Encompass®

Mortgage Loan Origination Software, with proven ROI

Simplify your operations and grow your business with ease. Our leading mortgage loan origination software, Encompass by ICE Mortgage Technology, connects and accelerates every step of the lending process, enabling you to streamline your workflows and save significant time with every loan. Trusted by current and aspiring industry leaders to power the American Dream of homeownership, Encompass helps you boost productivity, scale confidently and deliver seamless borrower experiences.

Featured customers

ROI that speaks for itself

With today’s high origination costs, efficiency and profit maximization are key to financial success. That’s where our top mortgage loan software, Encompass, comes in. Developed with this in mind, Encompass delivers significant ROI.

An independent research study* found that, on average, Encompass delivers:

$1,056

Increase in gross profit per loan

23%

Increase in loan production volume without adding staff

3 Days

Reduction in cycle times from application to close

5x

Return for every dollar invested in the platform

* Encompass 2024 customer ROI research study conducted by MarketWise Advisors

Streamline lending operations on our comprehensive mortgage loan platform

Improve operational efficiency, quality and compliance throughout the entire lending lifecycle with Encompass’ modern, intuitive workflows powered by intelligent automation.

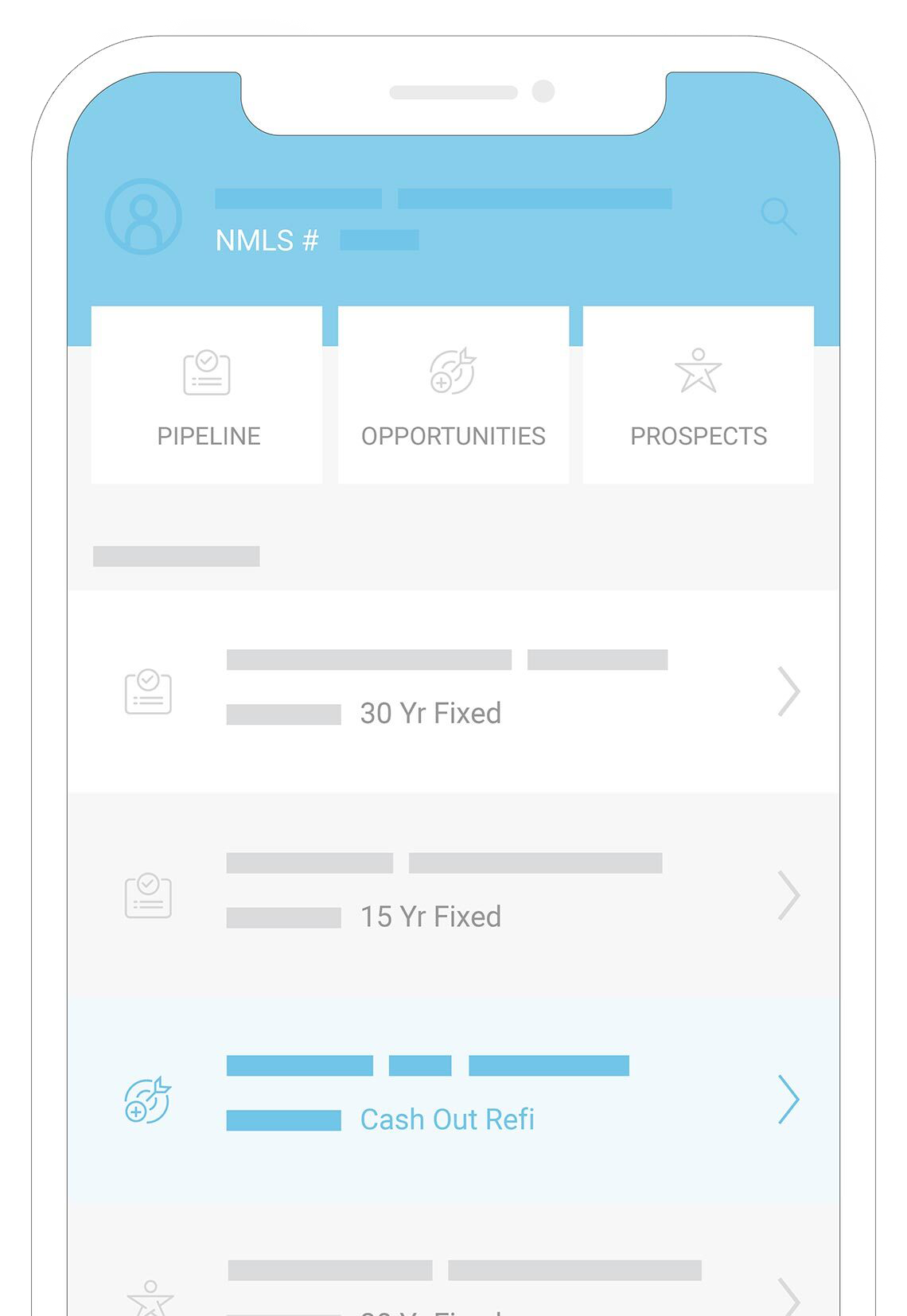

Customer acquisition

Drive leads, engage borrowers and close more loans

Convert more customers and build lasting relationships seamlessly with integrated sales tools and mortgage loan pricing. Additionally, deliver a frictionless, user-friendly experience with borrower and TPO point-of-sale solutions that simplify the loan application process.

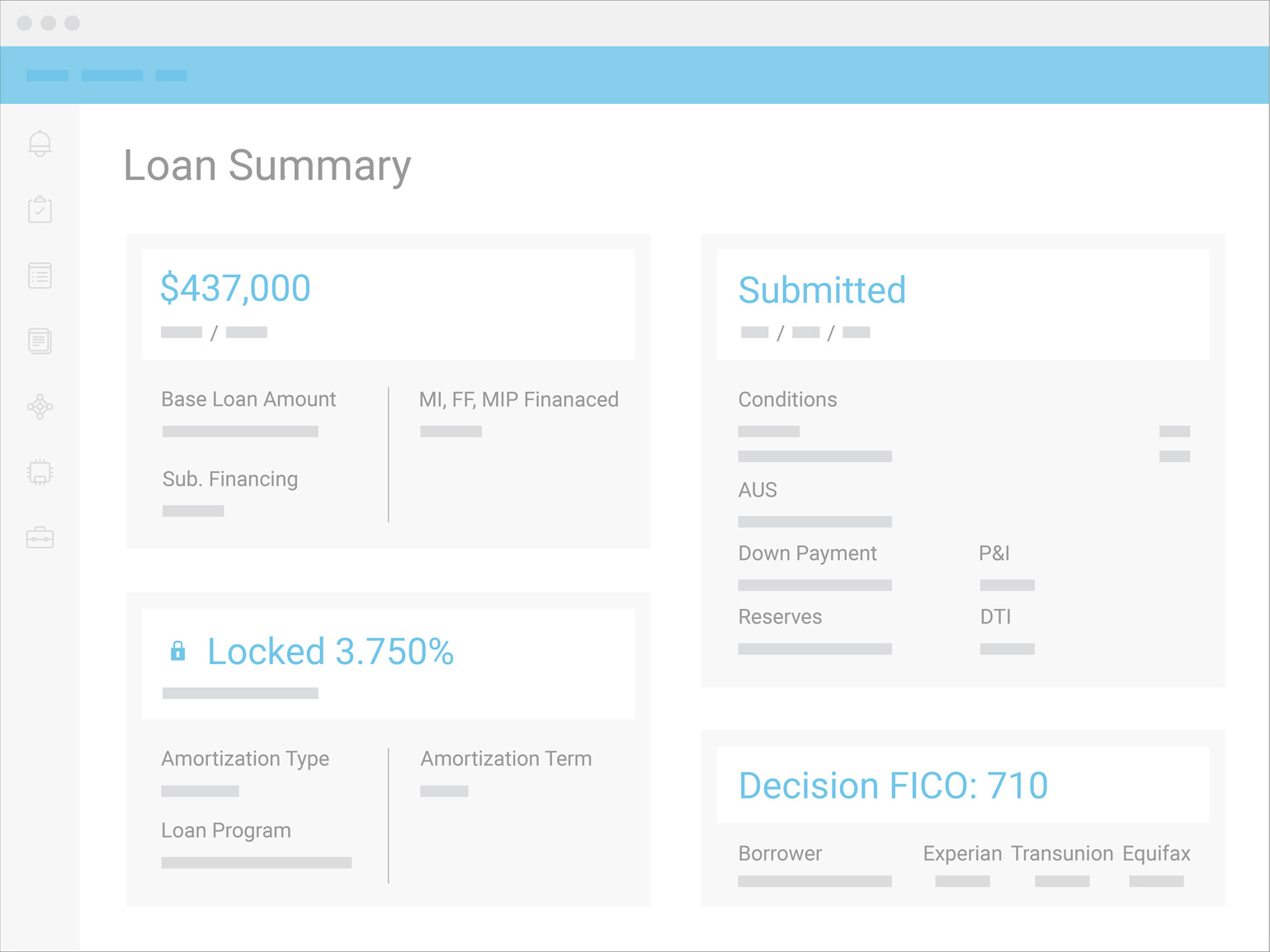

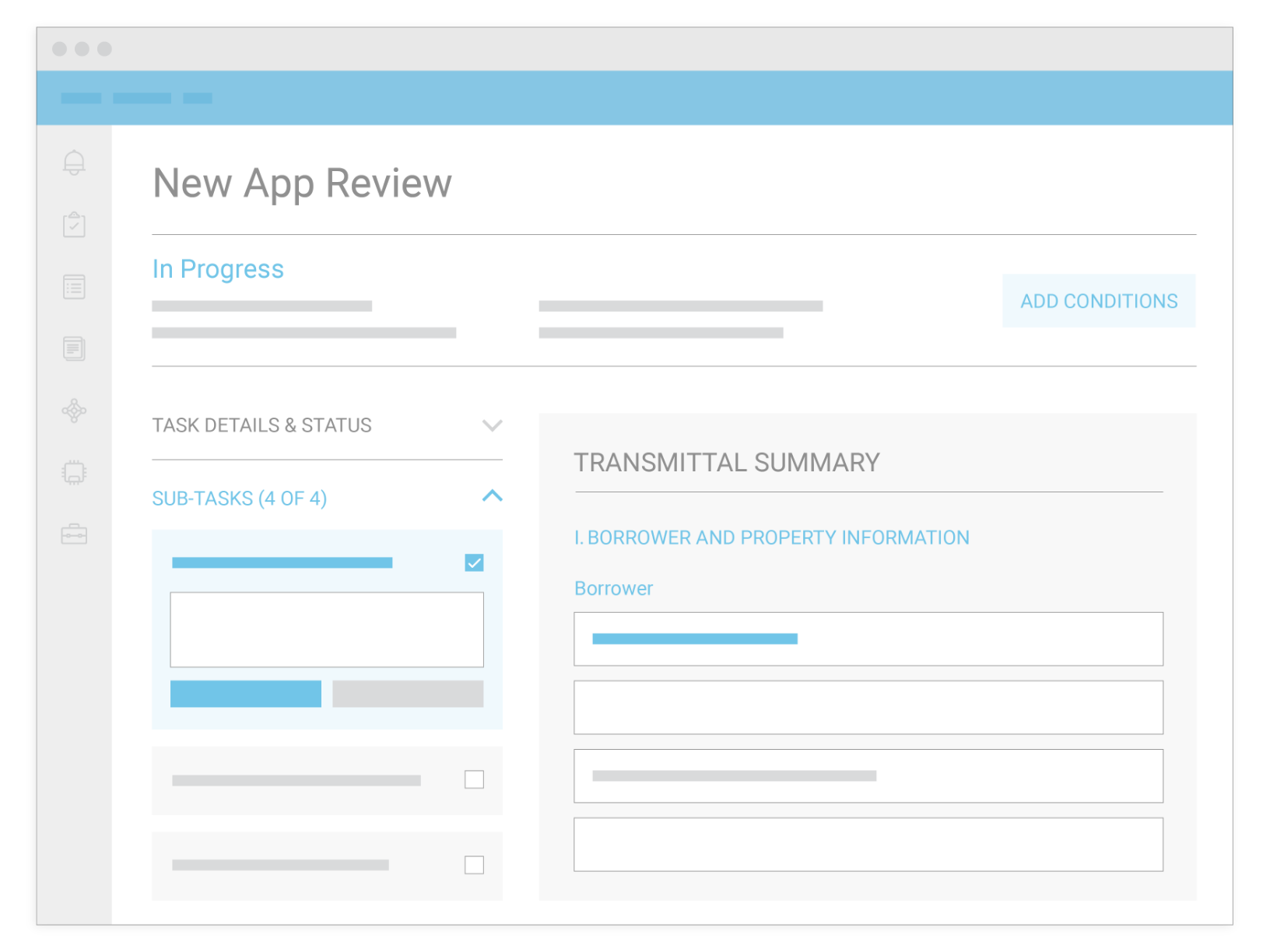

Loan origination and manufacturing

Produce more loans with less work

Encompass streamlines loan manufacturing processes with intuitive, configurable workflows. Powered by automation, you can reduce errors and save time on document collection, loan data verification and quality checks.

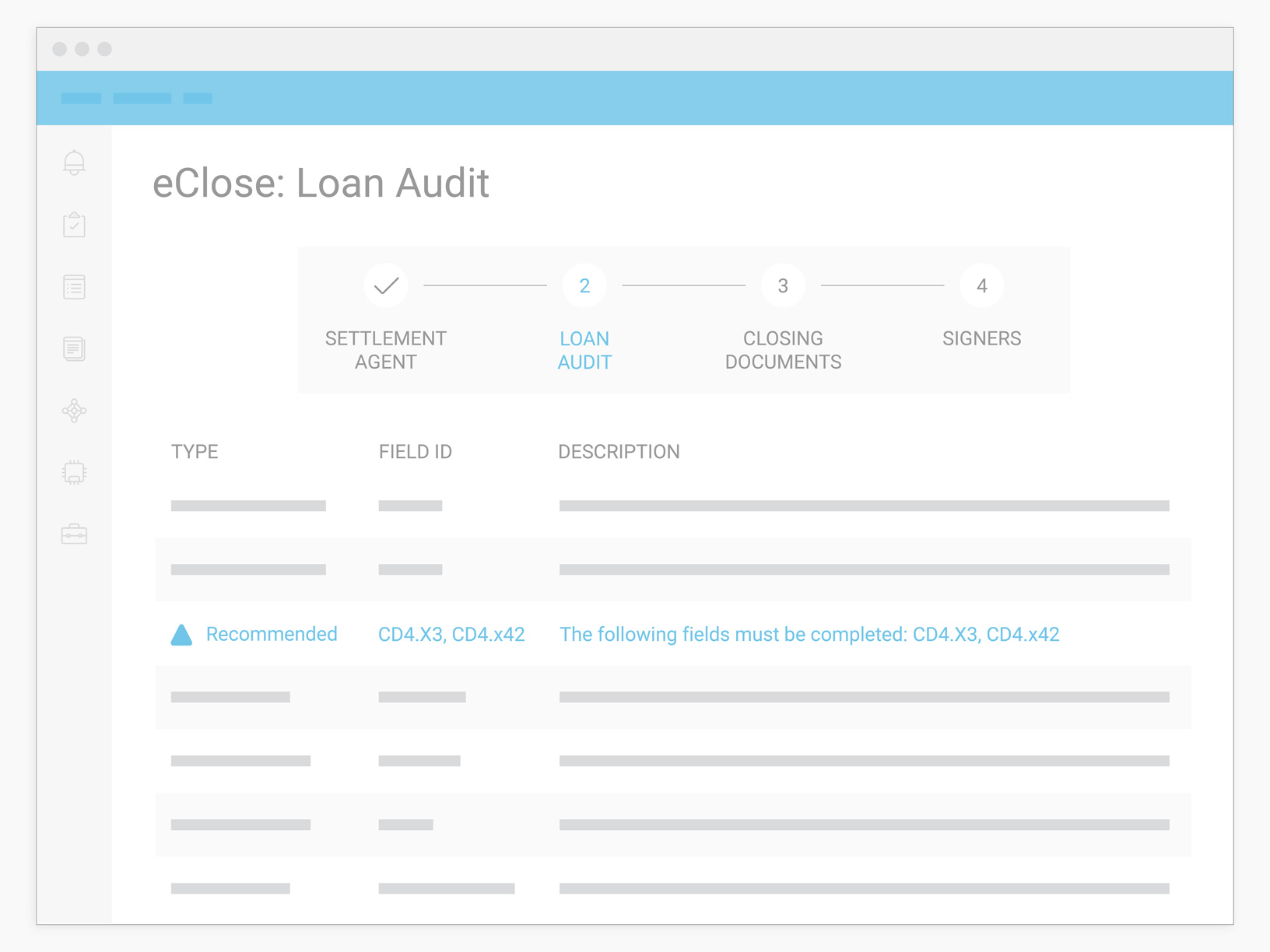

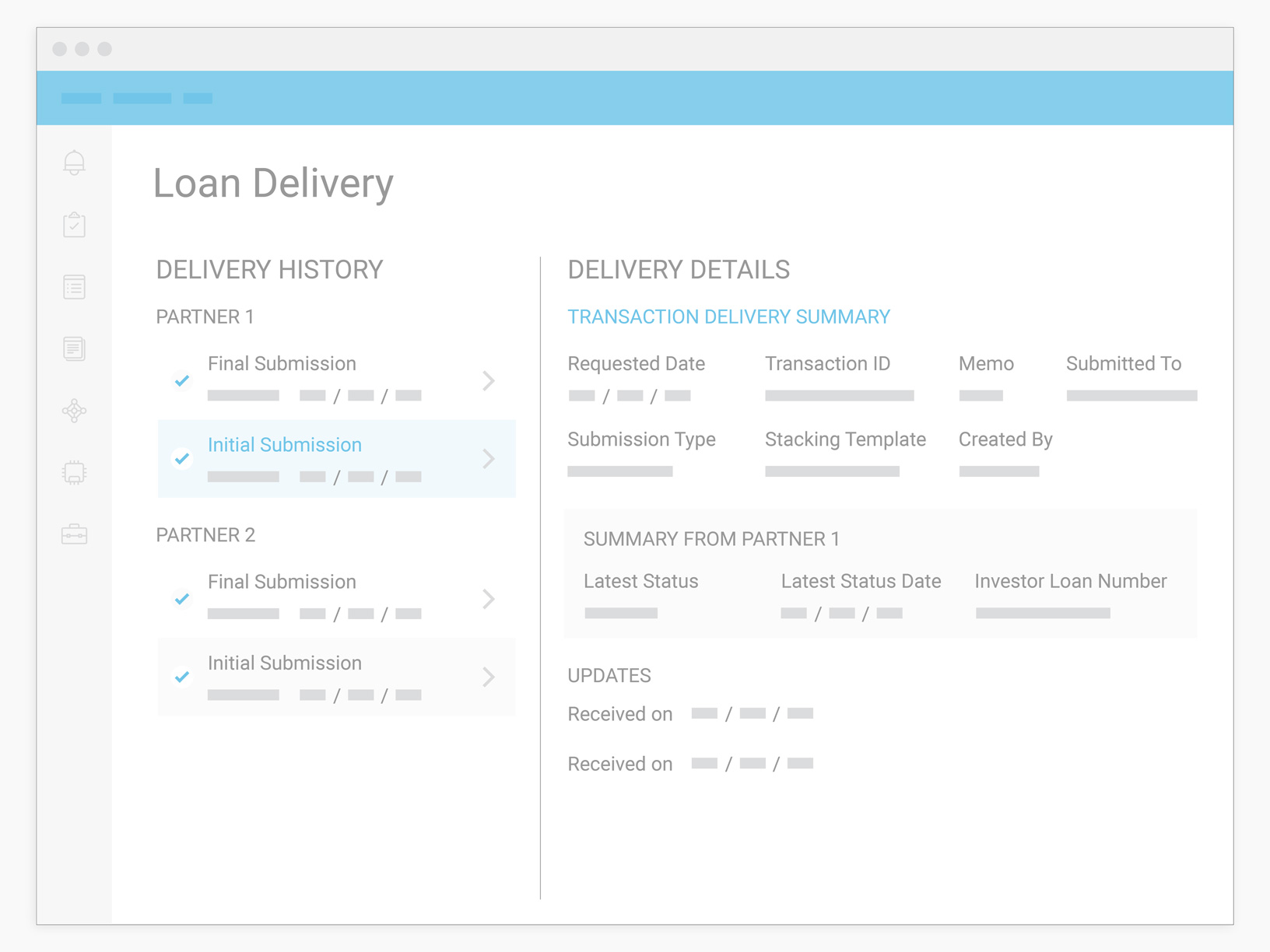

Settlement and closing

Electronically close, record and register mortgage loans from a single platform

Eliminate the complexity of dealing with multiple vendors and systems by leveraging the extensive settlement and closing ecosystem integrated within Encompass. Handle every step of the pre-close, closing and post-closing process directly from your system of record— from ordering documents, collaborating with partners, collecting borrower signatures, investor delivery, MERS registration and recording.

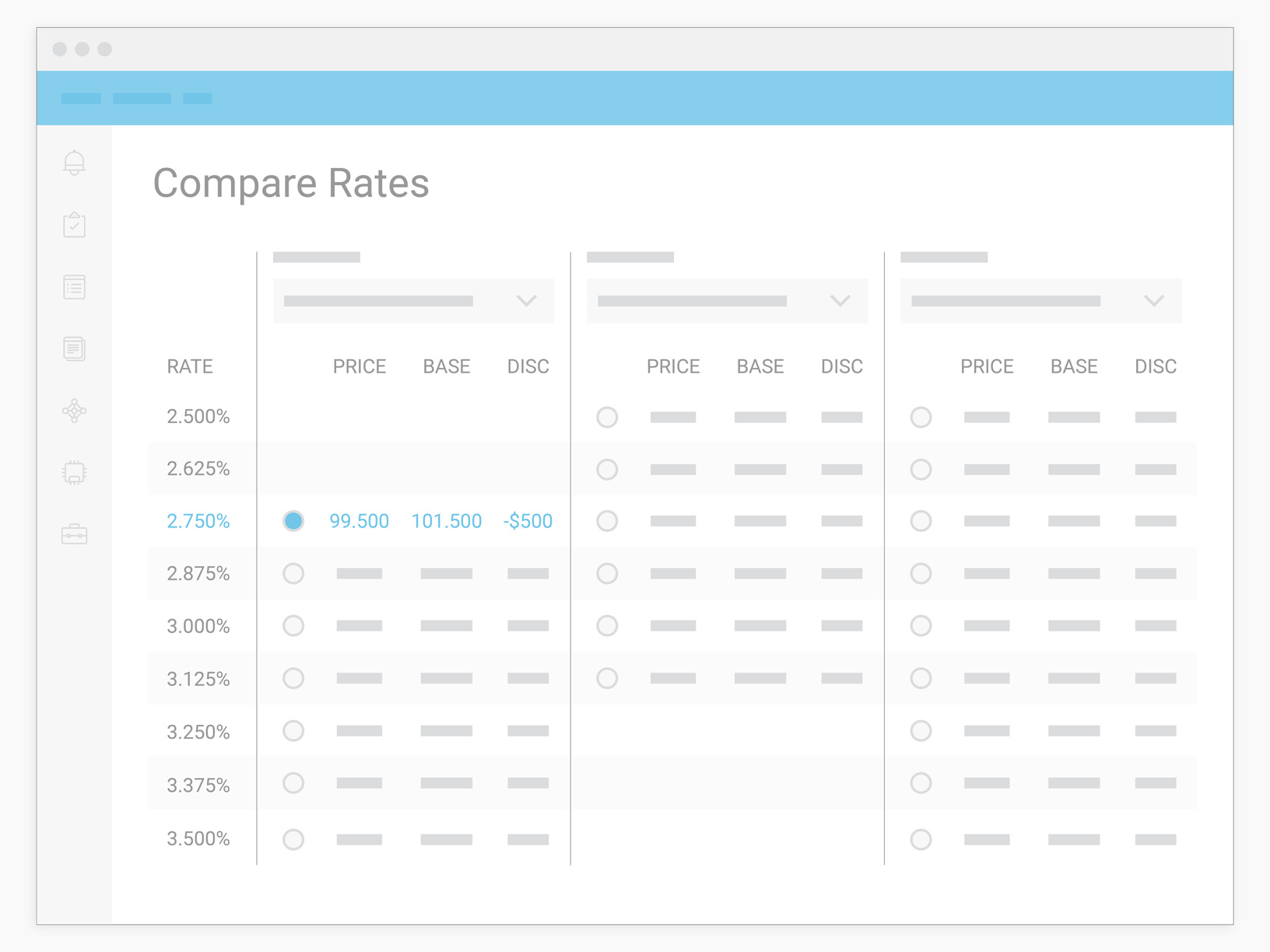

Secondary marketing

Sell mortgage loans with speed and precision

Manage your secondary and capital markets portfolios effortlessly with Encompass. Streamline pricing and lock policies, trades and loan delivery to investors in just a few clicks. Confidently sell high-quality loans to a wide network of investors and GSEs—all from a single, easy-to-use system.

Correspondent lending

Easily purchase loans and lower acquisition costs

Simplify your loan acquisition process and scale your portfolio with the industry's largest marketplace of sellers. Streamline acquisition pipeline management and close transactions faster, with automated, configurable workflows tailored to your unique business needs.

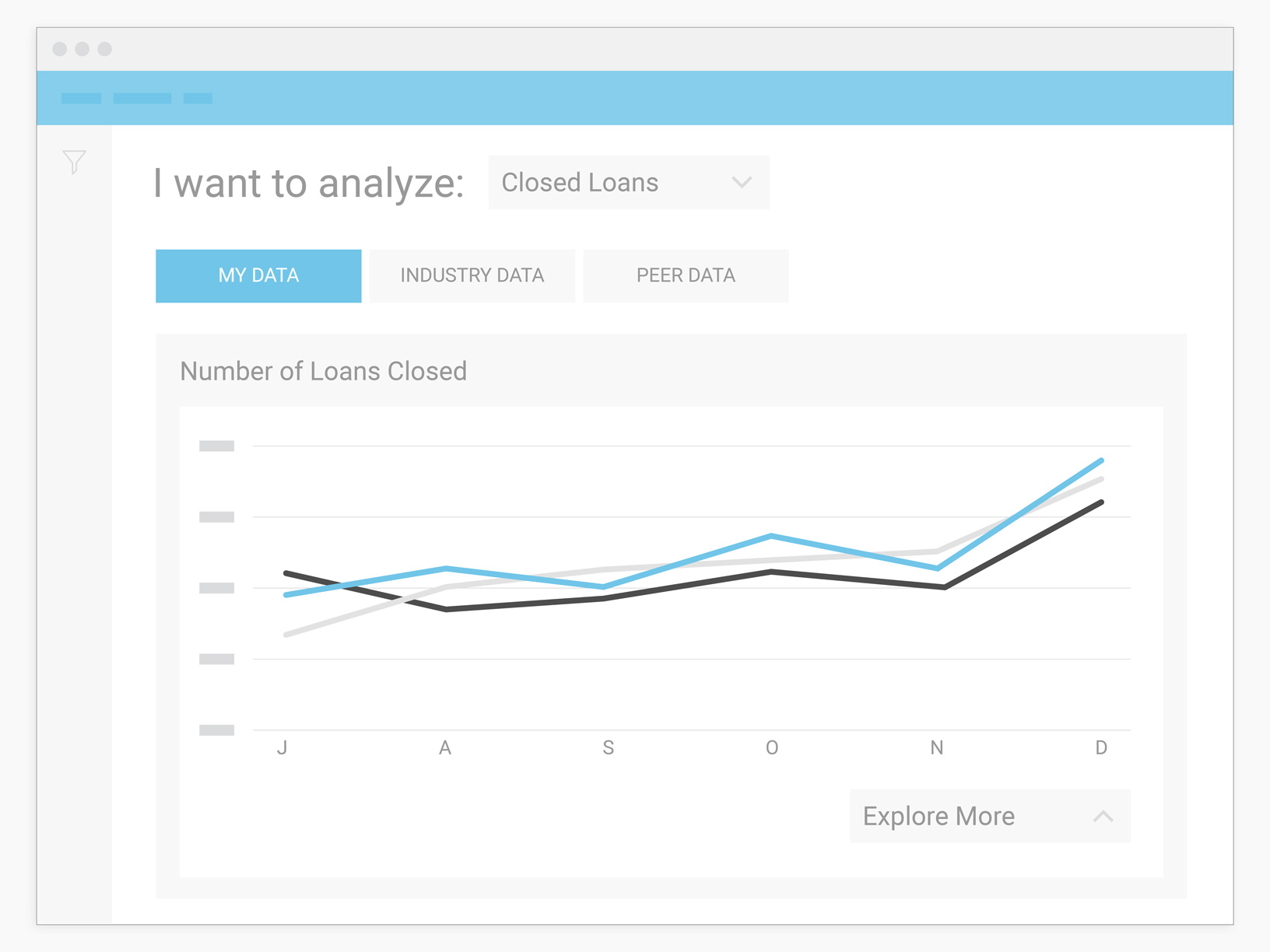

Data and analytics

Make informed, data-driven decisions

Turn analytics into action with real-time data delivery tools that provide actionable insights to optimize your business performance. Gain a strategic advantage with trusted data to uncover industry trends, compare peer performance and identify growth and efficiency opportunities.

Mortgage loan software for any market

Encompass is the platform of choice for thousands of banks, credit unions and independents mortgage bankers to run their business because it is:

Connected: access the industry’s largest network of lenders, investors, developers and service providers

Complete: leverage end-to-end workflows for any lending channel from a single system of record

Compliant: rest easy with technology that supports industry and regulatory compliance changes

Flexible: easily configure workflows for any business need or channel, and customize your experience using an expansive suite of APIs.

Automated: leverage lights-out automation to achieve unparalleled transparency and control

Ready to get started? Get in touch

Featured resource

Insider tips for navigating mortgage volatility

Concerned about the rising cost of origination and shifting industry conditions? Learn practical tips for increasing cost efficiencies and streamlining common lending processes with automation in any market.

Success stories

“Encompass cuts back on the manual workflow for our employees, allowing them to focus on the more complex issues.”

Chief Operations Officer

GMFS Mortgage

Encompass®

Take your Encompass experience to the next level

Leverage solutions across the Encompass platform to make smarter business decisions, lower costs, and drive innovation across all your channels.

Encompass Consumer Connect®

Borrowers expect an engaging online experience. Are you delivering?

Encompass TPO Connect®

Optimize how you receive and manage loans from your Third-Party Originators.

Encompass Connector® for Salesforce®

Connect Encompass and Salesforce to create a true digital mortgage platform.

MSP® Mortgage Servicing System

Best-in-class loan servicing software allowing servicers of all sizes the ability to tackle today’s most pressing operational challenges.