Servicing

Best-in-class solutions to help manage all aspects of servicing — from loan boarding to default. Transform your performance with automation and insights, and enhance the customer experience. Our solutions support first mortgages, as well as home equity loans, and help servicers lower costs, reduce risk and operate more efficiently.

Technology, data and analytics that help reduce the cost of servicing

ICE offers a comprehensive set of servicing solutions to create a consistent experience for customers and back-office teams alike. From loan boarding, escrow management and cash processing, through loan payoff or default, ICE’s technology can help servicers support each step of the servicing loan life cycle.

A single, comprehensive servicing system for first liens and home equity products

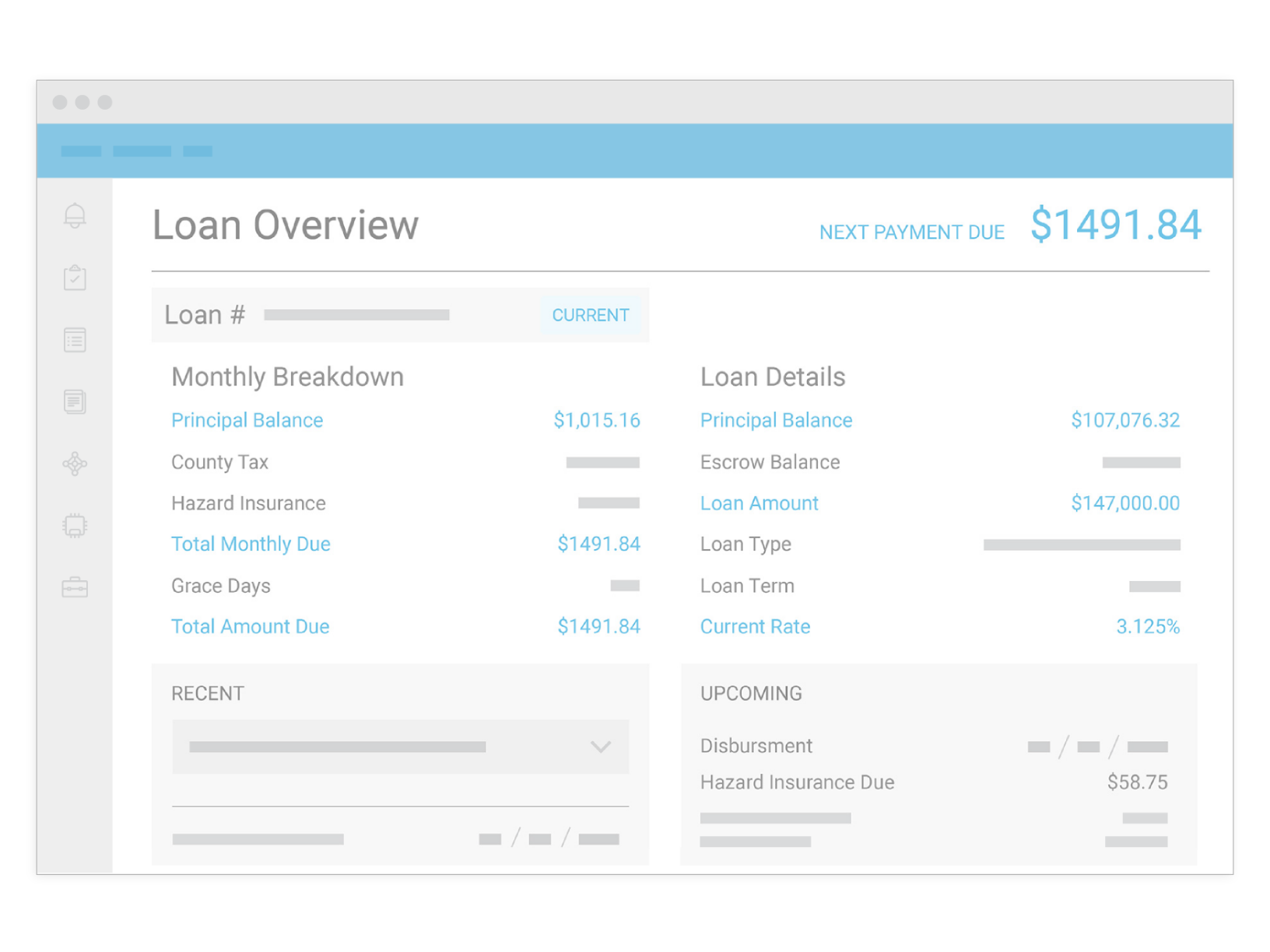

With the MSP® loan servicing system, servicers have access to a powerful system of record that can handle first mortgages and home equity loans and lines of credit on one consolidated platform. Banks, mortgage companies, credit unions, housing agencies and more trust MSP to help them tackle today’s most pressing business challenges while improving the customer experience that drive revenue and recapture business.

Digital consumer engagement tools built with homeowners in mind

ICE Servicing Digital is a white-labeled consumer engagement application that provides customers with fast, simple and seamless access to their home and loan information—anytime, anywhere. Beyond offering a convenient way to make mortgage payments online, Servicing Digital also helps customers understand their home’s equity and can even present them with opportunities to tap into it – helping servicers boost retention and recapture business.

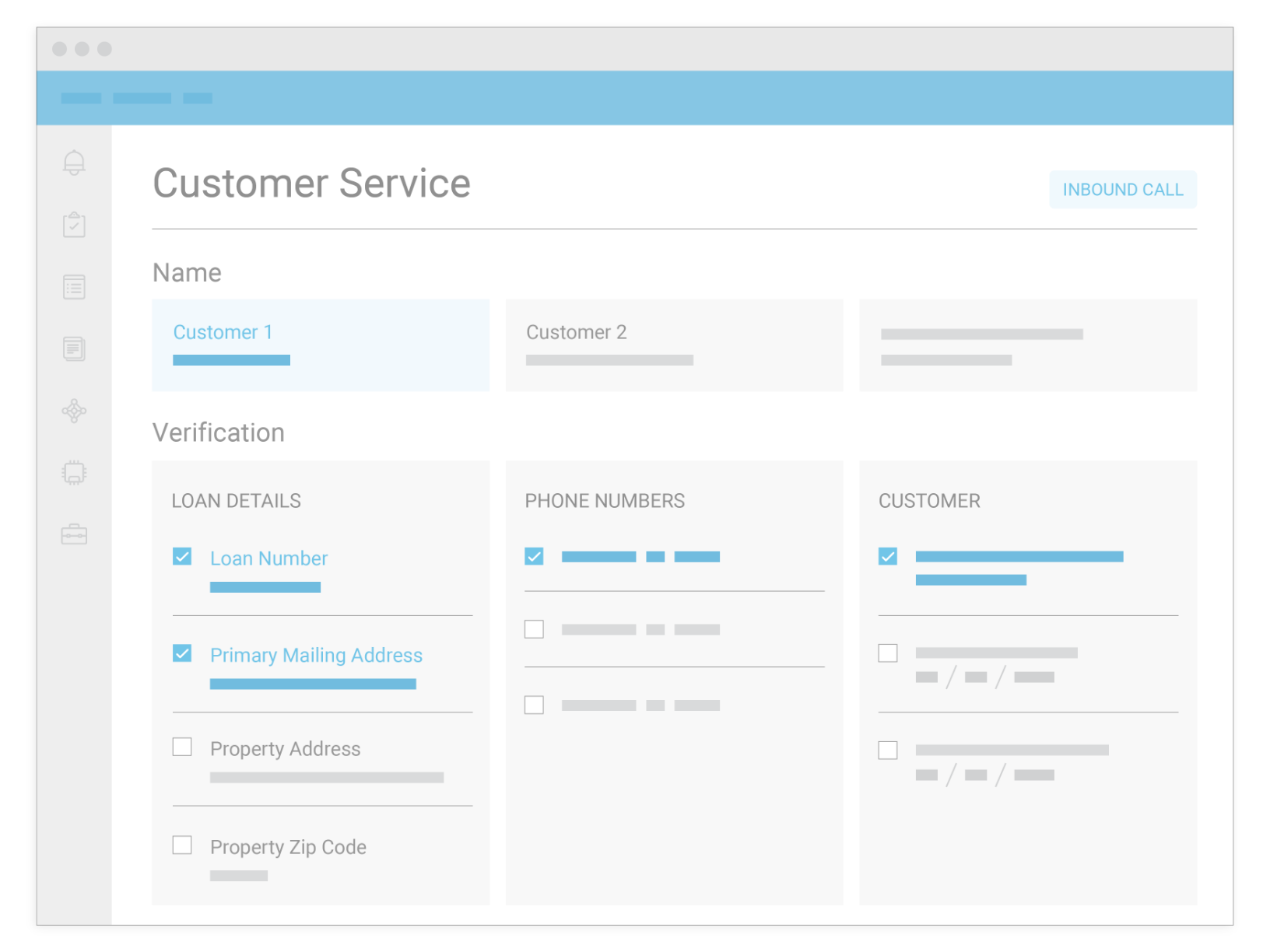

Streamline the call center and drive more one-call resolutions

Resolve customer inquiries faster with ICE Customer Service solution. Uniquely designed for mortgage operations, Customer Service presents support agents with a consolidated view of the customer’s loan, helping agents have more meaningful conversations with customers that lead to more positive outcomes in less time.

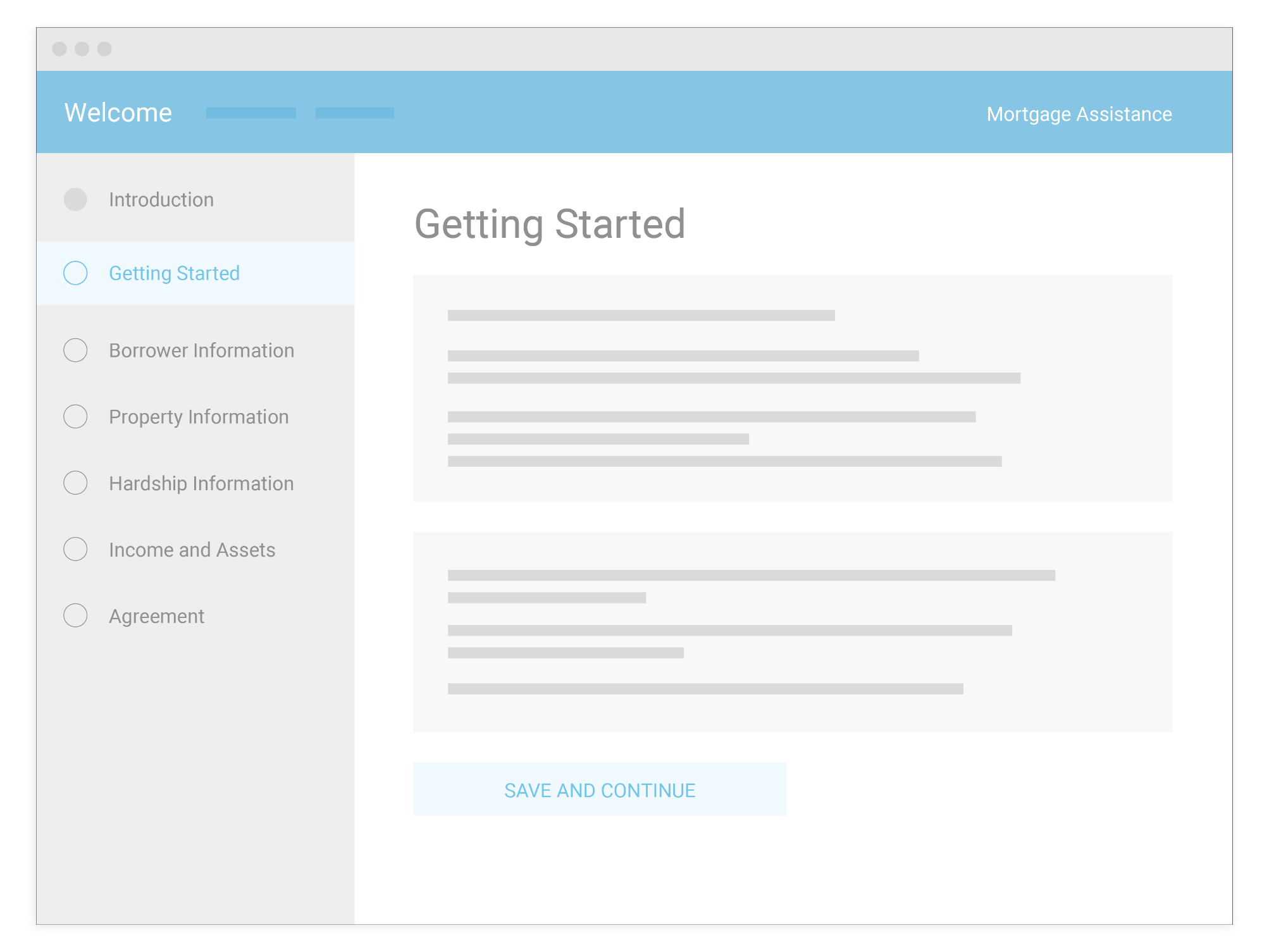

Connect customers in financial distress with qualifying relief options

Help homeowners when they need it most. ICE Loss Mitigation gives agents the tools they need to help customers throughout the complex and stressful loss mitigation process. Plus, when Loss Mitigation is paried with Servicing Digital, customers can discreetly initiate the loss mitigation process on their own via an advanced self-service prompt—helping them proactively seek help during difficult times.

Powerful customer-facing tools for added retention value

ICE is focused on helping servicers create a customer journey that is understandable, meaningful and less complicated. Watch below to see how Cenlar uses Servicing Digital’s powerful self-service capabilities to enhance the customer experience.

Featured Servicing products

Our powerful, proven and integrated servicing solutions automate all areas of the servicing process, from loan boarding to default. Our scalable capabilities are used by servicers who are just starting in the business – or those who service millions of loans. Transform your loan servicing performance while simplifying processes.

MSP® Mortgage Servicing System

Business Intelligence for servicing

Servicing Digital

Customer Service

Automated Lien Release

All Servicing products

Take your business to the next level with our suite of servicing solutions that can help servicers lower costs, reduce risk and operate more efficiently.