ICE First Look at Mortgage Performance: Foreclosure Starts Jump as VA Moratorium Ends; Wildfire Delinquencies Emerge

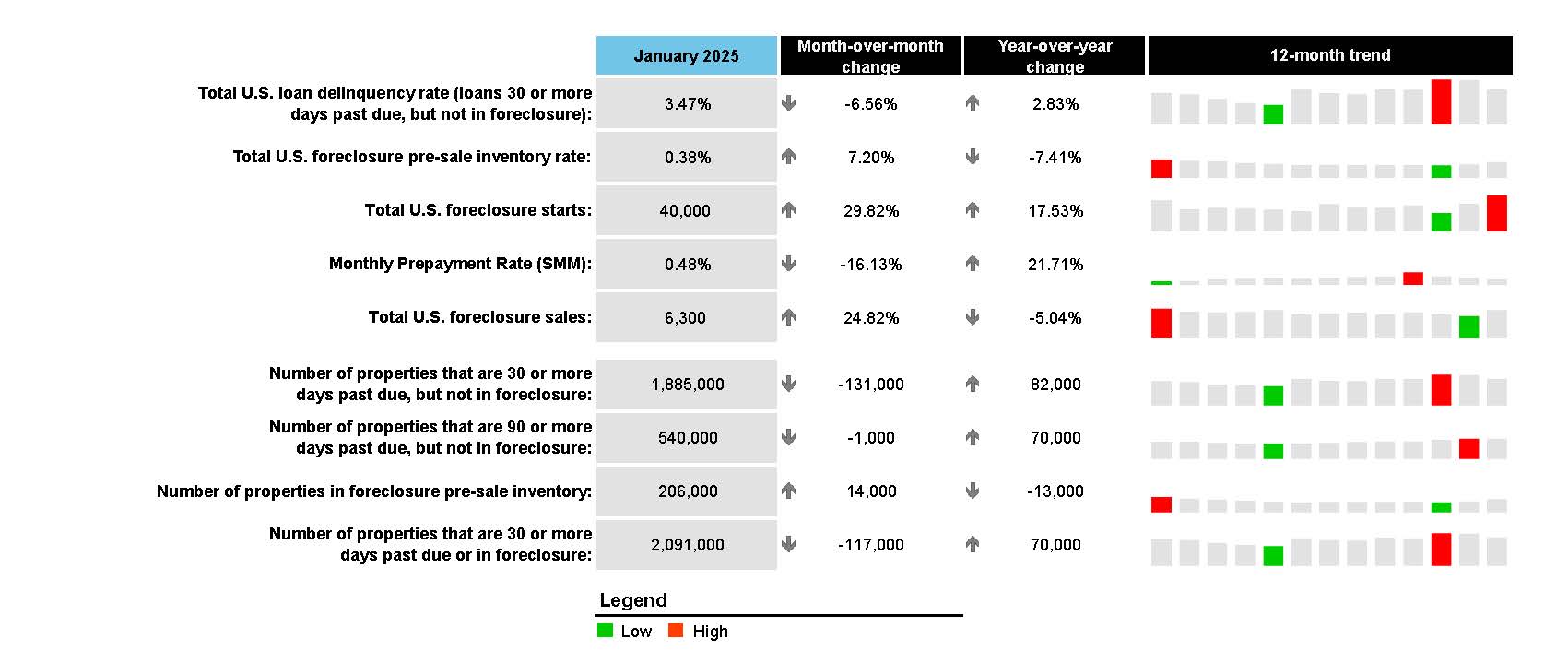

• Delinquencies fell 24 basis points (bps) to 3.47% in January; that’s 10 bps higher than last year, but 33 bps below pre-pandemic levels

• Foreclosure starts jumped by 30% and sales rose by 25% in January – driven by an expiration in the VA foreclosure moratorium – with active inventory rising by 7% in the month

• While the number of borrowers past due as a result of last year’s hurricanes has fallen from 58K to 41K in recent months, the financial impact from the recent Los Angeles wildfires is emerging

• An estimated 680 homeowners in the path of the Los Angeles wildfires missed their January mortgage payment, and ICE daily mortgage performance data through Feb. 17 suggests as many as 3,300 borrowers may be at risk of missing their February payment.

• Prepayment activity (SMM) fell to 0.48% in January, its lowest level in nearly a year, driven by the combination of modestly higher rates and the typical seasonal slowdown in home sale activity

ATLANTA and NEW YORK – February 21, 2025– Intercontinental Exchange, Inc. (NYSE:ICE), a leading global provider of technology and data, reports the following “first look” at January 2025 month-end mortgage performance statistics derived from its loan-level database representing the majority of the national mortgage market.

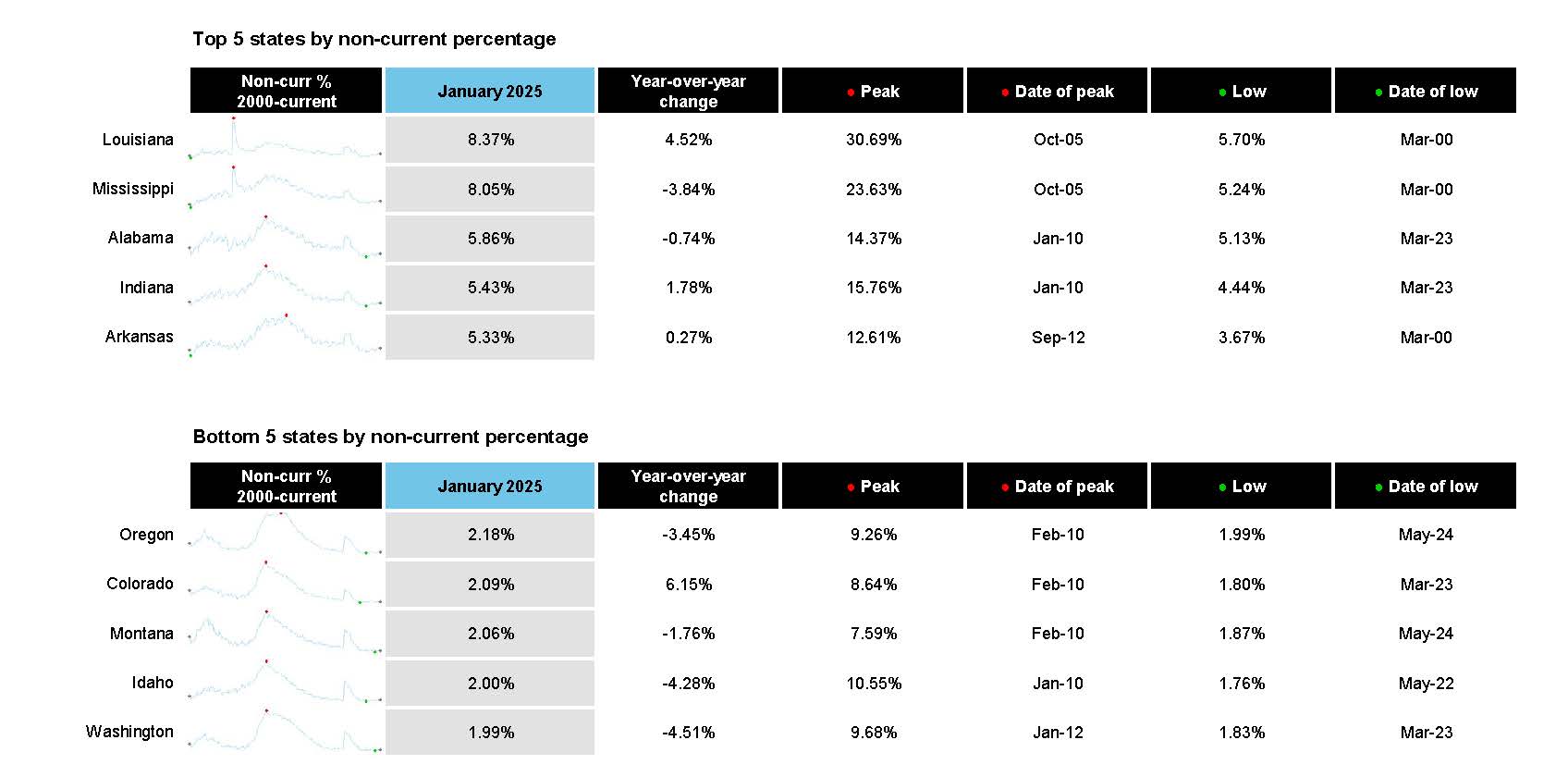

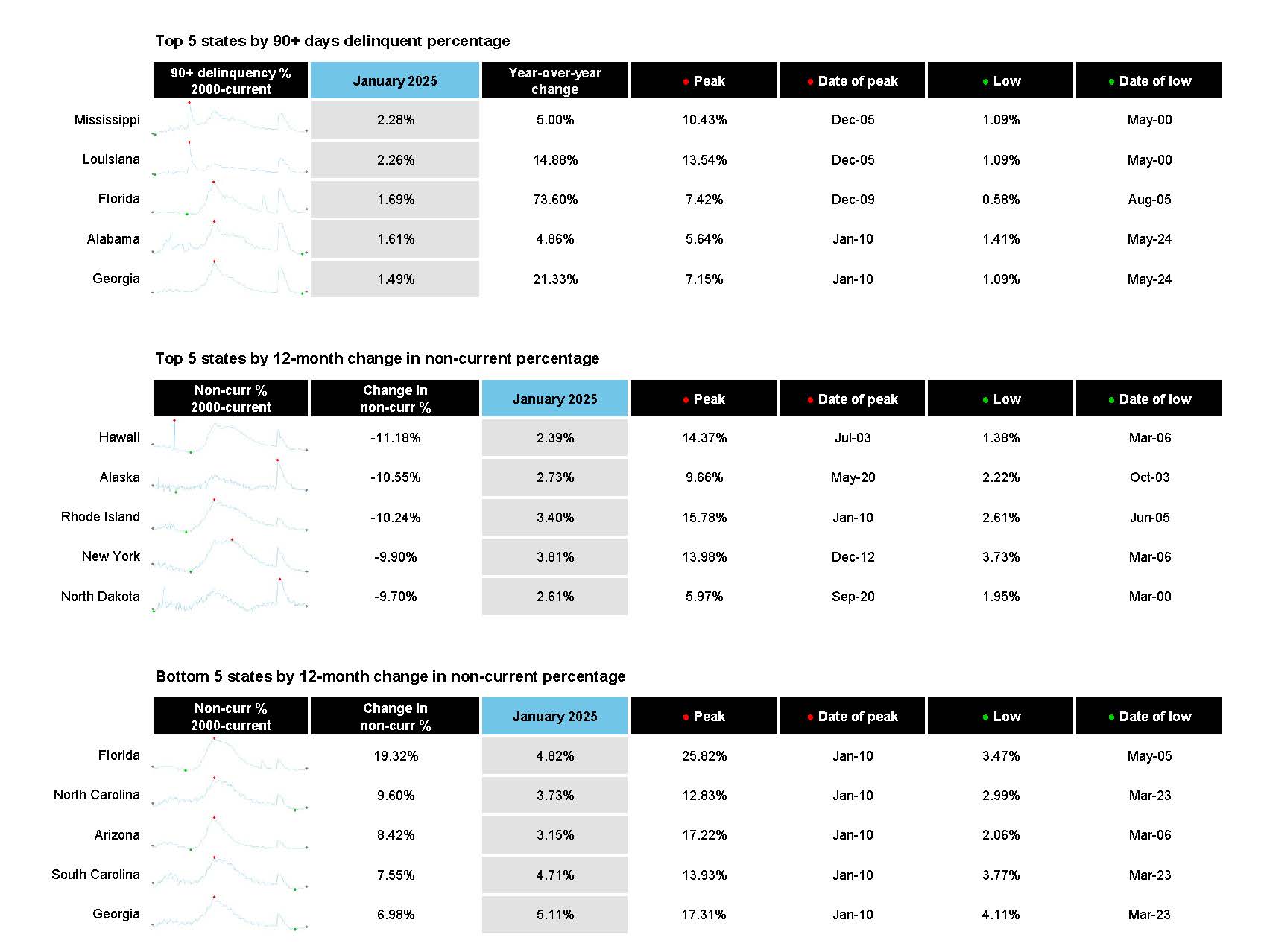

*Non-current totals combine foreclosures and delinquencies as a percent of active loans in that state.

Notes:

1) Totals are extrapolated based on ICE’s loan-level database of mortgage assets.

2) All whole numbers are rounded to the nearest thousand, except foreclosure starts and sales, which are rounded to the nearest hundred.

The company will provide a more in-depth review of this data in its monthly Mortgage Monitor report, which includes an analysis of data supplemented by detailed charts and graphs that reflect trend and point-in-time observations. The Mortgage Monitor report will be available online at https://mortgagetech.ice.com/resources/data-reports by March 3, 2025.

For more information about gaining access to ICE’s loan-level database, please send an email to [email protected].

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune 500 company that designs, builds and operates digital networks that connect people to opportunity. We provide financial technology and data services across major asset classes helping our customers access mission-critical workflow tools that increase transparency and efficiency. ICE’s futures, equity, and options exchanges – including the New York Stock Exchange – and clearing houses help people invest, raise capital and manage risk. We offer some of the world’s largest markets to trade and clear energy and environmental products. Our fixed income, data services and execution capabilities provide information, analytics and platforms that help our customers streamline processes and capitalize on opportunities. At ICE Mortgage Technology, we are transforming U.S. housing finance, from initial consumer engagement through loan production, closing, registration and the long-term servicing relationship. Together, ICE transforms, streamlines and automates industries to connect our customers to opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental Exchange, ICE, ICE block design, NYSE and New York Stock Exchange. Information regarding additional trademarks and intellectual property rights of Intercontinental Exchange, Inc. and/or its affiliates is located here. Key Information Documents for certain products covered by the EU Packaged Retail and Insurance-based Investment Products Regulation can be accessed on the relevant exchange website under the heading “Key Information Documents (KIDS).”

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 -- Statements in this press release regarding ICE's business that are not historical facts are "forward-looking statements" that involve risks and uncertainties. For a discussion of additional risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see ICE's Securities and Exchange Commission (SEC) filings, including, but not limited to, the risk factors in ICE's Annual Report on Form 10-K for the year ended December 31, 2024, as filed with the SEC on February 6, 2025.

Subscribe to our complimentary monthly mortgage & housing update

Receive an invite to our monthly Mortgage Monitor webinar and report for a current view of the mortgage market, including mortgage performance, secondary market metrics, home price and market trends.