Encompass Investor Connect

Loan delivery, funding, and purchases- fast

Deliver complete and accurate loans to investors and warehouse banks in record time, and get faster funding, purchases, and improved ROI in return.

Streamlined delivery

Encompass Investor Connect - system-to-system loan delivery

Investor Connect is the preferred delivery method from Encompass lenders to investors and warehouse banks, that's because Investor Connect delivers more than just complete, compliant, loan packages it also delivers:

Streamline loan delivery at no additional cost

Deliver up to 1,500 loans at a time directly from Encompass and simplify your login process across multiple systems. These features are already included in your Encompass investment.

Drive more consistent, better-quality loans

Documents and data are preformatted to meet investor requirements, so loans are complete when delivered. Investor Connect loans typically have fewer conditions and additional requirements.

Save time and money

Less conditions mean faster purchases. Lenders save an average of $48.85 and 39 minutes per loan using Investor Connect.

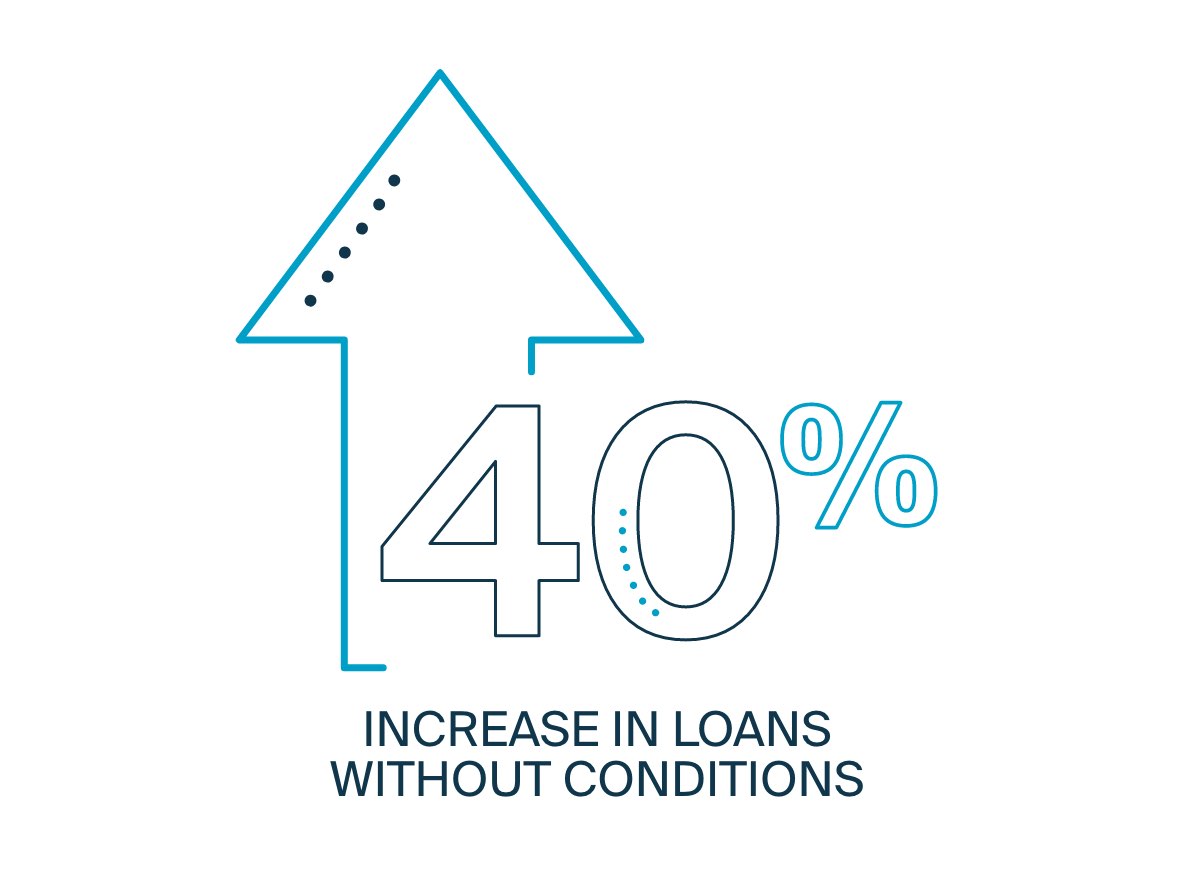

Experience faster reviews and purchases

When investors receive loans from Encompass, they can review them faster and complete purchases sooner, resulting in a 40% improvement in loans without conditions for both investors and lenders.

“Data is power. It’s how we keep working toward excellence. It’s how we continue to succeed.”

Mike Gatrell

President and CEO of Members Resource, Mortgage Solutions

Decrease cost, save time, boost security

Investors prefer Encompass Investor Connect over any other delivery process for Encompass users, because they know that the data will be packaged for their specific requirements. On the other end, lenders experience quicker loan delivery, higher first-pass rates, and faster purchases.

Make it easy

Loan delivery made simple

Encompass delivers loan packages directly to correspondent investors and warehouse banks, streamlining logging-in down to one portal and eliminating the need for manual data importing and exporting.

Make it better

Improve loan quality and consistency

Encompass Investor Connect preformats data and documents to meet investor requirements, and notifies you of any missing or required information before delivery, significantly reducing conditions review and purchase times.

INDUSTRY-LEADING PARTNERSHIPS

Companies enabling Encompass Investor Connect

Hear from our partners

What clients are saying about Encompass Investor Connect

Encompass Investor Connect will change how you do business, but you don't have to take our word for it. Explore all the ways our clients have improved efficiency and fine-tuned accuracy.

Success stories

“Our investors are happy, our team is more efficient, and the whole process is a lot smoother.”

Tiffany Blaylock

Post Closing Manager

First Community Mortgage

Your end-to-end workflow

Streamline every step of the mortgage process

ICE Mortgage Technology delivers a true digital mortgage experience across your entire workflow. Our technology enables mortgage professionals across the industry to focus on personal connections where they need them most.

Benchmarking

Expansive mortgage and housing-related data assets and analytics to help you more accurately benchmark performance. Our solutions include servicer-contributed loan level data; default, prepayment and loss predictive models; comprehensive valuation solutions; and more.

Capital Markets & Secondary Marketing

Data and analytics that help create efficiencies and cost savings for professionals who operate in the capital markets space. Our solutions help bank and non-bank mortgage servicers, investors and management firms make informed business decisions based on real-world market data.

Customer Acquisition

Stay ahead of the competition with our comprehensive suite of sales, marketing and borrower engagement solutions. Grow and retain your customer base, deliver world-class experiences and lower acquisition costs - all powered by world-class automation and integrated within the Encompass

Default

Scalable solutions to streamline the default process and support compliance. Featuring secure and flexible integrations, ICE’s configurable default capabilities help servicers navigate complex and oftentimes extensive default workflows while providing secure communication with attorneys, title vendors, notaries and more.

Home Equity

ICE offers end-to-end technology, data and analytic solutions that allow lenders to originate and service home equity loans and lines of credit on the same systems as first mortgage loans.

Loan Manufacturing

Advanced technologies that will help you create a consistent, uniform loan origination process to drive efficiency and improve loan quality. With our solutions, you have the ability to process mortgage applications with higher accuracy and achieve a better customer experience.

Market Analytics

Actionable intelligence to help you make smarter, more informed decisions. Combined with our extensive data assets and proprietary analytics, you can expand your operational view to help increase efficiencies, generate and protect revenue and support compliance requirements.

Partner Network/Integrations

With the largest network of integrated partners in the industry, ICE Mortgage Technology helps you extend your business by connecting you to thousands of mortgage professionals.

Portfolio Management

Comprehensive suite of mortgage portfolio management solutions. Maximize profitability, effectively manage risk, support regulatory compliance, identify opportunities and improve decision-making.

Real Estate

Easy-to-use, next generation solutions that help real estate professionals, MLSs and title companies generate more business, increase productivity, strengthen relationships and deliver a competitive edge in today’s market.

Retention

Integrated solutions to better support your customers. Our digital capabilities can help you proactively engage with customers to increase satisfaction and drive retention. Use our robust analytics and advanced marketing automation solutions to deliver the right messages at the right time.

Risk Management

Comprehensive solutions that help mortgage and title professionals reduce loss. Use our data and analytics to uncover potential risk to the properties in your portfolio or those that you are preparing for title and settlement. Our industry-leading solutions include reliable data, offer an intuitive experience and deliver the insights needed to help proactively prevent risk.

Servicing

Best-in-class servicing solutions to help manage all aspects of loan servicing — from loan boarding to default. Transform your performance with automation and insights, and enhance the customer experience. Our solutions support first mortgages as well as home equity loans, and help servicers lower costs, reduce risk and operate more efficiently.

Settlement and Closing

Electronically connect people, technologies and data in your real estate transactions. Save time and money and simplify processes from pre-closing through post-closing with electronic services, property information and fee solutions.

Title

Our suite of solutions for title professionals provides the valuable data and insights needed to help identify opportunities for business growth, develop and further relationships with lenders and real estate professionals and streamline the closing process.

Valuations

Comprehensive suite of market-leading valuation solutions that support the entire real estate and mortgage loan life cycle. Appraisers, lenders, servicers, investors and real estate agents rely on our valuation products to help them meet their specific business goals.

Professional Services

Take your business to the next level with ICE Mortgage Technology® Professional Services

We offer customizable implementation packages, advisory consulting, custom solutions development, and project management. Our Professional Services representatives are ready to help you optimize your system and improve operational efficiencies so you can get the most out of your investment.

Encompass®

Take your Encompass experience to the next level

Leverage solutions across the Encompass platform to make smarter business decisions, lower costs, and drive innovation across all your channels.

Encompass Consumer Connect®

Borrowers expect an engaging online experience. Are you delivering?

Encompass for Loan Officers

Empower your loan officers to drive more business and deliver better borrower experiences.

Encompass TPO Connect®

Optimize how you receive and manage loans from your Third-Party Originators.

Encompass CRM

Loan delivery, funding, and purchases- fast.

Encompass eClose

One source. One workflow: The future of closings is here.

ICE PPE (Product and Pricing Engine)

Loan pricing in an instant, with total confidence.

Encompass Data Connect

Do more with your data, anytime and anywhere.

Encompass Connector® for Salesforce®

Connect Encompass and Salesforce to create a true digital mortgage platform.

Home Equity

Connect Encompass and Salesforce to create a true digital mortgage platform.

Resources

Learn more about how ICE Mortgage Technology® is changing the industry and stay up-to-date with the latest tools and information.

Encompass Investor Connect

Webinar: Increase ROI and Efficiency with Faster, Streamlined Loan Delivery

First Community Mortgage sells loans three days faster with Encompass Investor Connect

Low VA Rates™ Makes Warehouse Bank Submissions as Simple as “Select, Click and Done”