Leveraging Validate as a first step in your home equity loan or line of credit workflow helps inform decisions earlier in the process, saving users time and money. Validate gathers property information and provides an evaluation via AVM and property condition report. Additionally, all captured photos can be used for any future desktop appraisals. Validate also assists in increasing pull-through rates by focusing on loans with higher probability to close.

Validate

Drive faster, objective and more cost-effective property valuations

Validate provides a fast, objective property-valuation tool that helps increase pull-through rates, lower origination costs and accelerate turn times. The mobile solution combines computer-vision technology, a condition-adjusted automated valuation model (AVM) and up-to-date property data with user-supplied photographs to automatically determine a property’s value and available equity.

Simplify the property valuation process

Fast, objective, reliable

Simplify and expedite the property valuation process to better inform business decisions from day one.

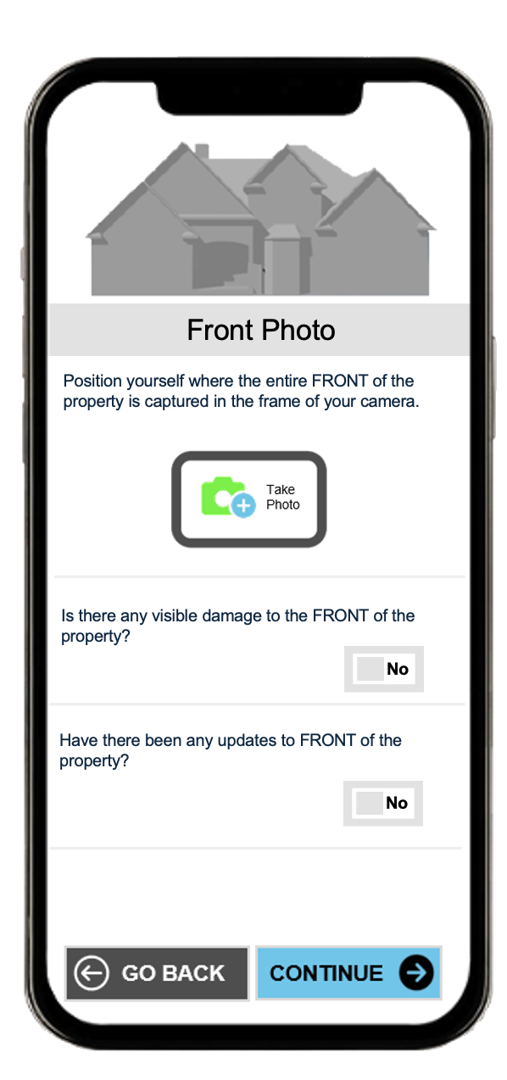

Provides an app to upload property photos

Using an intuitive app, homeowners capture property photos and verify property data.

Calculates property condition

Validate’s computer-vision capabilities assess the photos captured by the homeowner, then assign a numeric value to the home’s condition using the Uniform Appraisal Data Set’s (UAD) six condition levels.

Determines value range

Based on the condition level of the property, Validate uses a condition-adjusted AVM to provide an approximate range of the home’s value.

Runs comps and equity

Using additional tools and public records data directly from ICE, Validate provides the property’s estimated equity, confidence score, and a similarity score to compare the property to other homes in the market.

How it works

Once the homeowner accesses the Validate application on their mobile phone via a lender-provided link, several fields for the property’s features are displayed, such as street address, year built, number of bedrooms and bathrooms and so on. Using our comprehensive property records data, Validate automatically completes these fields. The homeowner simply confirms or updates this information.

The Validate app then prompts the homeowner to use their mobile phone’s camera to take several key photos of the property – including interior and exterior shots — and upload them directly in Validate. Homeowners have the option of uploading additional photos of amenities or views that would impact the property’s value. GPS verification and maps show where the photos were taken to confirm their legitimacy, and the photos are also time stamped.

One solution, multiple use cases

Validate works for a variety of use cases, offering solutions for home equity lending, reconsideration of home value and property recovery following unprecedented natural disasters. Based on the specific use case, Validate leverages computer-vision technology and data APIs to create seamless workflows for collateral risk assessment.

Validate for Home Equity

Validate for Reconsideration of Value (ROV)

Validate supports ROV requests and guides the borrower through the ROV process by providing an objective estimated price range for the property in question. Validate reduces the manual steps and paperwork associated with ROVs in addition to minimizing the need for a second appraisal which helps to save considerable time and costs and improve borrower satisfaction.

Validate for Disaster Recovery (DR)

Validate DR allows the user to input information including type of disaster and details involving level of accessibility and damage sustained to the property. This information is then paired with GPS-tracked user photos of the neighborhood and exterior of the home to assess overall damage to the property. Homeowners, buyers and sellers then receive a fast and efficient property condition report (PCR) that accounts for damage in the aftermath of climate- or disaster-related events in the property’s area.