Web Version of Encompass & TPO Connect 21.3 UX Highlights - chock full of end user goodness

By ICE Mortgage Technology

January 10, 2023 • 5 min read

Author: Shravan Mishra, Somnath Lokesh, Peter Mendes, Benson Lam and Misha Vaughan, ICE Mortgage Technology

ICE Mortgage Technology™ continues to invest in moving our web-based experiences forward. One of our biggest areas of ongoing user experience investment is our journey to the web for our Encompass product. Below are some key highlights from our 21.3 release that shed a little light on the work we are super proud of.

Forms & Tools

Our end users, loan officers, loan processors, and underwriters, make heavy use of digital forms. Ours is a highly regulated space where precision about data really matters. In our Smart Client product, known as Encompass, we made a large investment to get these forms over to our web-based experience – literally hundreds of pages. Below are examples of what this conversion looks like.

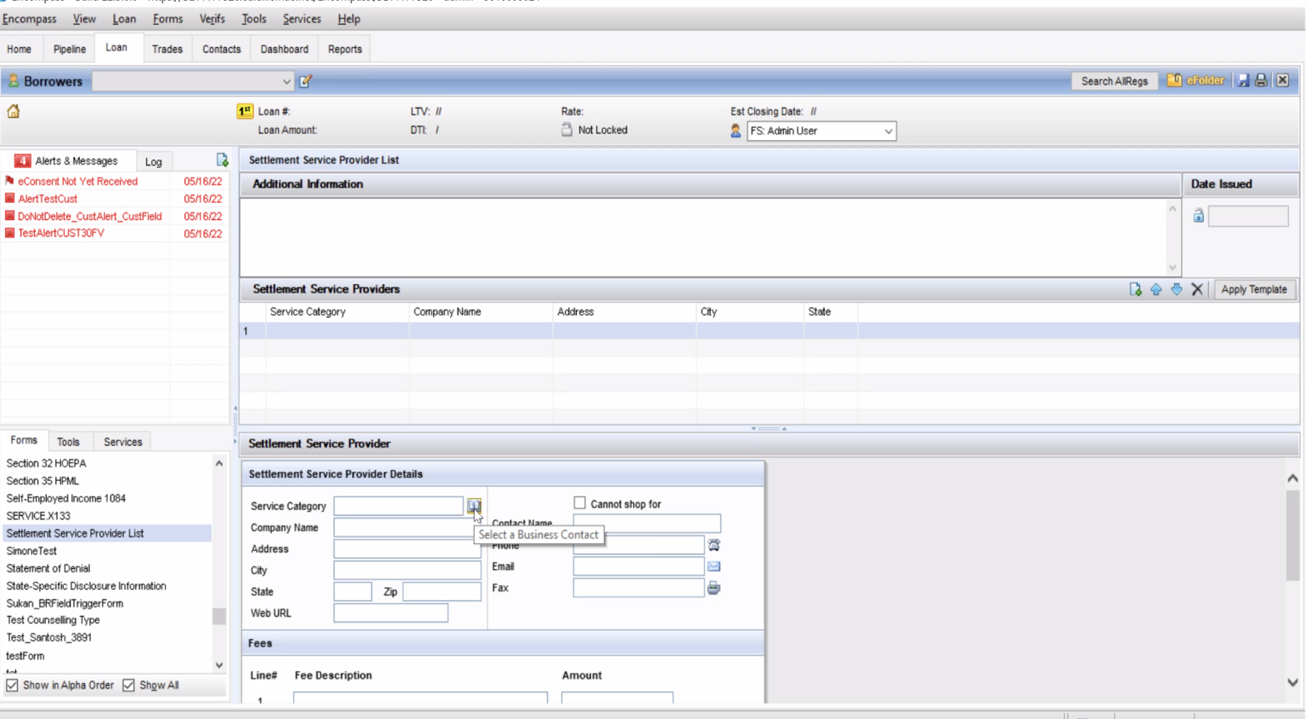

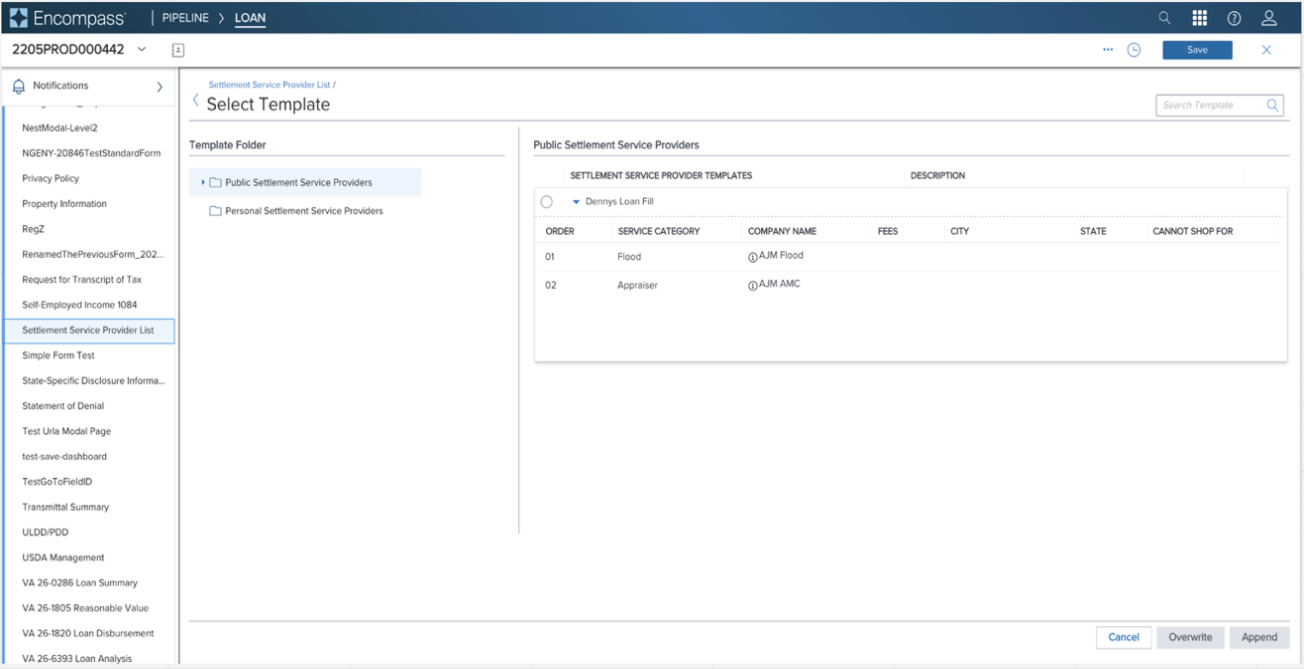

Settlement Service Provider

The Settlement Service Provider form is used for capturing the details of settlement service providers. When a loan originator allows a borrower to shop for third-party settlement services, RESPA regulations require that the originator provides the borrower with a list of settlement service providers who can be contacted to fulfill those services. The list is given to the borrower when the loan estimate is disclosed. A user can either manually add the details of the settlement service provider or use the set of existing templates which are available for that particular instance.

Before: The settlement service provider list and form in our Smart Client

After: The new template for service providers on the web

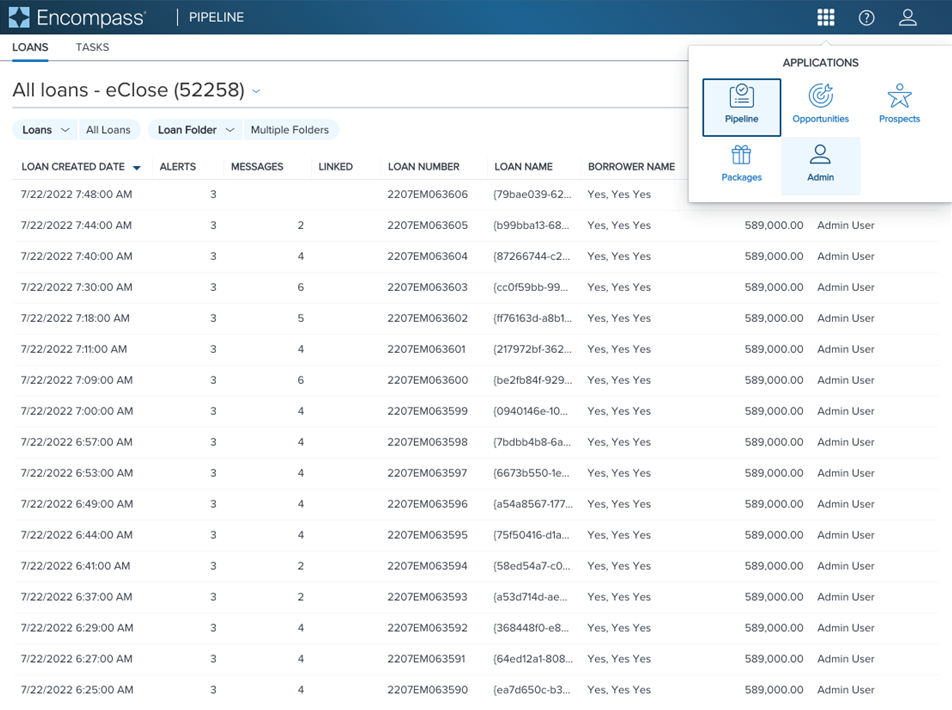

Streamlined Navigation

Processing mortgages is a lot of work. Inside the web version of Encompass, we now have a new streamlined mechanism to make doing the job faster. For Loan Officers, Loan Processors, and Underwriters we’ve added some streamlined navigation to make moving between Pipeline, Opportunities, Prospects, Packages, and Admin (for those who have access) easier. This new feature will save loads of clicks!

Encompass eSign displaying the new Applications menu on the top right

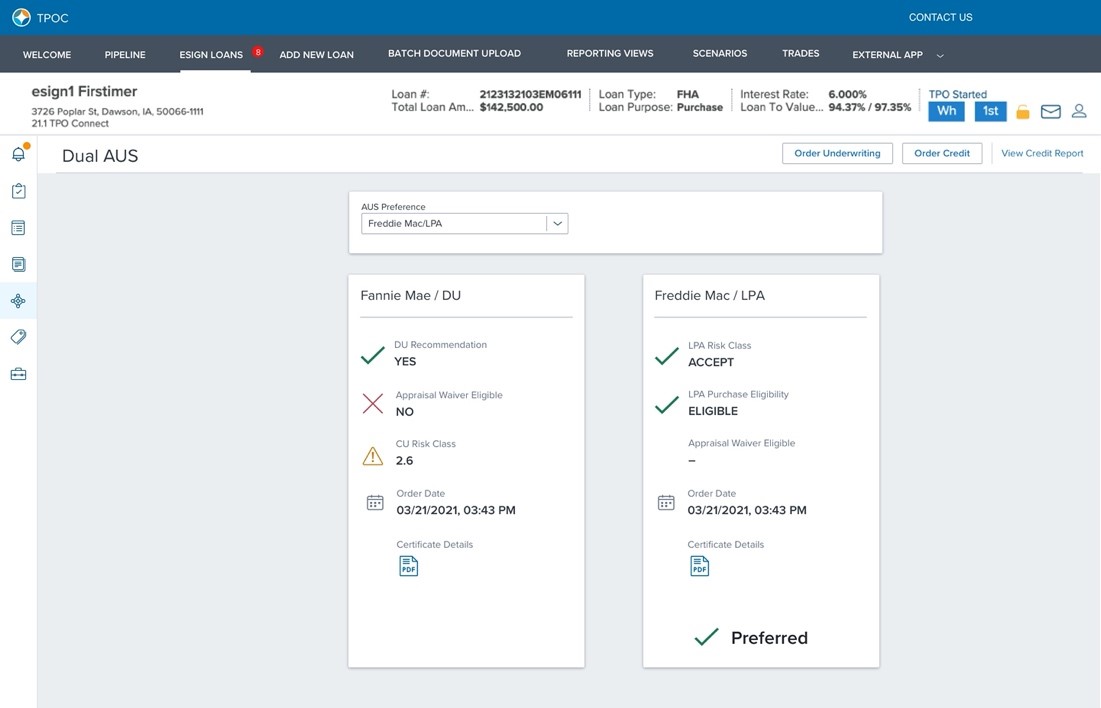

Third-Party Origination (TPO) Connect

Another piece of the loan manufacturing process is enhancing the workflow for Third Party Loan Originators, Loan Closers, and Loan Officers, who are working with Wholesale and Correspondent Lenders. In the 21.3 release, we made it easier to examine the underwriting options for a loan, and determining which Government Sponsored Entities (GSE) to use for trades. The design goal was to display a minimal amount of information, support for quick decision making, and to do it all in one place.

TPO Connect Dual Automated Underwriting Services (AUS)

Correspondent Lenders and Wholesale Lenders using Encompass TPO Connect now have the ability to give their lenders or loan originators a better experience. They have the option of ordering Loan Product Advisor (Freddie Mac) and Desktop Underwriter (Fannie Mae) in one click and leverage a quick-to-scan summary view to support faster decision making.

The new, simplified Dual Automated Underwriting Services (AUS) in TPOC

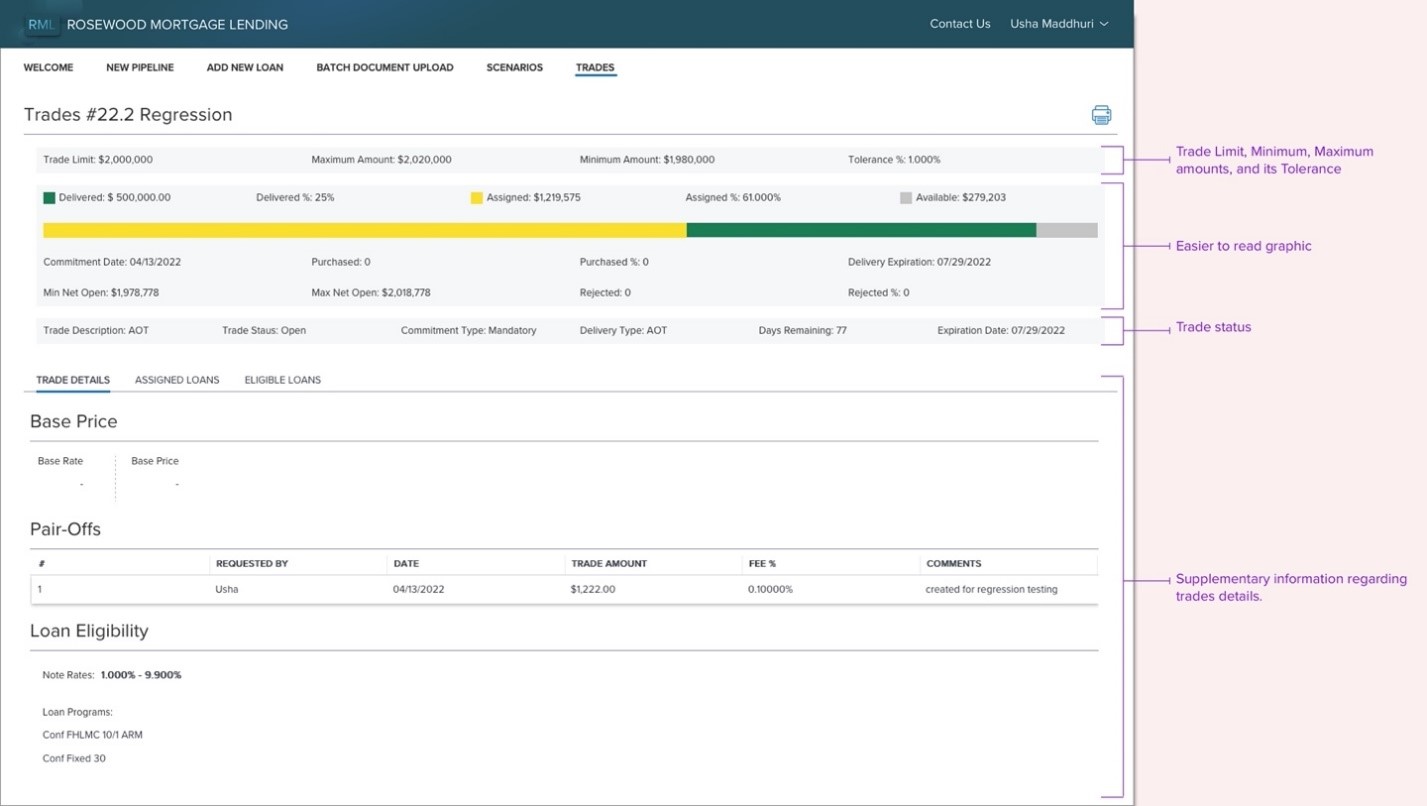

TPO Connect Trades, Enhanced

Investors who buy a set of loans to hold in their portfolio have specific criteria. Brokers will have a set of eligible loans to offer, and they are hoping they meet these criteria. While examining a collection of loans, investors are determining if they can deliver them to the secondry market. For example, “Do all assigned loans have a credit score of more than 750?”

In the design below, we focused on using visuals to communicate the story, not just data; making the data more readable, making it easy to view available loans to trade, and easy to view other loan details in context of the task. The design applies information hierarchy principles to establish order and sequence. The most vital information is at the top with an easy to read graphic. Users also have the ability to see other supplementary information regarding the trades.

The simplified new design for the TPOC trades

Related resources

Access Mortgage Monitor reports

2024 Borrower Insights Survey reports