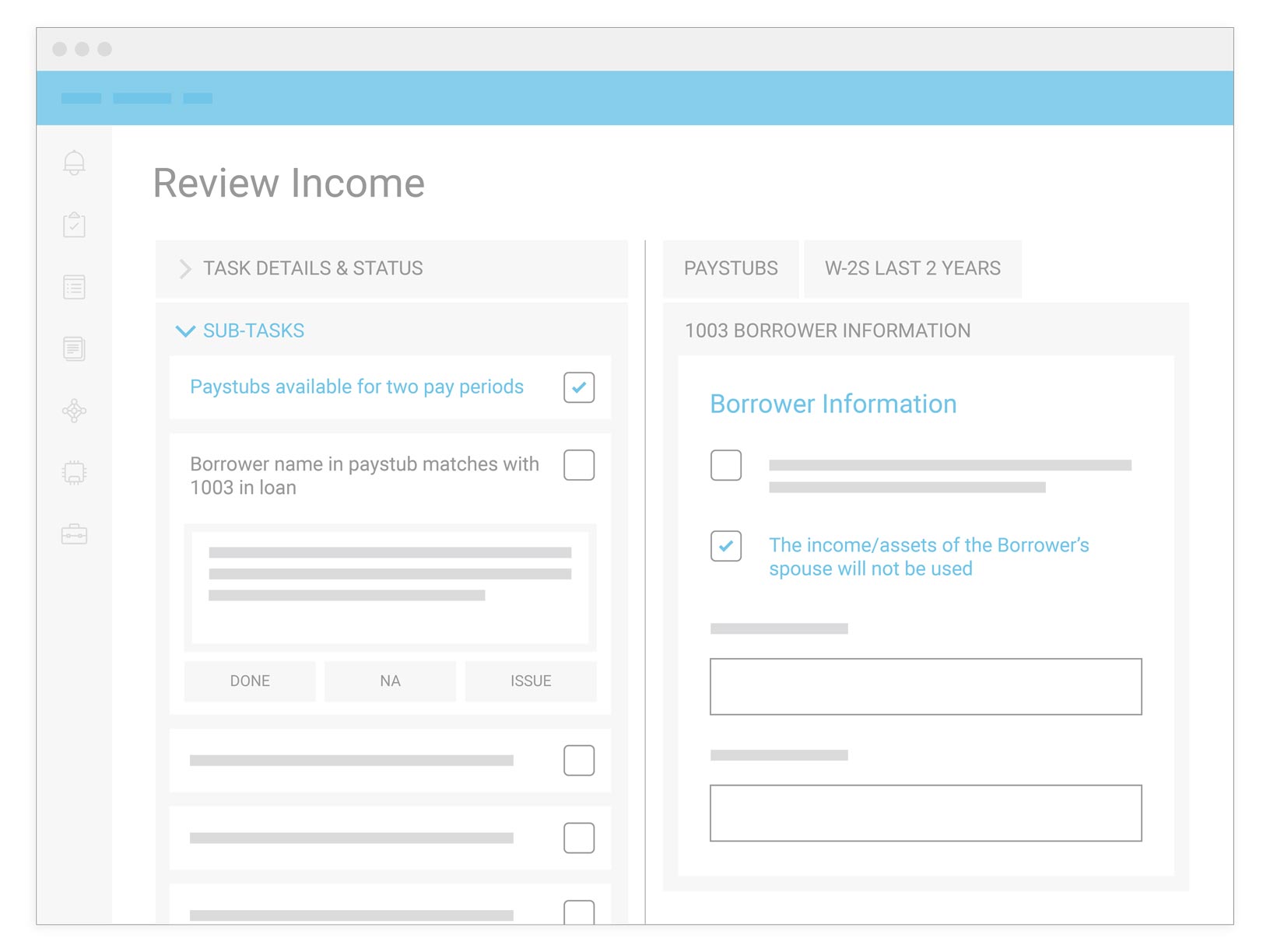

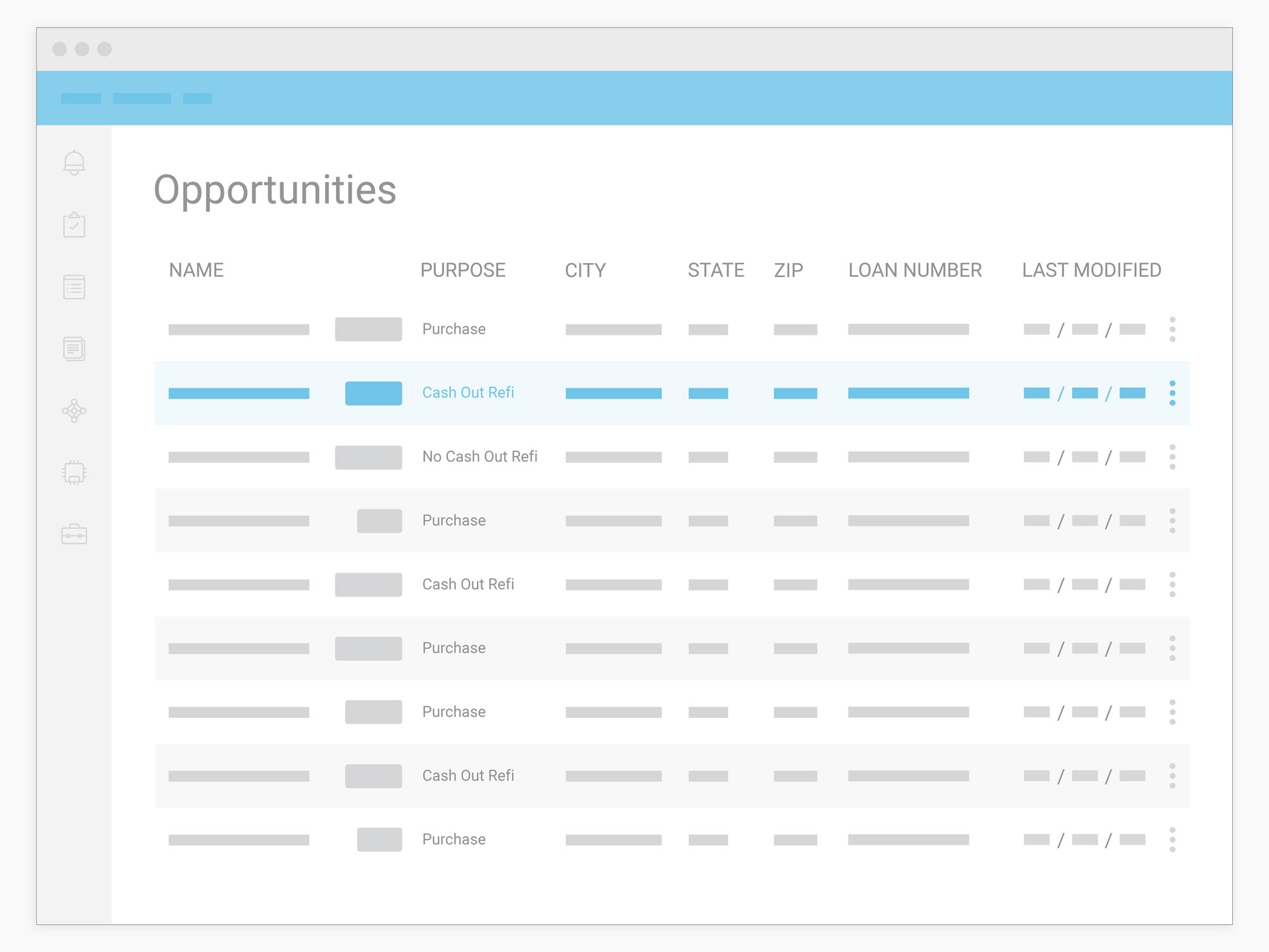

Encompass Consumer Connect provides a state-of-the-art digital mortgage experience for the home buying process where you can close loans faster, improve the borrower, and ensure compliance. With Consumer Connect, you can create a custom web experience unique to your company, virtually guide borrowers through the loan application process on any device, and provide real-time status updates.

Lender highlights

Drive more business with better automation and customization

- Utilize a modern digital mortgage workflow that streamlines everything from online applications to data collection.

- World class security comes baked in with all of the ICE Mortgage Technology® family of products, giving you greater peace of mind.

- Automatically receive compliant applications, underwritten by Fannie Mae’s Desktop Underwriter® or Freddie Mac’s Loan Product Advisor™, and enable services.

- Increase your online brand presence with a customized interface and template.

- Get alerts to any compliance obligations, even with incomplete applications.

Borrower highlights

Simplify the borrower experience

- Modern, responsive design lets borrowers fill out a simple, conversational style loan application and easily interact with your site from any device.

- A paperless way to collaborate with your team, securely send and receive documents, and share financial information.

- Borrowers can accelerate the application process by running their own credit reports, getting online verification of assets, and eSigning documents.

A mobile-first solution for today’s borrowers

The My Home Loans borrower app, a real-time mobile platform for easy loan management, simplifies the mortgage process for both borrowers and lenders. As an extension of Encompass Consumer Connect®, My Home Loans enables borrowers to stay in control of their loan anytime, while allowing lenders to launch a fully branded app experience with ease.

“By accessing Encompass from anywhere, our loan officers can get the app, finish it, price it, and be first to the finish line. In a lending environment where your ability to respond quickly to borrower applications is often a deciding factor on your ability to win the business, the Encompass platform’s ability to quickly act on new applications has given us a major competitive advantage.”

Brandon Durham,

Product Support Manager

Your end-to-end workflow

Streamline every step of the mortgage process

ICE Mortgage Technology delivers a true digital mortgage experience across your entire workflow. Our technology enables mortgage professionals across the industry to focus on personal connections where they need them most.

Benchmarking

Capital Markets & Secondary Marketing

Customer Acquisition

Default

Home Equity

Loan Manufacturing

Market Analytics

Partner Network/Integrations

Portfolio Management

Real Estate

Retention

Risk Management

Servicing

Settlement and Closing

Title

Valuations

Professional Services

Take your business to the next level with ICE Mortgage Technology® Professional Services

We offer customizable implementation packages, advisory consulting, custom solutions development, and project management. Our Professional Services representatives are ready to help you optimize your system and improve operational efficiencies so you can get the most out of your investment.

Encompass®

Take your Encompass experience to the next level

Leverage solutions across the Encompass platform to make smarter business decisions, lower costs, and drive innovation across all your channels.

Encompass Consumer Connect®

Borrowers expect an engaging online experience. Are you delivering?

Encompass for Loan Officers

Empower your loan officers to drive more business and deliver better borrower experiences.

Encompass TPO Connect®

Optimize how you receive and manage loans from your Third-Party Originators.

Encompass CRM™

Loan delivery, funding, and purchases- fast.

Encompass eClose

One source. One workflow: The future of closings is here.

ICE PPE (Product and Pricing Engine)

Loan pricing in an instant, with total confidence.

Encompass Data Connect

Do more with your data, anytime and anywhere.

Encompass Connector® for Salesforce®

Connect Encompass and Salesforce to create a true digital mortgage platform.

Home Equity

Connect Encompass and Salesforce to create a true digital mortgage platform.

Resources

Learn more about how ICE Mortgage Technology® is changing the industry and stay up-to-date with the latest tools and information.

Encompass Consumer Connect datasheet

Encompass Consumer Connect overview