Business Intelligence for origination

Delivering the right origination intelligence to the right people at the right time

ICE Business Intelligence (BI) for origination is a highly configurable, mortgage-centric analytics solution that enhances sales pipelines and team management, improves operational decisioning, and helps lenders close more loans at a lower cost. ICE BI delivers meaningful analytics to the right people at the right time to improve customer retention, reduce risk and more.

System integrations

Identify pipeline opportunities and optimize organizational efficiency

ICE BI combines loan origination system data — including data from ICE Encompass® LOS or other loan origination systems — with additional big data sources to help lenders retrieve, manage and analyze loan information. Combining the data with powerful business intelligence tools, lenders can easily drill down and proactively identify anomalies and trends, as well as create visualizations to more easily assess the data across the origination operation.

ICE BI helps lenders:

- Identify growth opportunities

- Reduce pipeline risk

- Reduce cycle times

- Support compliance requirements

- Preserve an audit trail

Powerful mortgage intelligence helps lenders of all sizes support smarter decision-making, generate more leads, reduce risk and lower the cost to originate a loan

ICE BI delivers pre-configured suites of analytics that are designed to help lenders introduce a number of benefits within their operations.

Increase revenue

Target borrowers for growth and retention, while mitigating or eliminating losses by identifying borrowers most likely to default.

Improve efficiency

Automatically and continually evaluate performance to identify inefficiencies and drive alignment of behaviors that support goals.

Support compliance

Alert staff when compliance rules are not followed based on configurable parameters or are outside compliance timeline.

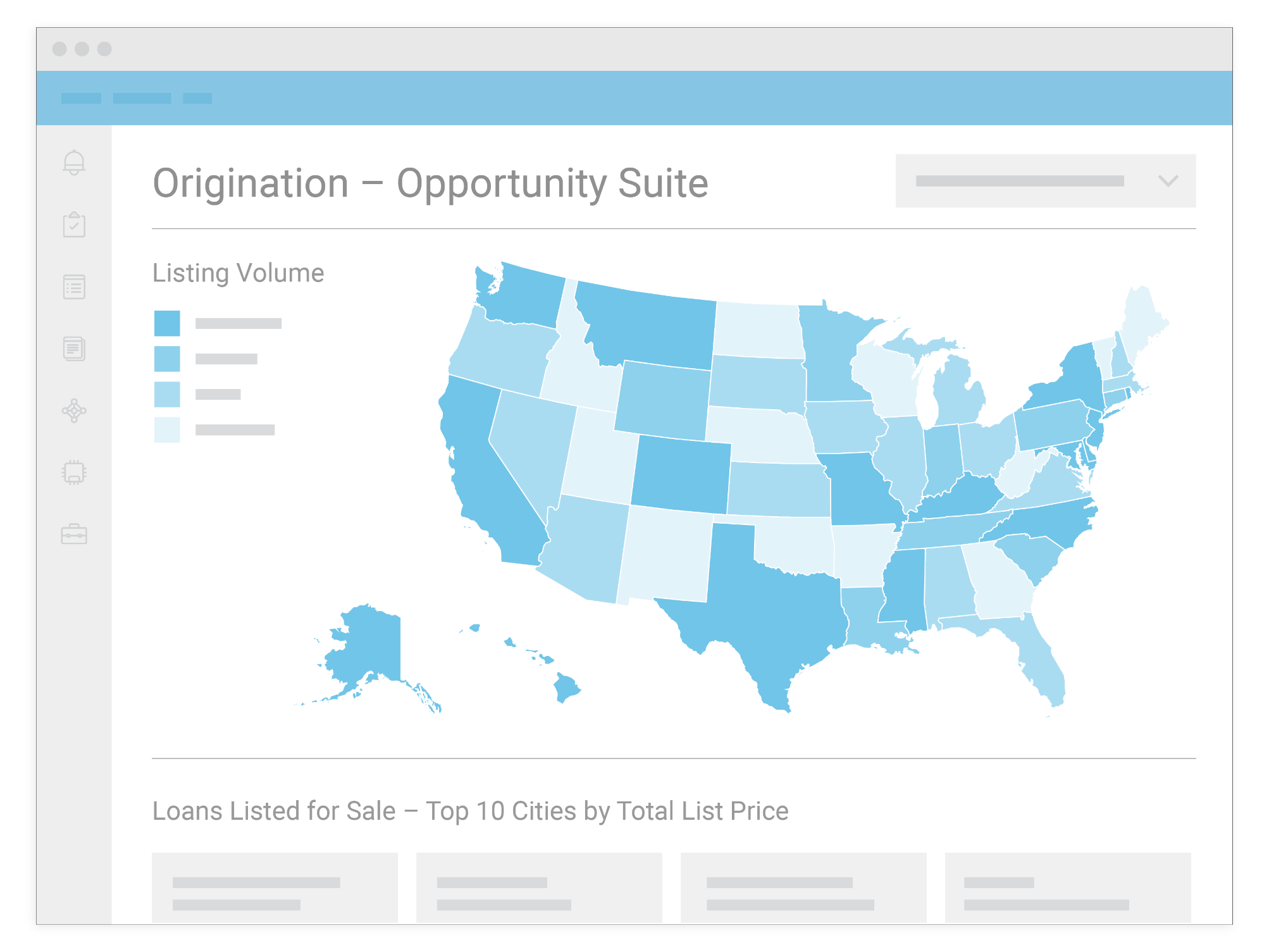

The origination collection

What’s included

ICE BI for origination supports growth and retention strategies, lead management, retail, wholesale and correspondent channels, loan loss, underwriting, closing and more. Below are some of the suites available in the origination collection:

- Capacity Planning: Provides a focused executive view into operational activity emphasizing capacity and priority management.

- Compliance: Incorporates sophisticated business rules that proactively focus on six key areas of origination compliance: HMDA, disclosures, re-locking, change of circumstance, APR and ECOA.

- Correspondent Lending: Provides an enterprise-wide overview of a company’s correspondent lending activity.

- Early Warning: Delivers analytics focused on properties found in disaster or event areas, with disaster information updated daily.

- Feedback Loop: Helps employees improve their expertise by providing them with personalized KPIs and other live metrics.

- Home Equity: Provides views of production, sales and compliance activity across the home equity side of an organization.

- Loan Loss: Provides key insight into pipeline fallout and potential lost loan business.

- Operations: Provides pipeline and activity overview of each key functional area of the loan origination process.

- Opportunity: Combines LOS data with premium data sets to automatically surface purchase, refinance, and home equity origination opportunities.

- Post Closing: An enterprise-wide overview of a company’s closing activity which then provides detailed information on specific post closers.

- Production: Focuses on executive-level metrics, including sales activity, pipeline performance, and forecasting. Additionally, the suite gives users the ability to score and rank their sales staff and know exactly what type of loans they’re funding and originating.

- Retail Management: An enterprise-wide overview of a company’s sales activity.

- Total Processing: An enterprise-wide overview of a company’s processing activity, as well as detailed loan information on specific processors.

- Underwriting Management: An enterprise-wide overview of a lender’s underwriting activity, as well as detailed loan information on specific underwriters.

- Wholesale Management: Offers detailed insights into account executive and broker performance, as well as in-depth information into specific metrics within the wholesale process.