Servicing Orders

Order and track servicing products through secure, reliable automation

Servicing Orders automates and centralizes the process of ordering servicing products from third-party providers. Fully integrated with the ICE Bankruptcy and Foreclosure solutions, Servicing Orders functions as the bridge between servicers and their approved providers for the ordering, tracking and fulfillment of servicing products.

Title and valuation orders made simple

Servicing Orders can significantly reduce manual work and lower the risk of human error in the product ordering process.

Automate time-sensitive orders

Reduce the time and costs associated with manual ordering, tracking and fulfilment

Optimize the ordering process

Intelligently order products based on loan conditions

Create repeatable orders

Use the same set of business rules to repeat the ordering process across all approved vendors

View your inbound products

Easily track and manage orders, as well as view tracking across functional lines

Support investor compliance

Leverage a configurable rules engine to help track that the correct product type is selected, and that the product is ordered within the proper time frame

Why Servicing Orders?

Servicing Orders helps servicers collaborate more easily with their approved providers using an array of features including:

- Order initiation based on defined triggers

- Product selection based on loan conditions

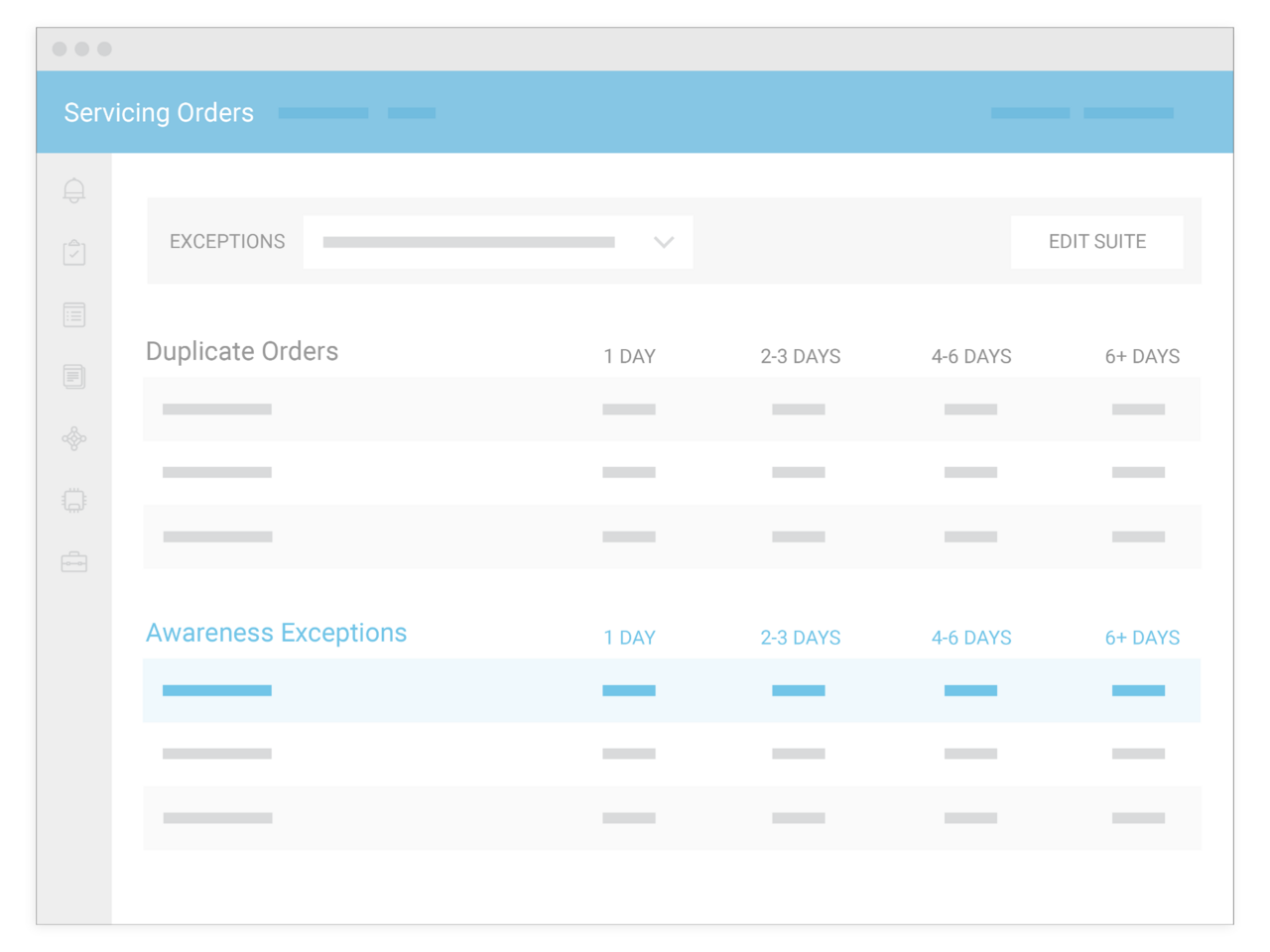

- Duplicate order prevention

- Percentage-based provider allocation for improved load balance

- Robust order tracking capabilities for order visibility and exception handling

- Document storage repository using ICE Servicing Vault

About Servicing Orders

Support compliance with investor rules and servicing agreements

Investors look closely not only at the products that a servicer orders, but how frequently those products are ordered. If the wrong provider is selected, or if a product is ordered outside of a proper time frame, some investors may require that the servicer absorb the expense.

Servicing Orders uses configurable rules to help track that the correct product type is selected, and that the product is ordered within the required time frame to help satisfy investor requirements and reduce costs.

Plus, the data from Servicing Orders updates directly within the MSP® loan servicing system to help keep orders consolidated on a single platform.

MSP loan servicing system

MSP®, ICE’s best-in-class loan servicing software, has set the industry standard and is unmatched, due to a strong focus on regulatory compliance and risk, protection of borrower-owned data, decades of proven performance and our commitment to continuous innovation. MSP offers servicers of all sizes the ability to tackle today’s most pressing business challenges.