Supporting the Salesforce-centric mortgage lender

By Marci Davis | Sr. Director, Product, ICE Mortgage Technology

August 17, 2021 - 3 min read

A step forward in the digital mortgage era

In the new digital mortgage era, more lenders are adopting Salesforce® to manage their relationships with borrowers, partners, and other constituents. This has created a natural need for mortgage lenders to have Salesforce and Encompass® talk to each other to share critical information to streamline processes, improve reporting and provide better customer service. Unfortunately, custom integrations are costly and time consuming to set up and maintain. Often times, lenders fill this gap with manual processes that don’t meet the needs of the business, are not adopted by users, and leave customers unsatisfied.

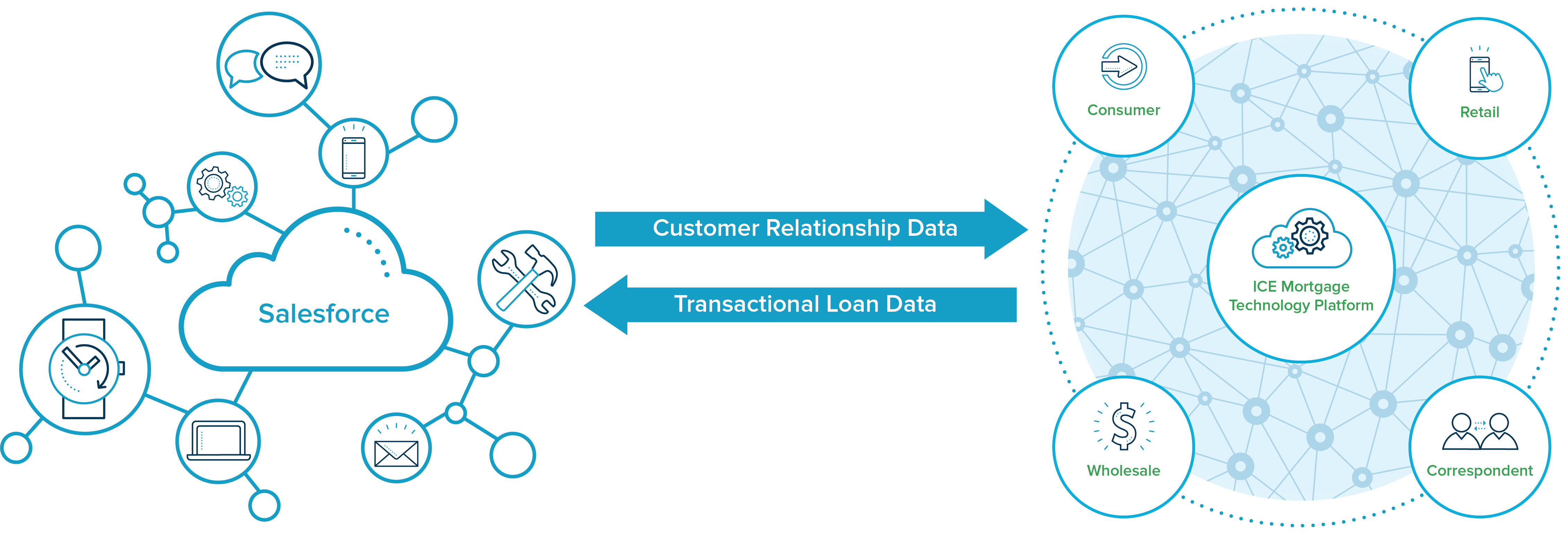

Now, there’s a better way. The development team at ICE Mortgage Technology® listened to customers, and strategically partnered with Salesforce to create the Encompass® Connector for Salesforce®. This groundbreaking new managed package offers a secure, bi-directional connection between the Encompass and Salesforce platforms. The solution saves time with point and click administration and it’s maintained and supported by ICE Mortgage Technology to ensure connectivity, even after major updates to Salesforce or Encompass platforms. Let’s take an inside look:

Encompass Connector for Salesforce: The ultimate solution for mortgage originators

With the Encompass Connector for Salesforce, your team can now leverage a true digital mortgage platform with real-time data transfer between Salesforce and Encompass.

This blended functionality unlocks many new capabilities to streamline digital lending

- Seamlessly map loan fields and data from Encompass to Salesforce, for easy and accurate data synchronization.

- Generate Encompass loans directly from Salesforce, either automatically, or with a single button click.

- Access Encompass loan transaction data from Salesforce. Create loans, receive real-time updates, and check loan status without logging into Encompass.

- Get a more complete view of borrower data across both platforms. These unparalleled reporting capabilities help you drive insights across all lines of business.

- Easily manage and support software updates across both platforms.

Multiple mortgage lending use cases. More to come.

Encompass Connector for Salesforce supports many use cases. Whether you want to improve your loan management process, turbocharge reporting, or take post-close marketing to the next level, Encompass Connector for Salesforce is your bridge. Check out a short demo here.

Learn more about the Encompass Connector for Salesforce, and about how this solution expands beyond retail to support wholesale and correspondent lending channels.

Related resources

Follow us on Linkedin

Access Mortgage Monitor reports

2024 Borrower Insights Survey report