Comprehensive real-time data at your fingertips

Our unique set of real-time data gives you an unmatched competitive advantage so you can make impactful business decisions.

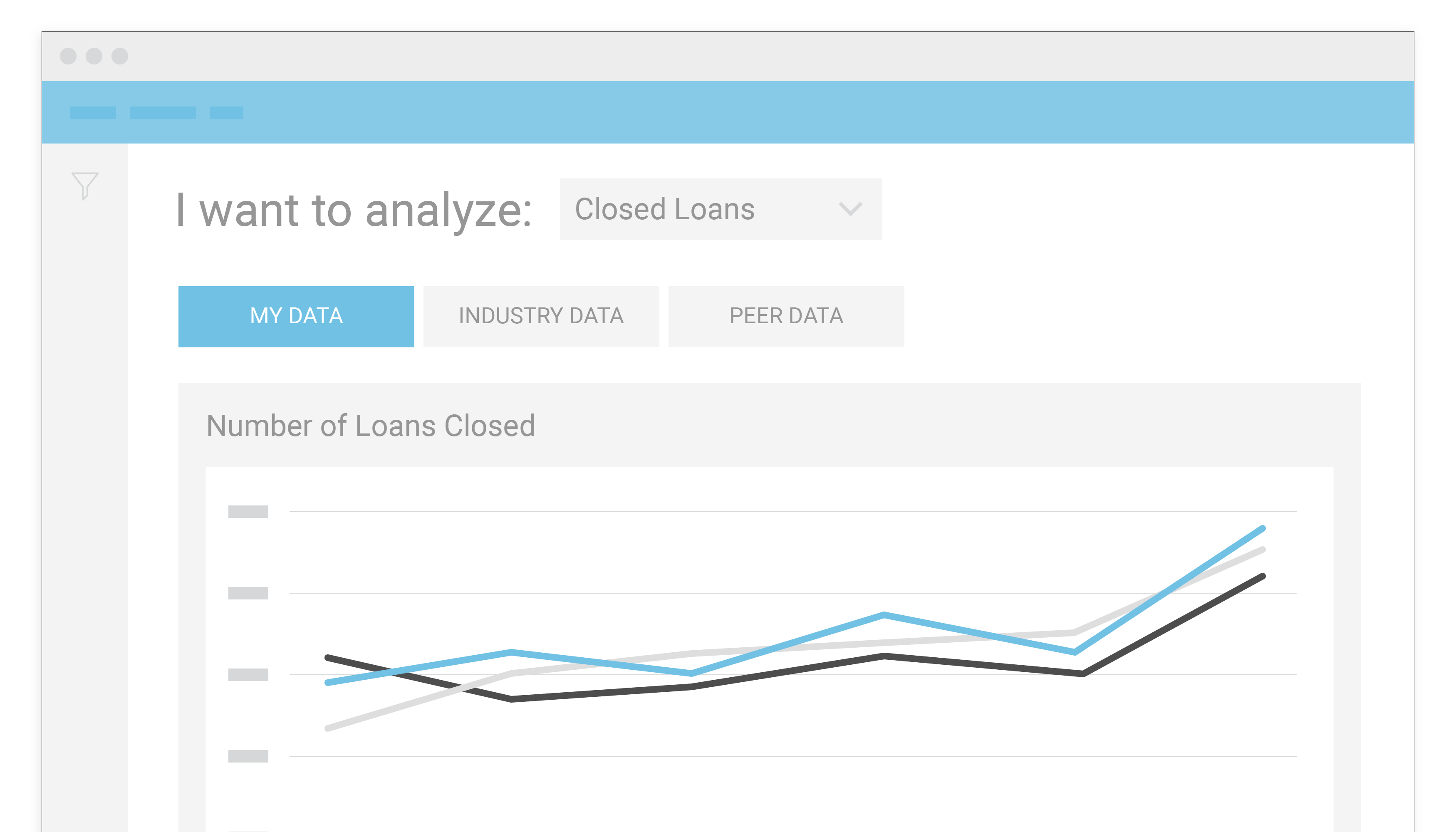

Insights™

Looking for details on how your business compares to the industry?

Insights™ by ICE Mortgage Technology provides an easy to use application to access industry and peer group data as well as industry benchmarking.

A better borrower experience throughout the entire mortgage process

Lenders and borrowers want to close loans as fast as possible. Using automation and robust data, you can positively impact the borrower experience. What are the closed-loan trends that you need to beat? See the current FICO scores, loan-to-value, and debt-to income ratio by state:

Trusted expertise and a streamlined workflow

Used by more mortgage companies than any other solution, Encompass enables you to make smarter decisions, lower costs, ensure compliance, and drive innovation across every aspect of your workflow. What can we do to help you stay ahead of the market? See the current market conditions.

Are you maximizing your profit potential?

Crunch the numbers to see how much you could save with the Encompass ROI Calculator.

Tell us about yourself

Use the sliders to modify each value to best reflect your organization.

200 Loans

100 Employees

Increase the scope of your ROI results by expanding the additional values below.

2 %

2 %

2 %

10 %

This is an estimate provided for demonstration purposes. Actual impact to your organization could be dependent on factors not included in this model or realities not accounted for in the assumptions.

Let’s take a look at your estimated ROI

572%

ROI

$19

Savings Per Loan

$1,289,159

5-Year Outlook

8 months

Payback Period