Automation and Technology

Originate and acquire loans faster: Introducing our new task-based workflow

At ICE Mortgage Technology, our mission is to automate everything automatable in the residential mortgage industry. In pursuit of this mission, we’re constantly looking for new, innovative ways to automate traditionally manual, time-consuming tasks that hinder productivity and take you away from what really matters – growing your business. With the recent influx of refinance volume, we know now, more than ever, that mortgage companies need technology solutions that can help make their workflows more efficient, so they can handle the increase in customer demand. That’s why we’re thrilled to introduce a new way for lenders and investors to simplify their workflows and automate manual repetitious tasks.

Introducing our new task-based workflow

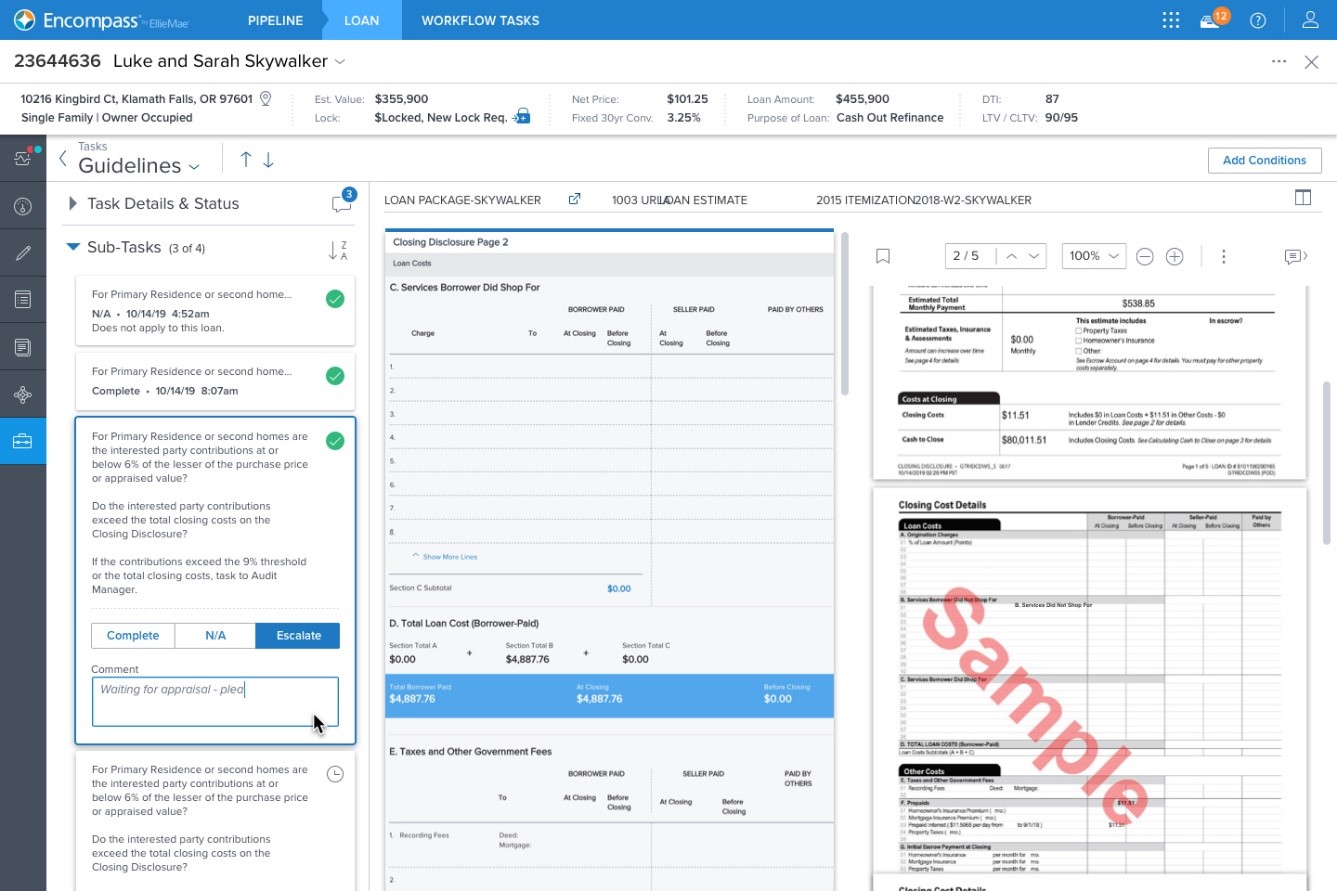

In the 21.1 Major Release, we released a new task-based workflow exclusively in the desktop version of Encompass LO Connect™. This new workflow model enables lenders to easily orchestrate, delegate and automate the completion of tasks across any user, at any stage of the loan lifecycle, and at any time. The traditional mortgage model, where each stage of the process is managed one at a time, creates bottlenecks and inefficiencies because each stage in the process cannot commence until the previous stage has been completed. With our task-based workflow, teams can now reimagine the current paradigm of mortgage management and easily complete tasks across multiple stages in parallel within tailored workspaces that contain everything a user needs to do their job. Based on customer feedback, we believe the new task-based workflow will enable lenders and investors to more efficiently manufacture and acquire loans, complete milestones faster, collaborate more effectively, as well as dramatically reduce time to close and time to purchase.

Figure 1: The new task-based workflow in Encompass

Our new task-based workflow helps mortgage companies in four primary ways:

1. Digitize and streamline the management of all of your tasks.

2. Provide customers with more options for the sequence of how tasks are completed.

3. Simplify how originators and operations employees work on loan tasks.

4. Automate the creation and completion of tasks for your employees.

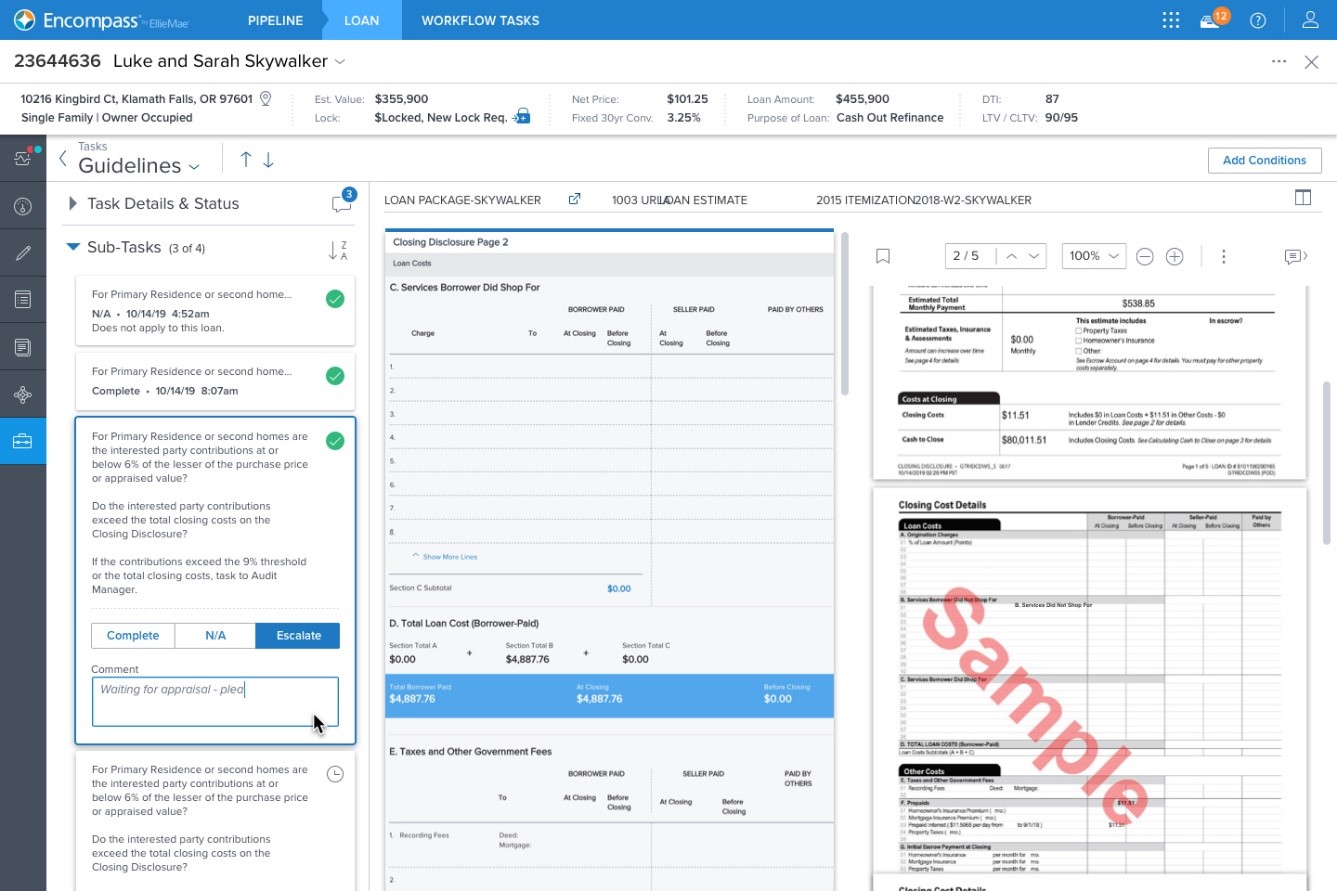

Figure 2: Creating new workflow rules in Encompass

We’re tremendously excited about the potential our new task-based workflow has to change the paradigm of how mortgage companies work. With this step forward, ICE Mortgage Technology is moving significantly closer to our north star vision of automating everything automatable within the mortgage process. Best of all, consistent with all of our other products, it’s flexible and easy to configure for any channel, any role and any workflow. We’ve worked closely with our customers throughout the product development process and so far, feedback has been tremendously positive. We expect a substantial number of our customers to adopt the task-based workflow in 2021.

Tips for getting started:

If you’re a current ICE Mortgage Technology customer, we encourage you to leverage these helpful resources to learn more about our new innovative capabilities for driving workflow automation:

- Review the 21.1 Major release notes

- Explore our helpful materials on the Encompass LO Connect Customer Resource Center, including “how to get started” videos and configuration guides

- Watch our on-demand Q4 2020 National Sys Admin Call webinar recording which includes an in-depth product demonstration on task-based workflow

- Attend Experience 2021, between March 8-26, to participate in several task-based workflow sessions (There’s no cost to register!)

Related resources

Follow us on Linkedin

Access Mortgage Monitor reports

2025 Borrower Insights Survey report