First Look at March 2021 Mortgage Data

National Mortgage Delinquency Rate Plunges Nearly a Full Percentage Point in March as Calendar and Economy Drive Improvement

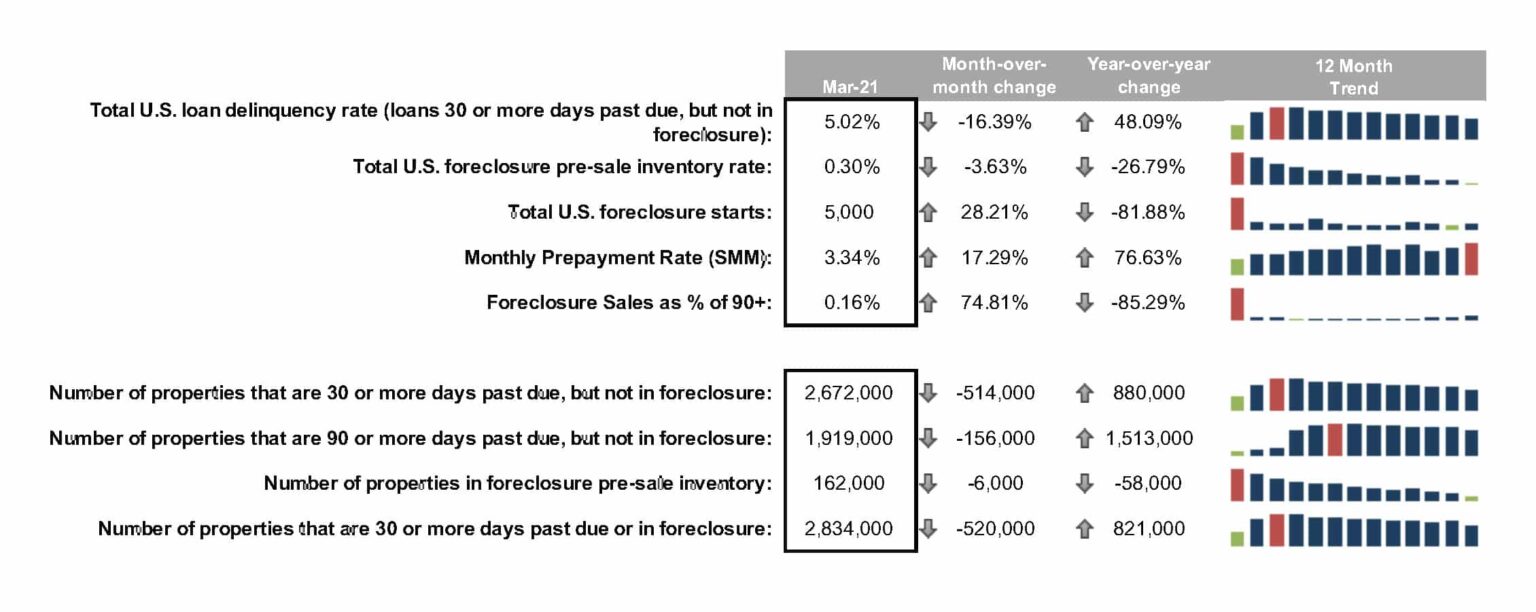

- The national delinquency rate fell to 5.02% from 6.00% in February – a 16.4% decline – driven by a combination of economic and calendar-related tailwinds

- Over the past 20 years, delinquencies have fallen by nearly 10% on average in March due to tax return and other seasonal funds being used by homeowners to pay down past-due mortgage debt

- The decline was stronger than usual due to both January and February ending on Sunday – which tends to dampen performance and lead to following-month gains – as well as broader economic improvements

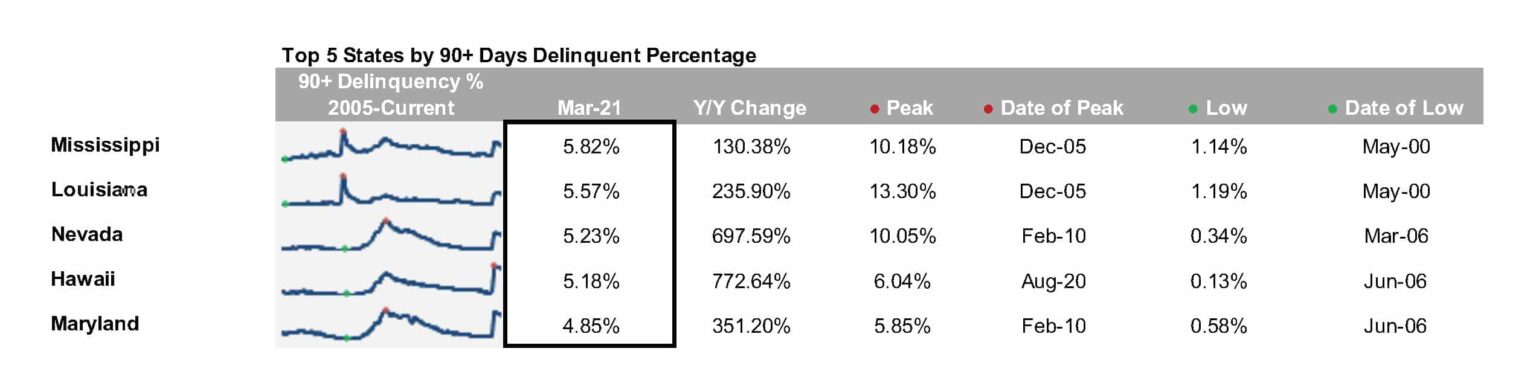

- Despite March’s strong performance, some 1.9 million mortgage-holders – including those in active forbearance – are at least 90 days past due on payments

- There are 1.5 million more such serious delinquencies than at the onset of the pandemic, nearly five times pre-pandemic levels

- Active foreclosures fell to yet another record low in March due to widespread moratoriums and forbearance utilization limiting both foreclosure inflow and outflow

- Prepayments rose by 17% in March to the highest level in more than 17 years driven by a seasonal rise in home sales alongside a rise in refinance activity locked in before rates began to rise in mid-February

JACKSONVILLE, Fla. – April 22, 2021 – ICE reports the following “first look” at March 2021 month-end mortgage performance statistics derived from its loan-level database representing the majority of the national mortgage market.

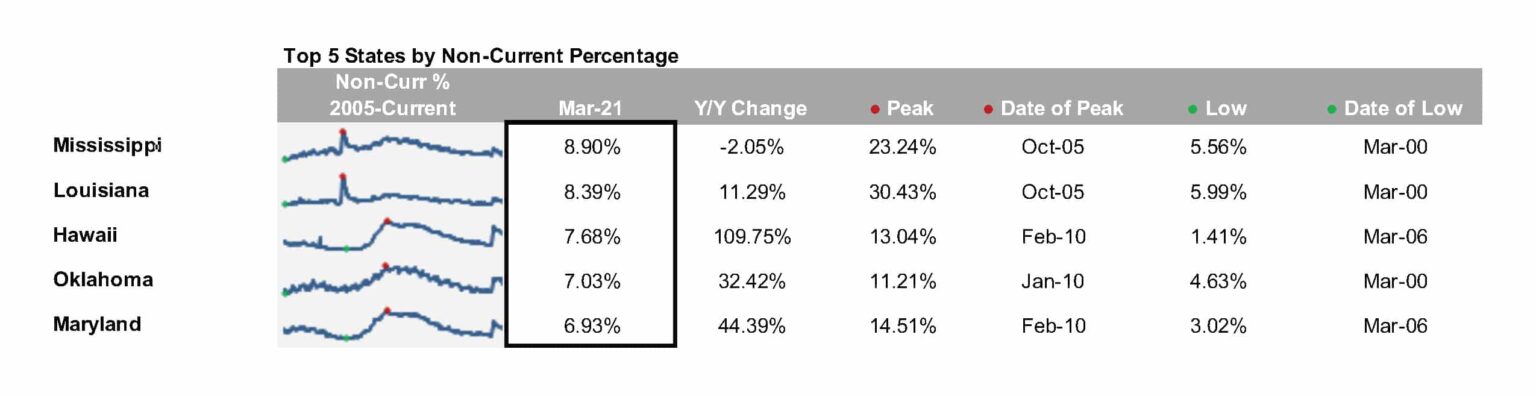

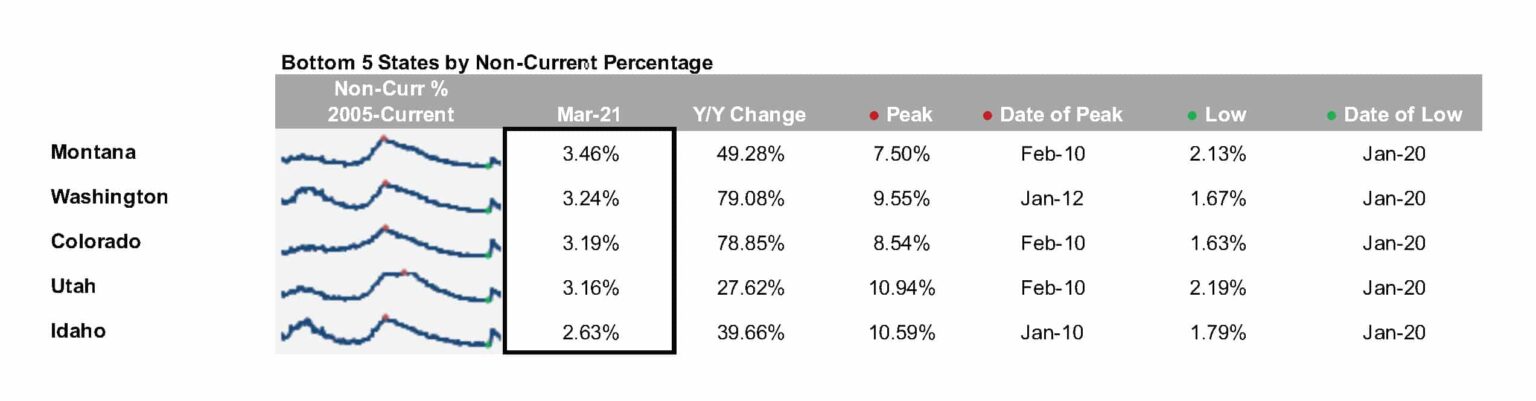

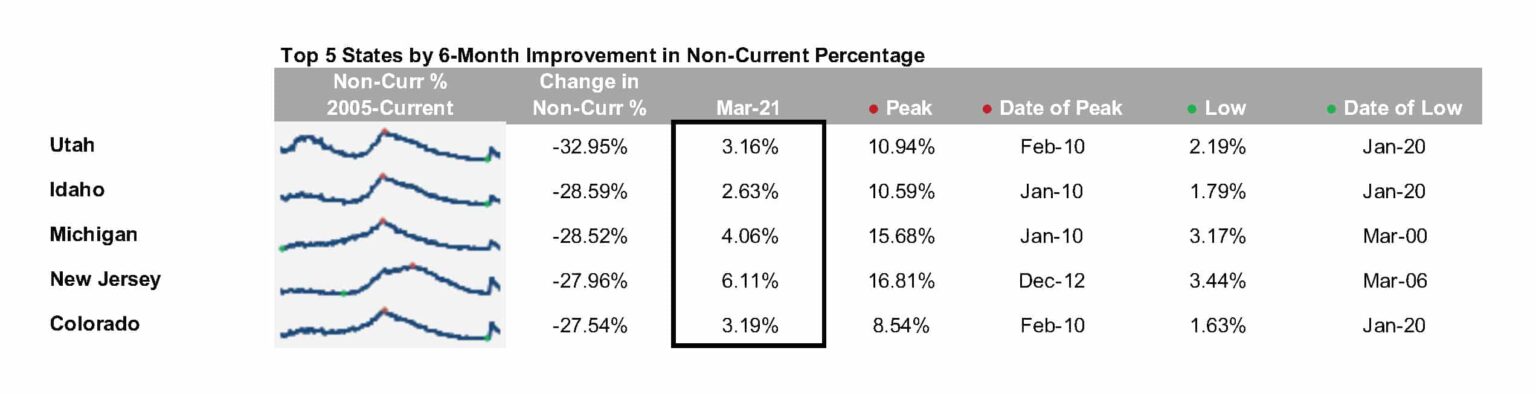

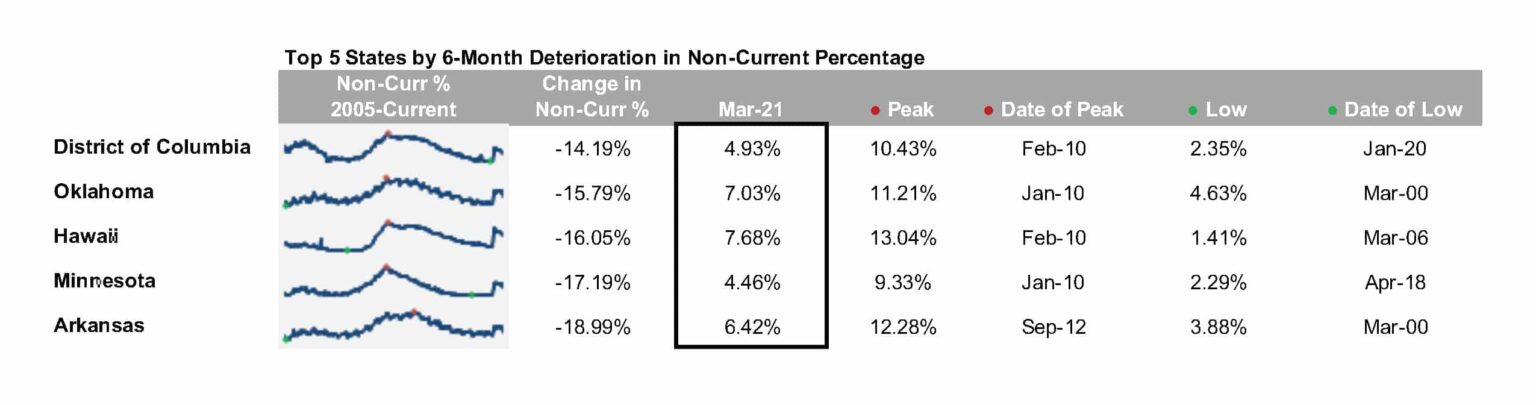

*Non-current totals combine foreclosures and delinquencies as a percent of active loans in that state.

- Totals are extrapolated based on ICE’s loan-level database of mortgage assets.

- All whole numbers are rounded to the nearest thousand, except foreclosure starts, which are rounded to the nearest hundred.

The company will provide a more in-depth review of this data in its monthly Mortgage Monitor report, which includes an analysis of data supplemented by detailed charts and graphs that reflect trend and point-in-time observations. The Mortgage Monitor report will be available online at https://www.icemortgagetechnology.com/resources/data-reports by May 3, 2021.

For more information about gaining access to ICE’s loan-level database, please send an email to [email protected].

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune 500 company that designs, builds and operates digital networks that connect people to opportunity. We provide financial technology and data services across major asset classes helping our customers access mission-critical workflow tools that increase transparency and efficiency. ICE’s futures, equity, and options exchanges – including the New York Stock Exchange – and clearing houses help people invest, raise capital and manage risk. We offer some of the world’s largest markets to trade and clear energy and environmental products. Our fixed income, data services and execution capabilities provide information, analytics and platforms that help our customers streamline processes and capitalize on opportunities. At ICE Mortgage Technology, we are transforming U.S. housing finance, from initial consumer engagement through loan production, closing, registration and the long-term servicing relationship. Together, ICE transforms, streamlines and automates industries to connect our customers to opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental Exchange, ICE, ICE block design, NYSE and New York Stock Exchange. Information regarding additional trademarks and intellectual property rights of Intercontinental Exchange, Inc. and/or its affiliates is located here. Key Information Documents for certain products covered by the EU Packaged Retail and Insurance-based Investment Products Regulation can be accessed on the relevant exchange website under the heading “Key Information Documents (KIDS).”

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 -- Statements in this press release regarding ICE's business that are not historical facts are "forward-looking statements" that involve risks and uncertainties. For a discussion of additional risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see ICE's Securities and Exchange Commission (SEC) filings, including, but not limited to, the risk factors in ICE's Annual Report on Form 10-K for the year ended December 31, 2024, as filed with the SEC on February 6, 2025.

Media Contacts

Related resources

Subscribe to our complimentary monthly mortgage & housing update

Receive an invite to our monthly Mortgage Monitor webinar and report for a current view of the mortgage market, including mortgage performance, secondary market metrics, home price and market trends.