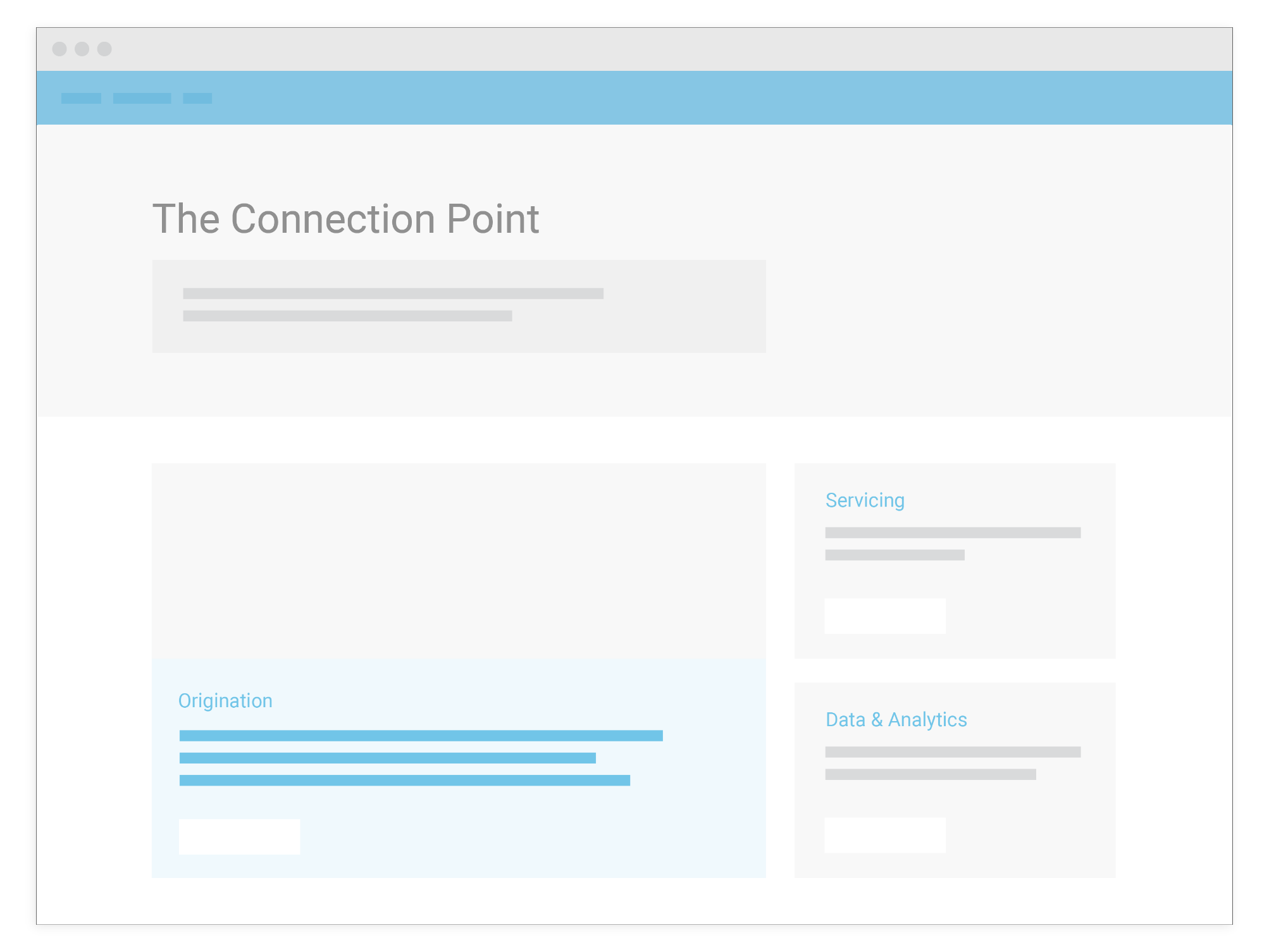

Loss Mitigation

Identify available assistance options to help struggling homeowners

The Loss Mitigation solution delivers the tools your agents need to help homeowners facing financial hardship. The feature-rich, web-based solution supports industry-standard retention and liquidation workouts, as well as proprietary forbearance and modification programs. This comprehensive solution can help your servicing operations streamline processes, simplify decisioning and reduce risk throughout the loss mitigation experience.

Feature-rich, web-based solution supporting industry-standard retention and liquidation workouts

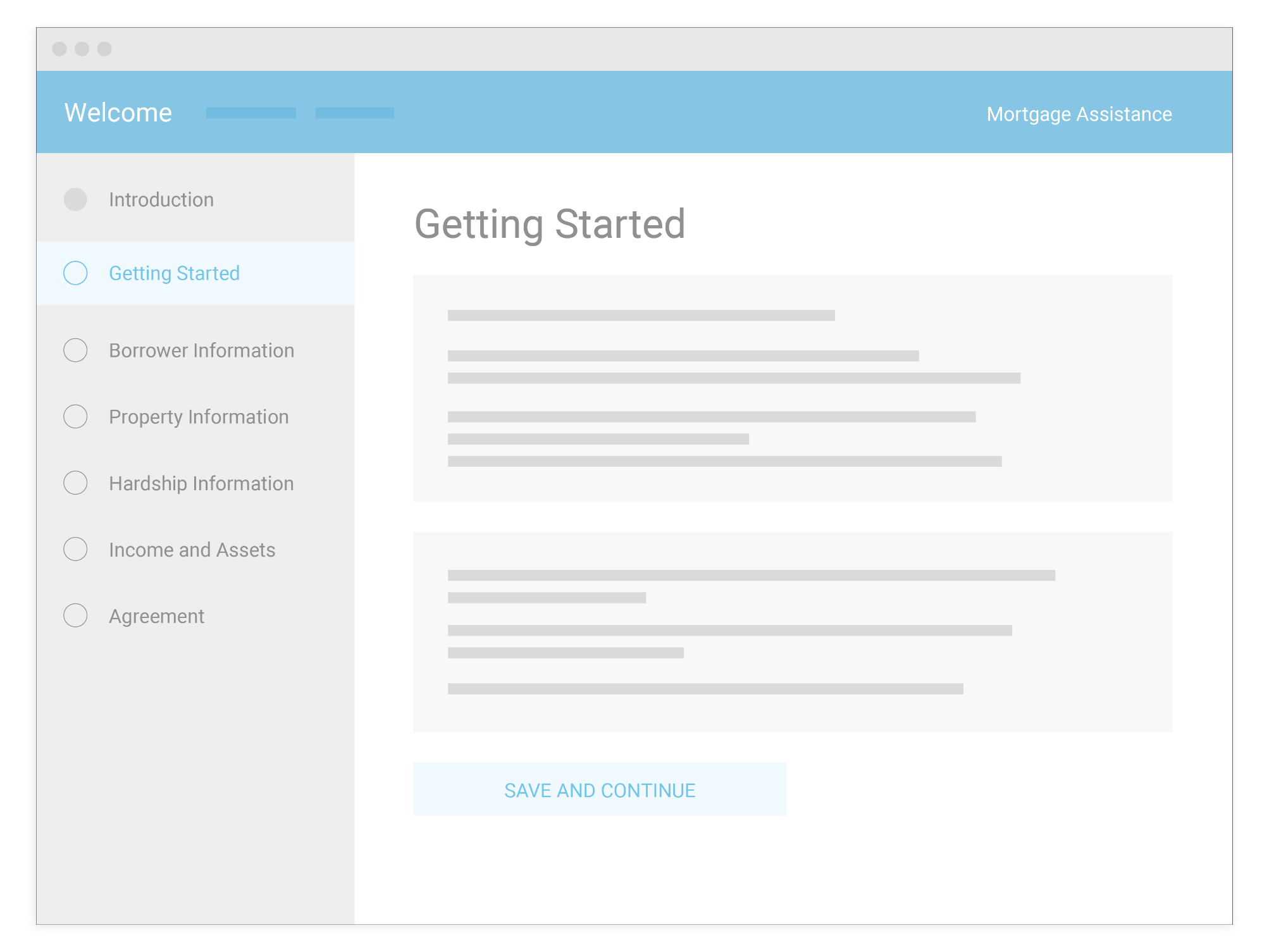

Loss Mitigation leverages configurable business rules to guide agents throughout the process with an intuitive user interface. Rules-driven activity tracking provides built-in quality controls and validation points to help agents reduce risk and manage customer information.

Risk management

Second-level reviews, validation points and entry-accuracy controls help reduce risk throughout the solution.

User-friendly agent experience

A simplified user interface supports proactive, guided next-best options to foster a quality customer experience.

Electronic document delivery

A streamlined process of gathering borrower response packages includes direct integration to ICE’s electronic signature and document-delivery capabilities.

Integrations for maximum efficiency

Integrations with MSP®, Servicing Digital and other ICE servicing products promote operational efficiency, and API integrations with Freddie Mac and Fannie Mae automate receipt of GSE decisions and settlement.

Near-real-time loan modification

Integration with MSP allows loan terms to be updated in accordance with the loan modification activity.

Audit tracking

Evaluations and decision outcomes can be viewed in the application or through the creation of an on-demand PDF.

Additional options for working with homeowners in loss mitigation

Strong home equity cushions can open additional options for servicers to explore with homeowners who are in loss mitigation, such as salvaging earned equity with a traditional home sale rather than going through foreclosure. Those equity cushions can also provide homeowners incentive to work with their servicers to return to making mortgage payments.

With the ICE Servicing Digital solution, customers can initiate the loss mitigation process through an advanced self-service prompt and proactively seek help during difficult times.

Pairs homeowners navigating hardship with eligible loss mitigation programs

With Loss Mitigation, your servicing operations benefit from API integrations with Fannie Mae (SMDU) and Freddie Mac (Resolve), to help automate receipt of GSE decision and settlement steps. Additional integrations with MSP, Servicing Digital and other ICE products assist with title orders, credit reporting and access to print vendors – making a seamless experience possible for your agents and homeowners alike.

Serve your homeowners who are facing financial hardship more effectively with a highly configurable decision engine that helps inform the assistance process with eligible programs. Loss Mitigation aims to help you uncover assistance options early to help homeowners arrive at resolutions.

MSP loan servicing system

MSP®, ICE’s best-in-class loan servicing software, has set the industry standard and is unmatched, due to a strong focus on regulatory compliance and risk, protection of borrower-owned data, decades of proven performance and our commitment to continuous innovation. MSP offers servicers of all sizes the ability to tackle today’s most pressing business challenges.

Industry conversations

An end to pandemic-era loss mitigation provisions is not a return to norms

Servicers face a compressed timeline and complex new rules as HUD accelerates the next chapter of loss mitigation. Read this HousingWire article from Vicki Vidal, regulatory associate general counsel at ICE, to learn the five things to consider ahead of the Oct. 1 deadline.