Intro to RAP

By Becca Smith and Michael Saccento

September 3, 2024 | 5 min read

A Brief History of Rapid Analytics Platform® (RAP®)

The idea for the Rapid Analytics Platform, or RAP for short, was born close to 10 years ago from a need to provide ICE data engineers and scientists the tools necessary to innovate. What this translated to was giving them access to all Mortgage Data & Analytics in a single environment where the data is managed and has compute resources available through a universal development interface. This resulted in our first foray into the cloud and a search for the best developer tools and data services available to integrate with. After many months of design and rapid prototyping, we developed the initial version of what we know as RAP Studio today, a data science “sandbox” to create the ICE data and analytics products of tomorrow.

From Internal Tool to ICE Mortgage Data & Analytics Product

Client collaboration and expert-level interactions have always been the lifeblood of the RAP Data Science team. Through these engagements, we heard echoes of the same data and technology needs we were trying to solve for, being invested in by our clients, but often progressing at a much slower pace. The reality was and still is, not every business is set up to manage and execute large scale technology initiatives, whereas at ICE, that’s sort of what we do. The challenges of our customers are exacerbated by the fact that mortgage lenders, servicers, and investors license a ton of 3rd party data they must connect with their own data; often represented by a portfolio of mortgages, real estate, or mortgage-backed securities. Realizing we could help solve this problem with our expertise and the platform we had just developed, we decided to offer it to our clients as an alternative way to access Mortgage Data & Analytics.

A RAP Star is Born

In 2019, we introduced RAP to the market and since then we have evolved it, while still focused on a singular mission; to ease the consumption of Mortgage Data & Analytics and elevate our client’s data science capability. What we have learned over time is that every client is at a different stage of their data science journey and the technology is continuously changing, so we’ll constantly have to adapt so we’re maximizing value to the client and providing the best customer experience.

Educational Content is Paramount to the Client Experience

This need to constantly adapt made us realize a blog medium would be the perfect way to communicate and educate our clients on an array of topics.

RAP Data Science Blog by Category

- Getting Started on RAP

- RAP New Features

- RAP New Datasets

- RAP Solutions

- RAP Data Science Best Practices

- RAP Use Cases

- Industry Insights

- Technology

- Events & Webinars

More about RAP

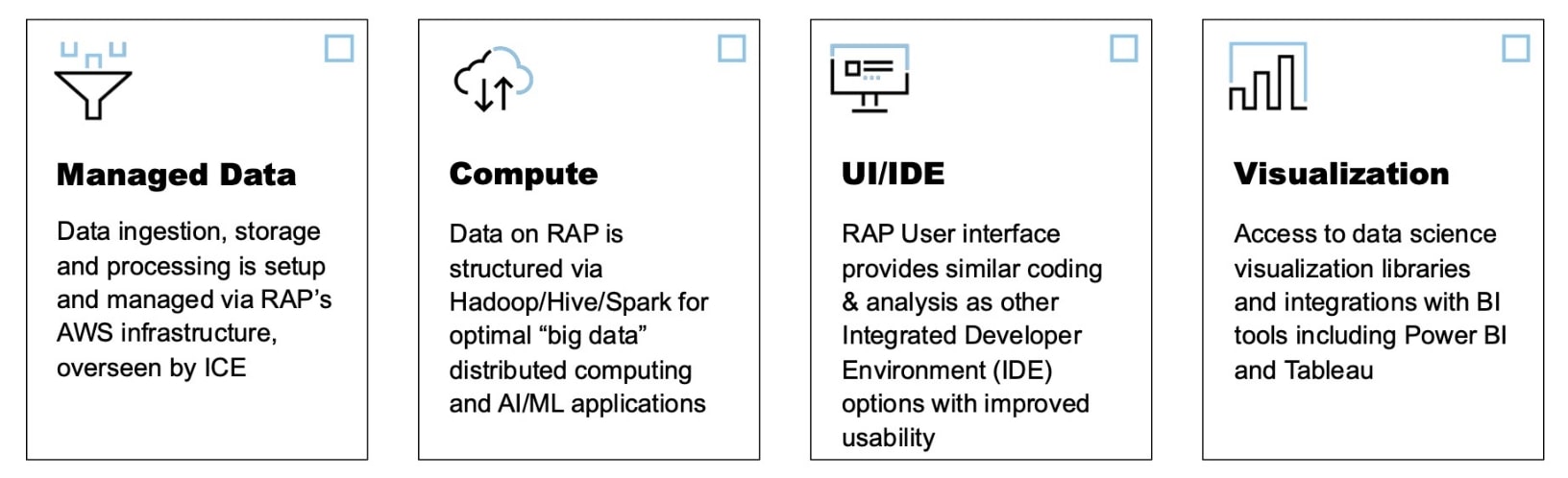

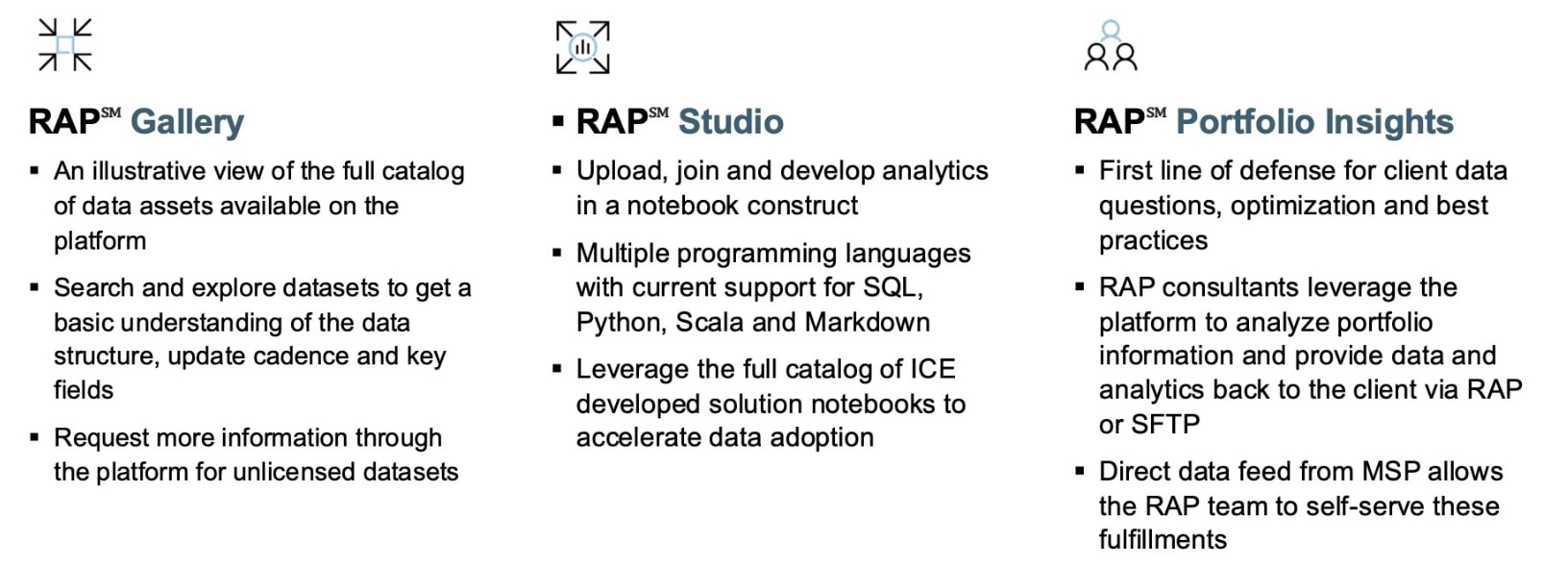

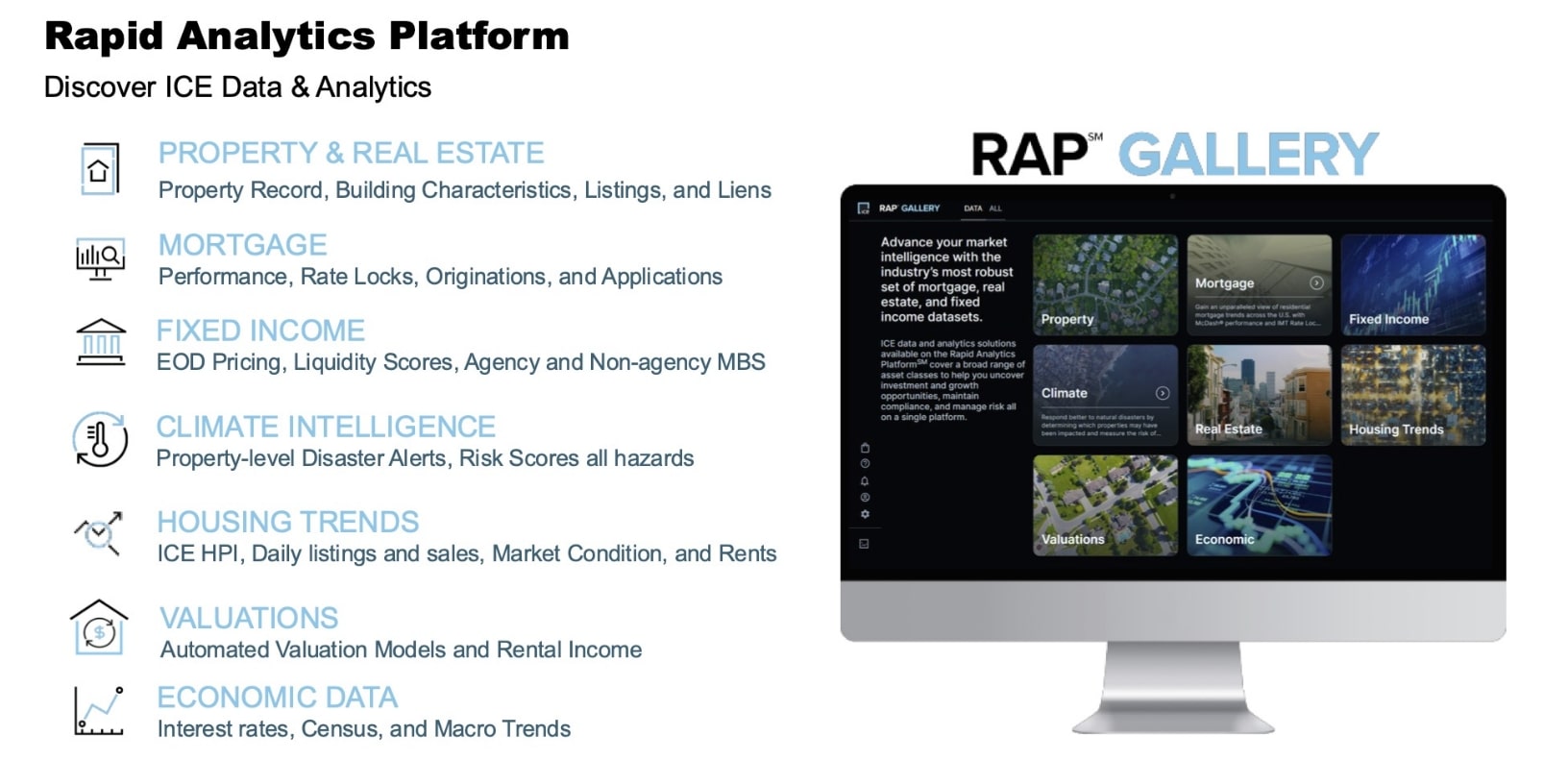

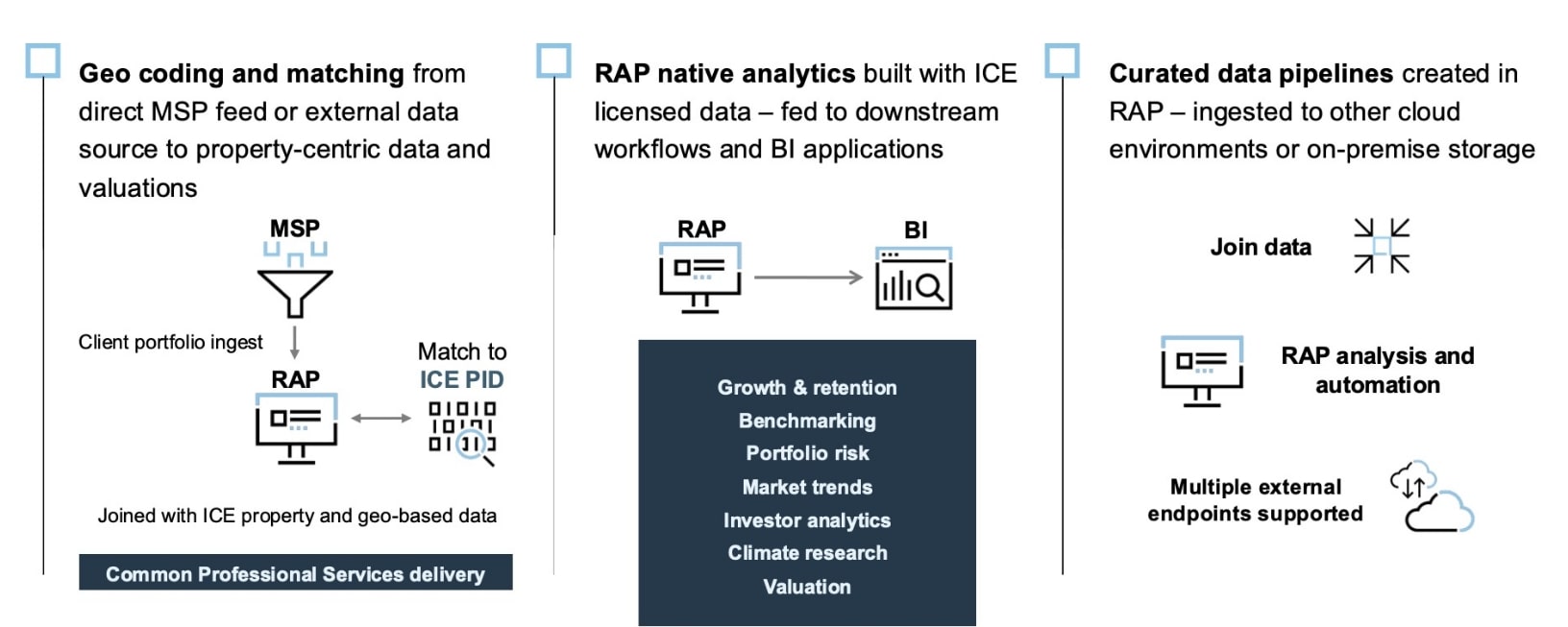

The Rapid Analytics Platformis a cloud-based data exploration and decision science studio that accelerates the integration of ICE IDS & ICE Mortgage Technology data & analytics, thus facilitating customers in decreasing the lead time to generate insights from ICE data.

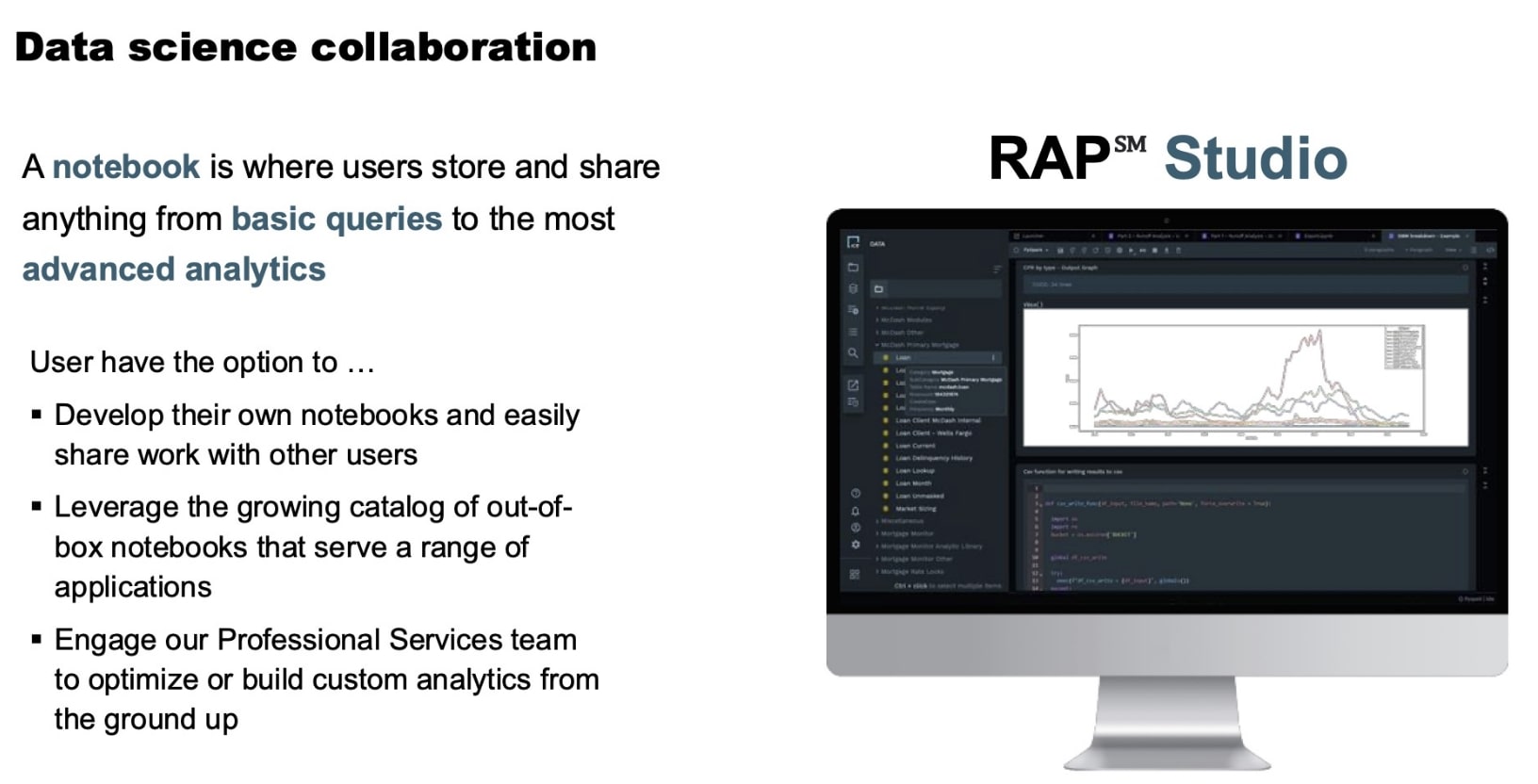

RAP is comprised of managed storage, compute, and a custom notebook IDE. RAP customers are generally financial analysts, data engineers and data scientists that generate code using SQL, Python, PySpark or SparkR.

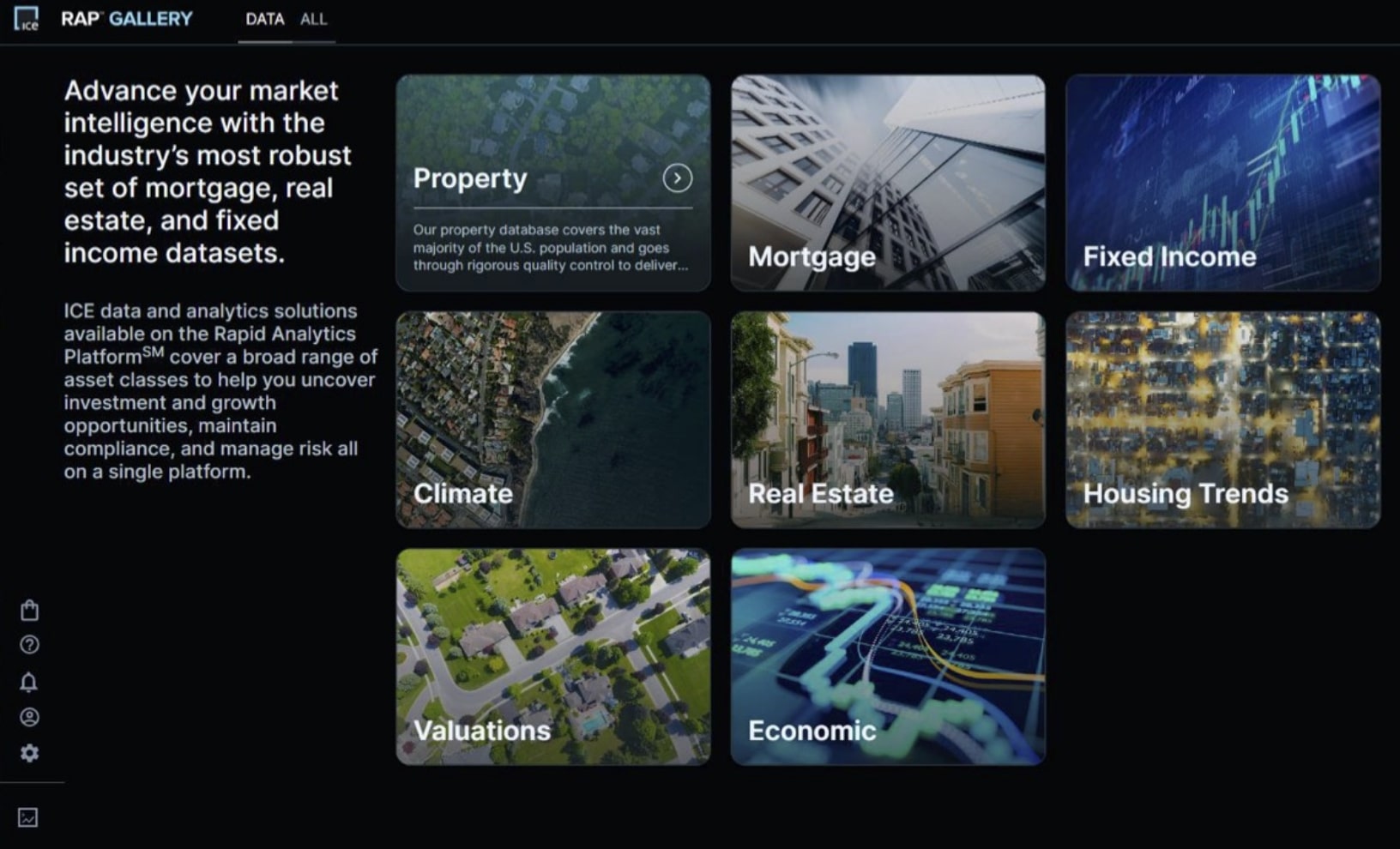

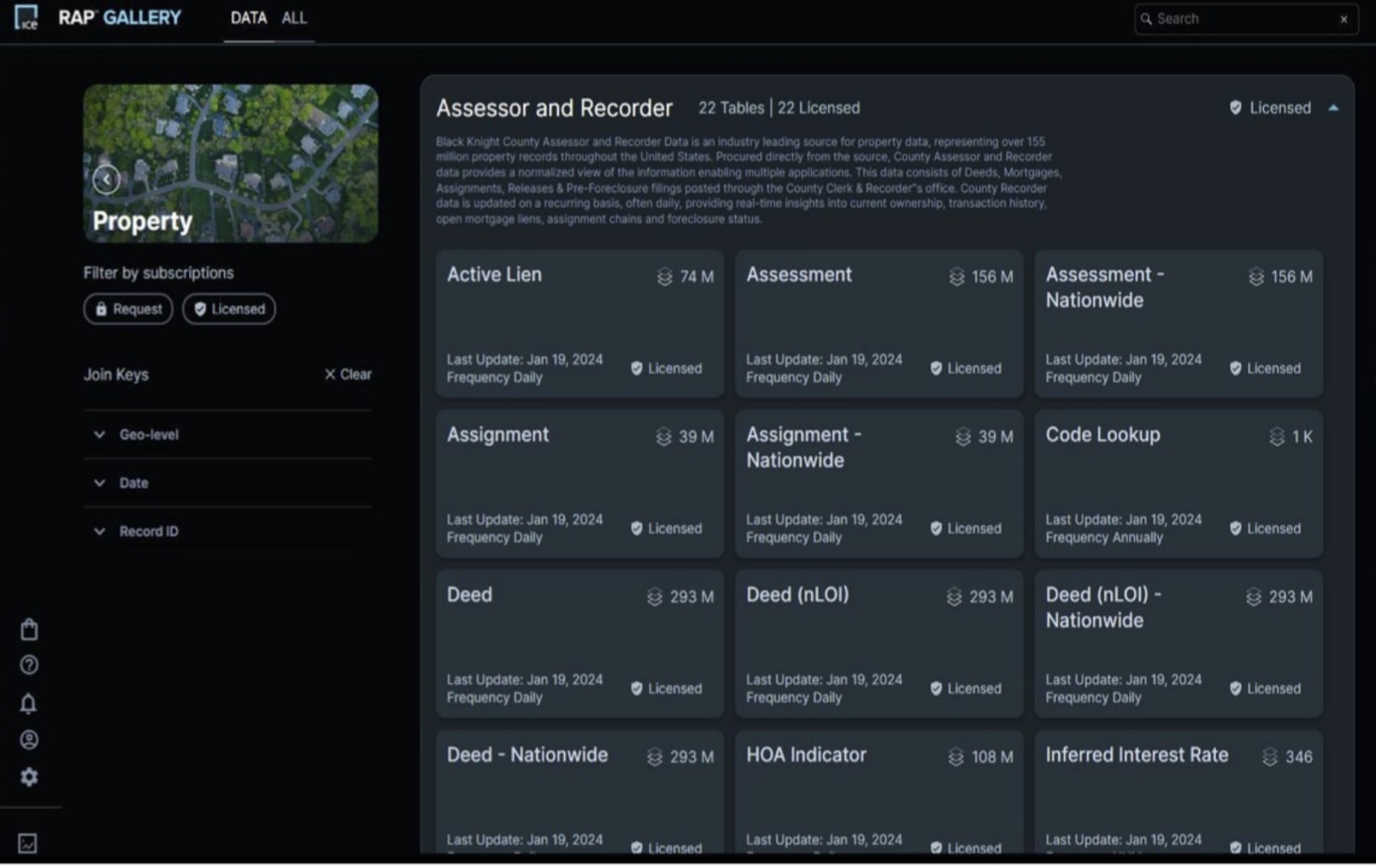

Additionally, RAP has a custom data catalogue where users can explore new datasets as they become available and view data dictionaries and helpful metadata to get an understanding about the data fields.

Gallery View:

Dataset View:

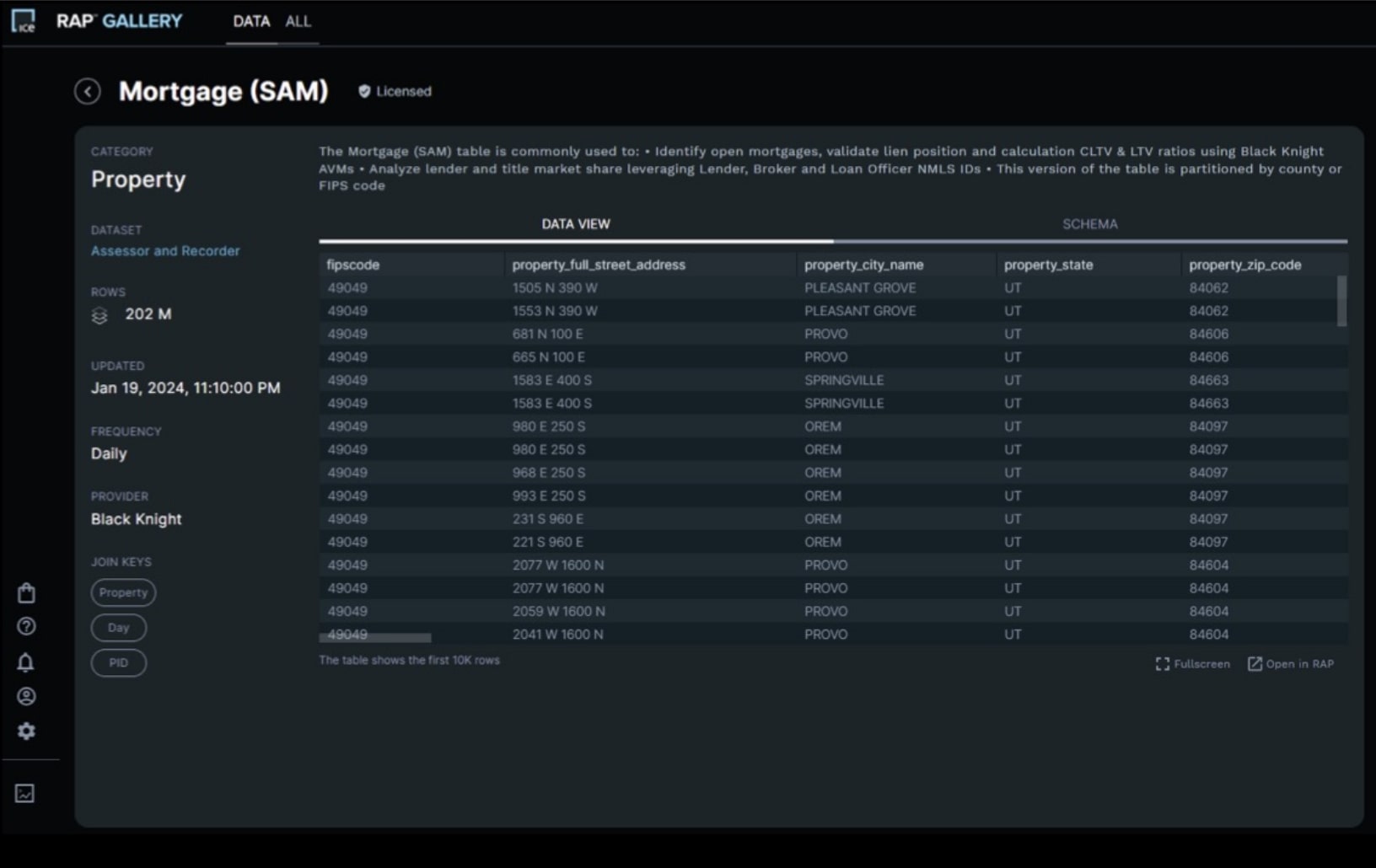

Data Table View:

RAP Studio IDE:

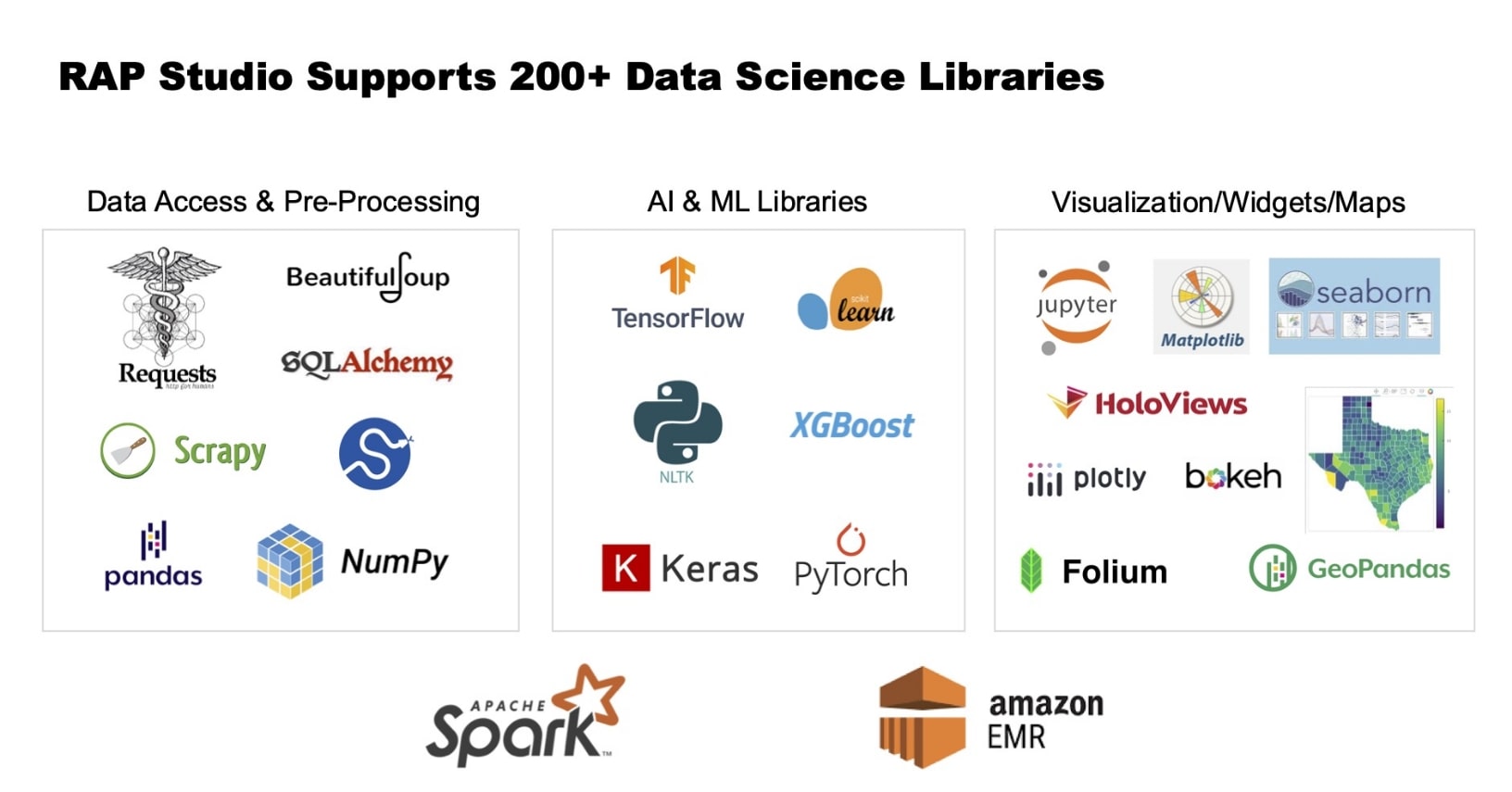

Data Science Libraries:

Use Cases:

Becca Smith, Director, Mortgage Data & Analytics

Becca has over 10 years of experience as a Data Scientist implementing Machine Learning and AI solutions within the life sciences, healthcare, manufacturing and financial services industries and 4 years of experience as a product leader. She holds a Bachelor of Science in Computational Biochemistry from the University of Texas at Austin and a Master of Science in Analytics from the Georgia Institute of Technology.

Michael Saccento, Principal, Mortgage Data & Analytics

Michael has been a product manager at ICE for 5 years focused on Mortgage Data and Analytics solutions. With over 20 years of experience split between industry and product roles, Michael’s background spans all aspects of mortgage and he is regarded as an expert in the industry. When he’s not developing data and analytics solutions to support ICE customers, he enjoys traveling with his family, cooking, playing guitar and hockey.

Related resources

Follow us on Linkedin

Access Mortgage Monitor reports

2025 Borrower Insights Survey report